Tech News

Exclusive: Superlawyer David Boies expected to hit Boeing with wrongful death suit spurred by suicide of whistleblower John Barnett

Attorney David Boies and the legal team that have long championed the case of the late Boeing whistleblower John Barnett, are expected to file a “wrongful death suit” against the troubled aerospace colossus, Fortune has learned. A little over a year ago, after giving two days of testimony in a long-running action versus Boeing, Barnett was found dead after spending the entire night in his Clemson orange, Dodge Ram truck, his finger on the trigger of a sliver Smith and Weston pistol, and a note sitting next to his body. In May, an investigation by the Charleston Police Department found that Barnett had committed suicide by putting by putting a bullet through his head. (You can read the full story of Barnett’s life and tragic death in our feature here.)

Fortune is the first to report the news of the expected suit and Boies’ involvement. When asked for comment, Boeing provided the following statement to Fortune: “We are saddened by John Barnett’s death and extend our condolences to his family.”

Barnett’s passing didn’t end his crusade to make Boeing expose blatant violations of its own policies and procedures that he claims to have experienced in his seven years at the 787 Dreamliner factory in North Charleston, South Carolina. Starting in 2017, just before Barnett left Boeing due to the onset of PTSD and panic and anxiety attacks, Charleston attorneys Rob Turkewitz and Brian Knowles sued Boeing on a so-called Air21 complaint under an Office of Health and Safety Administration law that protects whistleblowers from retaliation by their employers. But the wrongful death suit versus Boeing is a new action that’s being introduced in addition to the OSHA or regulatory suit. The team will strive to prove “causation” showing that Boeing’s specific actions caused the workplace stress that led him to suicide. And the Trukewitz-Knowles duo added big time firepower by engaging Boies, Schiller et al. to join the campaign, and especially in getting the 84-year old founder who’d won a landmark antitrust case for the US Justice Department against Microsoft, represented the Al Gore campaign in the 2000 Florida presidential recount and garnered big settlements for the Jeffrey Epstein victims to take a leading role in both cases. (Boies, it should also be noted stirred controversy for his representation of movie mogul Harvey Weinstein, who’s serving time for sexual offenses, and Elizabeth Holmes of Theranos.)

The OSHA and new wrongful death suit each seeks financial damages on behalf of Barnett’s estate, including Vicky Stokes and his brothers Rodney, Michael and Robbie Barnett. “When we got the police and autopsy reports concluding that John had taken his own life, Brian and I issued a press release expressing our sadness and stating that ‘while Boeing may not have pulled the trigger, the company is legally responsible for his death,'” Turkewitz told Fortune. Boeing greatly hardened its stance, he says, after it became clear that the Barnett lawyers were also seeking to file a wrongful death case.

Up against what he characterizes as a small army of Boeing lawyers, Turkewitz and Knowles decided they needed to engage powerful reinforcements. So Turkewitz turned to his old friend Boies. The two had collaborated in the late 1990s, securing a big verdict in an asbestos liability case in New York City. “David’s one of the best lawyers in America,” said Turkewitz. “He got to know the Barnett family. He took the case not because the dollars are huge but because of the message we’d be sending.” Boies is working closely on the cases with Boies, Schiller et al. managing partner Sigrid McCawley.

Boies blasts “the old Boeing arrogance”

When this writer interviewed Boies in mid March at his rambling country home set in horse country north of Manhattan in Amonk, New York, the litigator was in full reformer mode. Boies, who’d turned 84 the previous week, insisted that Barnett was a hero who embodied just the kind of dedication to diligently following safety rules that Boeing now needs to restore its reputation. Attired in a vintage blue suit over red-and-green plaid work shirt and Sketchers shoes, Boies told me, “He wasn’t looking for anything for himself. He was just looking to make airplanes safe. And they immediately wanted to bury him because they considered any kind of criticism a threat. If they’d listened to people like Barnett all along, they wouldn’t have had the problems that injured them so badly.”

