Tech News

Proposed Trump policy could force thousands of citizens applying for social security benefits to verify their identities in person

Trump’s Social Security Administration proposed a major change that could force thousands of people every week to show up at a shrinking list of field offices before they can receive benefits.

In an effort to combat fraud, the SSA has suggested that citizens applying for social security or disability benefits over the phone would also need to, for the first time, verify their identities using an online program called “internet ID proofing,” according to an internal memo viewed by the Washington Post.

If they can’t verify their identity online, they will have to file paperwork at their nearest field office, according to the memo sent last week by Acting Deputy Commissioner for Operations Doris Diaz to Acting Social Security Commissioner Leland Dudek.

The memo acknowledged the potential change could force an estimated 75,000 to 85,000 people per week to seek out field offices to confirm their identities and could lead to “increased challenges for vulnerable populations,” “longer wait times and processing time,” and “increased demand for office appointments,” the memo read, according to the Post.

The change would disproportionately affect older populations who may not be internet savvy, and those with disabilities. Claimants seeking a field office will also have fewer to choose from, as more than 40 of 1,200 are estimated to close, the New York Times reported, citing advocacy group Social Security Works. The list of offices slated to close is based on an unreliable list released by DOGE, according to Social Security Works. Elon Musk’s DOGE has also said it will cut 7,000 of the SSA’s 57,000 employees.

The White House and the Social Security Administration did not immediately respond to Fortune‘s request for comment.

The SSA previously considered scrapping telephone service for claims, the Post reported, but backtracked after a report by the outlet. Regardless, the SSA said claimants looking to change their bank account information will now need to do so either online or in-person and could no longer do so over the phone.

Almost every transaction at a field office requires an appointment that already takes months to realize, according to the Post.

The White House has repeatedly said it will not cut Social Security, Medicare, or Medicare benefits, and has said any changes are to cut back on fraud. A July 2024 report from the Social Security Administration’s inspector general estimated that between fiscal 2015 and fiscal 2022, the SSA sent out $8.6 trillion in disbursements. Fewer than 1% of the disbursements, or $71.8 billion worth were improper payments, according to the report.

Acting Social Security Commissioner Dudek said for phone calls, the agency is “exploring ways to implement AI — in a safe, governed manner in accordance with” guidance from the Office of Management and Budget “to streamline and improve call resolution,” according to a Tuesday memo obtained by NBC News.

Dudek mentioned in the memo that the agency has been frequently mentioned in the media, which has been stressing out employees.

“Over the past month, this agency has seen an unprecedented level of media coverage, some of it true and deserved, while some has not been factual and painted the agency in a very negative light,” he wrote. “I know this has been stressful for you and has caused disruption in your life. Personally, I have made some mistakes, which makes me human like you. I promise you this, I will continue to make mistakes, but I will learn from them. My decisions will always be with the best intentions for this agency, the people we serve, and you.”

This story was originally featured on Fortune.com

Tech News

Sequoia Capital to cut policy team and shutter Washington, D.C. office just as the tech industry increases its visibility under Trump

Sequoia Capital, one of Silicon Valley’s most prominent venture capital firms, is laying off its Washington, D.C.-based policy team and shuttering its office there, just as some tech-related companies try to increase their visibility in the U.S. capital after President Trump’s re-election.

The changes will take effect at the end of March and impact three full-time employees as well as policy fellows who worked with the firm. Sequoia confirmed the layoff while two sources familiar with the matter who requested anonymity because the topic is sensitive, said that the firm would close its Washington office.

Sequoia says it had set up its small policy team five years ago—during the first Trump Administration—to advise its investment team and portfolio companies on regulatory issues, deepen its knowledge of the policy landscape, and strengthen its connections with global policymakers, experts, and think tanks. Don Vieira, who had held senior national security positions at the Department of Justice and House Permanent Select Committee on Intelligence, opened the office, according to his LinkedIn. Vieria will leave the firm as part of the changes. He did not respond to requests for comment.

“Thanks to [the policy group’s] strategic guidance and efforts, Sequoia is now well-positioned to carry these relationships in the U.S. and Europe forward,” a Sequoia spokesperson said. “To that end, we are sunsetting the dedicated policy function and closing our D.C. office at the end of March. We are grateful to the team for their contributions and impact.”

The changes at Sequoia are in contrast to tech companies that have been increasing their visibility in Washington, D.C. since President Trump’s re-election. Meta in January hired Joel Kaplan, former deputy chief of staff to former President George W. Bush, to head its global policy team and CEO Mark Zuckerburg has visited Trump at the White House and Mar-a-Lago.