Boies says that in the litigation, Boeing adopted a “scorched earth policy” that “you see from time to time, but thankfully not often.” He professes amazement that leadership isn’t settling the Barnett case as part of an initiative symbolizing that Boeing’s shedding its recently troubled past to find a new direction. “They should be celebrating Barnett instead of continuing to try to ignore his example of doing the right thing,” he allows. For Boies, the new management keeps using the right words, but contradicting its position by not admitting openly to its past mistakes. “They purport to want to close the door to the past. But every time you bring up the kind of specific abuses Barnett identified, they deny them. The old Boeing arrogance and refusal to accept criticism comes back,” declares Boies.

Says Turkewitz, “John’s death has been devastating for his family and friends. John’s mom Vicky and his brothers are amazing people and want to continue John’s mission to protect the flying public. We had hoped to resolve the cases at mediation, but unfortunately reached an impasse.”

Boies expects the wrongful death case to go to trial

As for the cases, Boies recounts that the two sides have discussed a deal that would settle both actions in a single package. “But I don’t think we ever got into a narrow enough range,” he says. “It was clear they were not willing to be reasonable in terms of numbers. They want to treat this like they’re an insurance company that doesn’t want to pay out any money.” He believes that in the OSHA case, the administrative judge will award the Barnetts a settlement if the two sides don’t reach an agreement beforehand. “Boeing will mainly argue about the amount to be paid,” he says. In the wrongful death action, he adds, the outcome will hinge on whether Boeing’s alleged harassment of Barnett on the job that he claims brought on post dramatic stress syndrome and anxiety and panic attacks was legally responsible for his demise, when he took his own life. “It will be the argument ‘We didn’t pull the trigger, we didn’t push him off a ledge,'” says Boies. “But I think we know a lot about PTSD today and the effects it can have in destroying a person’s life.”

Boies believes the wrongful death case will go to trial, and Turkewitz agrees. The Charleston attorney predicts that Boeing will fight hard to prevent it from getting before a jury. “Boeing’s lawyers will argue that it’s frivolous, they’ll file motions and seek summary judgment to block it,” he says. Both Turkewitz and Boies believe that Barnett’s ultimate vindication may be from the judgment of twelve Americans assessing whether Boeing caused the death of this passionate maverick by punishing him for a crusade that, had leadership joined in, could have saved a great American institution from its steep fall from grace.

This story was originally featured on Fortune.com

Tech News

Sequoia Capital to cut policy team and shutter Washington, D.C. office just as the tech industry increases its visibility under Trump

Sequoia Capital, one of Silicon Valley’s most prominent venture capital firms, is laying off its Washington, D.C.-based policy team and shuttering its office there, just as some tech-related companies try to increase their visibility in the U.S. capital after President Trump’s re-election.

The changes will take effect at the end of March and impact three full-time employees as well as policy fellows who worked with the firm. Sequoia confirmed the layoff while two sources familiar with the matter who requested anonymity because the topic is sensitive, said that the firm would close its Washington office.

Sequoia says it had set up its small policy team five years ago—during the first Trump Administration—to advise its investment team and portfolio companies on regulatory issues, deepen its knowledge of the policy landscape, and strengthen its connections with global policymakers, experts, and think tanks. Don Vieira, who had held senior national security positions at the Department of Justice and House Permanent Select Committee on Intelligence, opened the office, according to his LinkedIn. Vieria will leave the firm as part of the changes. He did not respond to requests for comment.

“Thanks to [the policy group’s] strategic guidance and efforts, Sequoia is now well-positioned to carry these relationships in the U.S. and Europe forward,” a Sequoia spokesperson said. “To that end, we are sunsetting the dedicated policy function and closing our D.C. office at the end of March. We are grateful to the team for their contributions and impact.”

The changes at Sequoia are in contrast to tech companies that have been increasing their visibility in Washington, D.C. since President Trump’s re-election. Meta in January hired Joel Kaplan, former deputy chief of staff to former President George W. Bush, to head its global policy team and CEO Mark Zuckerburg has visited Trump at the White House and Mar-a-Lago.

Some other venture capital firms have been beefing up their presence in Washington, D.C. to help portfolio companies that operate in highly regulated or political industries like defense, crypto, or AI. Venture capital firm Andreessen Horowitz, for example, which has had several of its partners take official or advisory positions in the White House, recently hired Patrick McHenry, the former North Carolina congressman, and Matt Cronin, former Chief Investigative Counsel and Deputy General Counsel for the U.S. House Select Committee on Strategic Competition, as senior advisors to the firm. Last fall, before the election, General Catalyst launched what it calls the “General Catalyst Institute” to influence AI, healthcare, defense and intelligence, manufacturing, and energy policy.

Sequoia Capital has historically remained politically neutral as a firm, even though many of its partners individually express political views or make large donations to presidential candidates. Top partner Roelof Botha said last summer that he is not registered with either political party, but that he is “more focused on the policies that will drive entrepreneurship, job creation, and making sure that the United States stays ahead.”

This story was originally featured on Fortune.com

Tech News

Is Google’s $32 billion Wiz acquisition a one-off—or a sign that Big Tech M&A is back?

Google plans to acquire cybersecurity company Wiz for $32 billion in the search giant’s largest-ever acquisition.

In a vacuum, that’s stunning, but it’s even more so in context. The last couple years have been an exhaustingly stalled time for venture capital-backed companies looking for a big ticket exit. Under former Federal Trade Commission Chair Lina Khan, acquisitions by Big Tech became a hazy exit lane because of antitrust concerns. Meanwhile, economic considerations and geopolitical pressures mostly froze the IPO market.

Cybersecurity was a sector that saw some acquisitions and even the occasional IPO amid broader industry consolidation (Wiz itself did a number of acquisitions in 2024, including Dazz and Gem Security). At the same time, Wiz’s fortunes have risen in tandem with the increasing importance of cybersecurity across the global economy—as cyberattacks increased, so has investment in cybersecurity companies.

In short, Wiz, founded about five years ago, is both riding the cybersecurity and cloud adoption waves and has simultaneously defied the exit odds. The blockbuster deal, by extension, presents more questions than answers for the broader landscape.

The first question is perhaps the most obvious: Is Big Tech M&A back? During her tenure, Khan actively blocked Big Tech deals large and small, from Meta’s acquisition of VR company Within (deal value was reported at $400 million) to Microsoft’s $69 billion mega-deal for Activision Blizzard. Under the Trump administration, is it now open season for major deals? Or will another FTC-sized hammer drop?

This leads implicitly to a second question: Is Wiz a one-off? There are certainly signs the broader environment for tech is warming, especially given Klarna and CoreWeave’s recent IPO filings in quick succession. And Rubrik’s IPO last year and a steady stream of smaller intra-industry cybersecurity deals proves that cybersecurity is still hot.

But here is the situation where Wiz is fundamentally a one-off—that other cybersecurity companies now look at Wiz and have higher expectations of what an exit might look like, expectations prospective buyers aren’t willing to meet. In other words, Wiz isn’t the bellwether for the industry so much as an incredibly successful anomaly.

In that sense, Wiz’s high-flying outcome presents more questions than answers for the broader ecosystem—for now.