Some other venture capital firms have been beefing up their presence in Washington, D.C. to help portfolio companies that operate in highly regulated or political industries like defense, crypto, or AI. Venture capital firm Andreessen Horowitz, for example, which has had several of its partners take official or advisory positions in the White House, recently hired Patrick McHenry, the former North Carolina congressman, and Matt Cronin, former Chief Investigative Counsel and Deputy General Counsel for the U.S. House Select Committee on Strategic Competition, as senior advisors to the firm. Last fall, before the election, General Catalyst launched what it calls the “General Catalyst Institute” to influence AI, healthcare, defense and intelligence, manufacturing, and energy policy.

Sequoia Capital has historically remained politically neutral as a firm, even though many of its partners individually express political views or make large donations to presidential candidates. Top partner Roelof Botha said last summer that he is not registered with either political party, but that he is “more focused on the policies that will drive entrepreneurship, job creation, and making sure that the United States stays ahead.”

This story was originally featured on Fortune.com

Tech News

Is Google’s $32 billion Wiz acquisition a one-off—or a sign that Big Tech M&A is back?

Google plans to acquire cybersecurity company Wiz for $32 billion in the search giant’s largest-ever acquisition.

In a vacuum, that’s stunning, but it’s even more so in context. The last couple years have been an exhaustingly stalled time for venture capital-backed companies looking for a big ticket exit. Under former Federal Trade Commission Chair Lina Khan, acquisitions by Big Tech became a hazy exit lane because of antitrust concerns. Meanwhile, economic considerations and geopolitical pressures mostly froze the IPO market.

Cybersecurity was a sector that saw some acquisitions and even the occasional IPO amid broader industry consolidation (Wiz itself did a number of acquisitions in 2024, including Dazz and Gem Security). At the same time, Wiz’s fortunes have risen in tandem with the increasing importance of cybersecurity across the global economy—as cyberattacks increased, so has investment in cybersecurity companies.

In short, Wiz, founded about five years ago, is both riding the cybersecurity and cloud adoption waves and has simultaneously defied the exit odds. The blockbuster deal, by extension, presents more questions than answers for the broader landscape.

The first question is perhaps the most obvious: Is Big Tech M&A back? During her tenure, Khan actively blocked Big Tech deals large and small, from Meta’s acquisition of VR company Within (deal value was reported at $400 million) to Microsoft’s $69 billion mega-deal for Activision Blizzard. Under the Trump administration, is it now open season for major deals? Or will another FTC-sized hammer drop?

This leads implicitly to a second question: Is Wiz a one-off? There are certainly signs the broader environment for tech is warming, especially given Klarna and CoreWeave’s recent IPO filings in quick succession. And Rubrik’s IPO last year and a steady stream of smaller intra-industry cybersecurity deals proves that cybersecurity is still hot.

But here is the situation where Wiz is fundamentally a one-off—that other cybersecurity companies now look at Wiz and have higher expectations of what an exit might look like, expectations prospective buyers aren’t willing to meet. In other words, Wiz isn’t the bellwether for the industry so much as an incredibly successful anomaly.

In that sense, Wiz’s high-flying outcome presents more questions than answers for the broader ecosystem—for now.