This story was originally featured on Fortune.com

Tech News

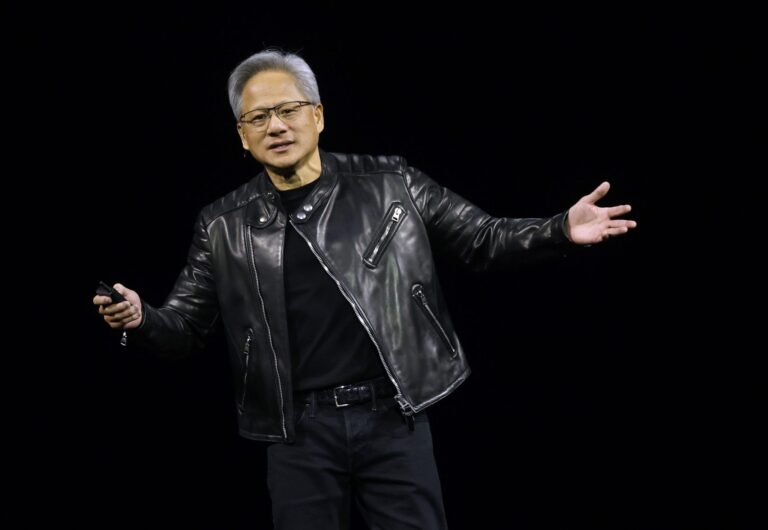

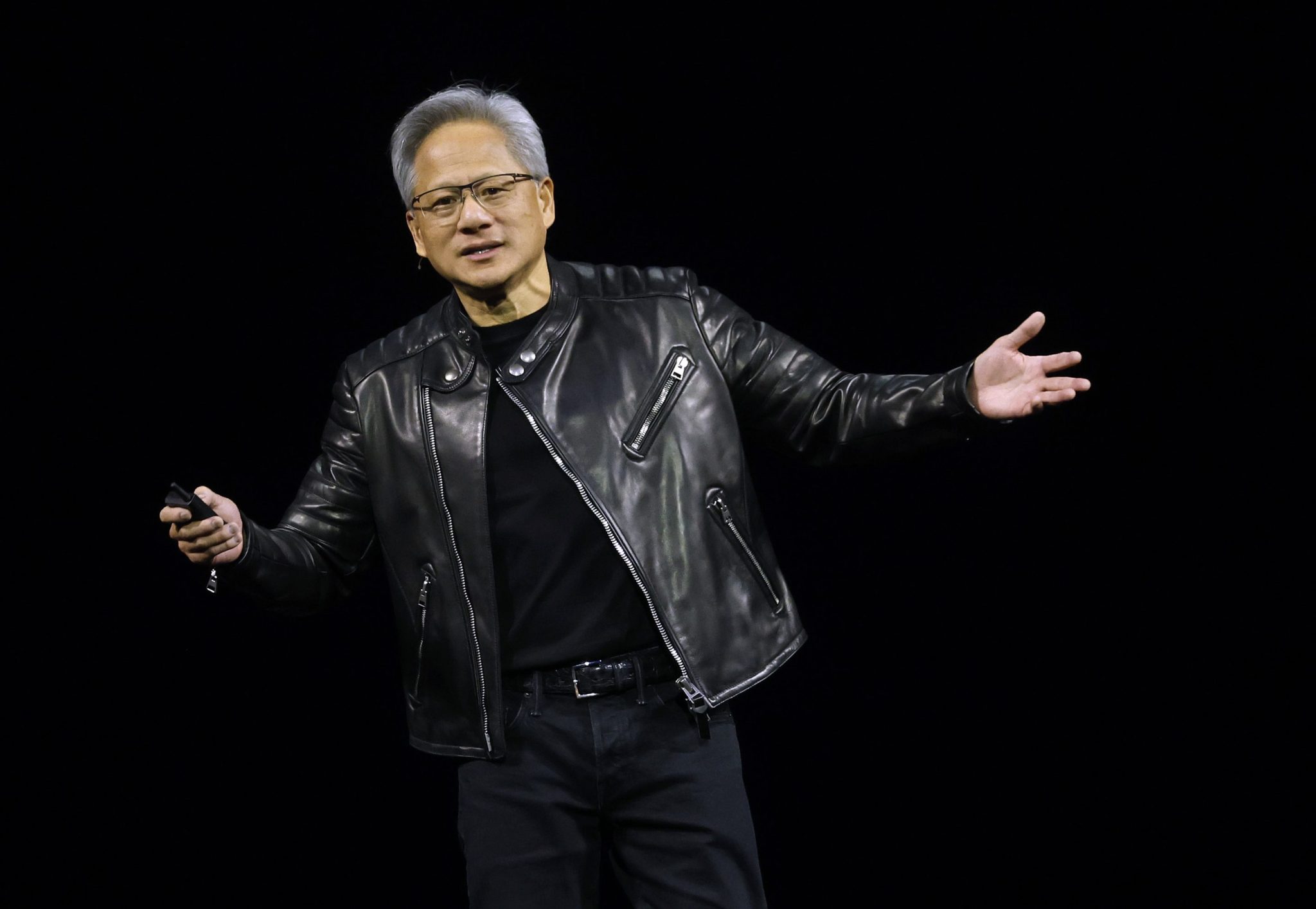

Nvidia CEO Jensen Huang called GTC a Super Bowl where there are no losers — then he tackled concerns about China’s DeepSeek

- Jensen Huang reaffirmed Nvidia’s starring role in the AI industry during a keynote address at Nvidia’s annual GTC conference on Tuesday. Through its new open-source software, Huang showed how Nvidia can ramp up DeepSeek R1’s efficiency 30-fold. Yet, while he spoke, Nvidia’s stock price dropped more than 3%—after the company announced its GPU timelines.

Clad in his signature black leather, Nvidia CEO Jensen Huang took center stage at Nvidia GTC on Tuesday, defending the chip maker’s dominance in the industry and touting the impact it could have on DeepSeek.

The event drew more than 25,000 people to the SAP Center’s National Hockey League arena, and Huang opened the keynote by launching t-shirts into the crowd and coronating this year’s GTC the “Super Bowl of AI.”

“The only difference is everybody wins at this Super Bowl, everybody’s a winner,” he joked. And like the Super Bowl, there were GTC watch parties and packed crowds to get a glimpse of Huang on stage.

With his address, Huang sought to dispel any uneasiness around AI investment, and said discussion about lower spending does not concern Nvidia. In January, apprehension engulfed the chip maker after it lost $589 billion in market cap in a single day after Chinese AI reasoning model Deepseek R1 claimed to operate at a fraction of the cost.

While large language models offer foundational knowledge, reasoning models offer more complex, analytical responses. Using the company’s new open source software Nvidia Dynamo, Huang said the tech giant’s Blackwell chips will be able to make DeepSeek R1 30 times faster. He then played a video demonstrating for the crowd how it could be done.

“Dynamo can capture that benefit and deliver 30 times more performance in the same number of GPUs in the same architecture for reasoning models like DeepSeek,” said Ian Buck, vice president and general manager of Nvidia’s hyperscale and HPC computing business.

From there, Huang’s keynote covered everything from the chip maker’s plans to roll out its newest chips— Blackwell Ultra later this year, Vera Rubin in 2026, and Feynman in 2027.

“We have an annual rhythm of roadmaps that has been laid out for you,” Huang said.

While Nvidia’s announced its strategic runway for years to come, that wasn’t enough to stop the stock’s slide. The chip maker’s share price tumbled 3.4% Tuesday.

This story was originally featured on Fortune.com

-

Tech News3 months ago

Tech News3 months agoHow Costco’s formula for reaching uncertain consumers is pushing shares past $1,000 to all-time highs

-

Tech News3 months ago

Tech News3 months agoLuigi Mangione hires top lawyer—whose husband is representing Sean ‘Diddy’ Combs

-

Tech News3 months ago

Tech News3 months agoLego bricks have won over adults, growing its $10 billion toy market foothold—and there’s more to come

-

Tech News3 months ago

Quentin Tarantino thinks movies are still better than TV shows like Yellowstone

-

Tech News3 months ago

Tech News3 months agoInside the FOMC: Boston Fed President Susan Collins on changing her mind, teamwork, and the alchemy behind the base rate

-

Tech News3 months ago

Tech News3 months agoNancy Pelosi has hip replacement surgery at a US military hospital in Germany after falling at Battle of the Bulge ceremony

-

Tech News3 months ago

Tech News3 months agoTrump and members of Congress want drones shot down while more are spotted near military facilities

-

Tech News3 months ago

Tech News3 months agoHundreds of OpenAI’s current and ex-employees are about to get a huge payday by cashing out up to $10 million each in a private stock sale