This story was originally featured on Fortune.com

Tech News

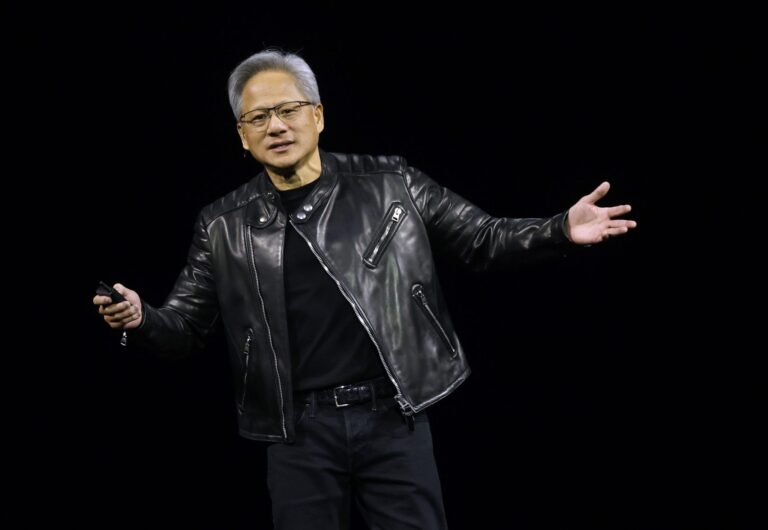

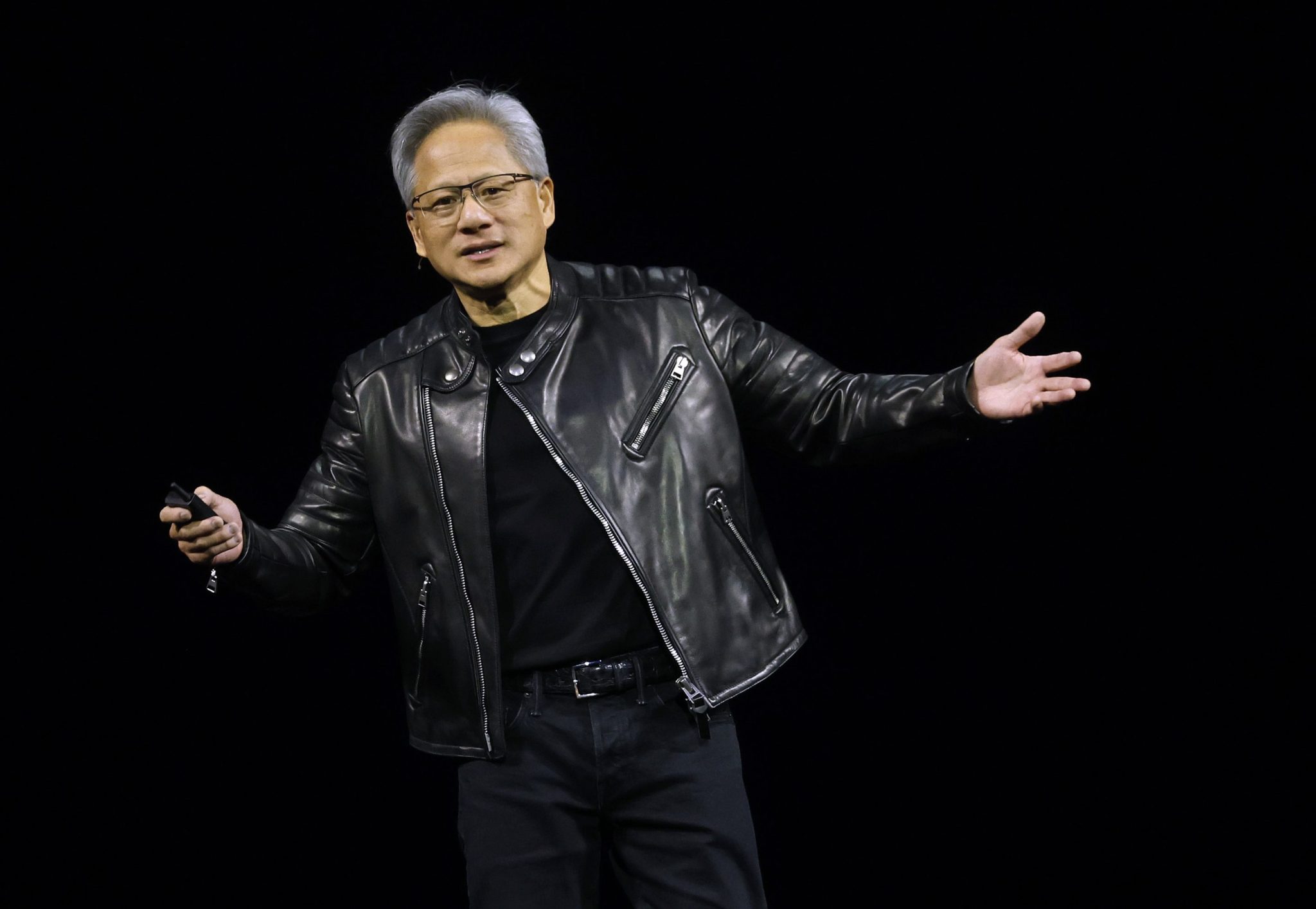

Nvidia CEO Jensen Huang called GTC a Super Bowl where there are no losers — then he tackled concerns about China’s DeepSeek

- Jensen Huang reaffirmed Nvidia’s starring role in the AI industry during a keynote address at Nvidia’s annual GTC conference on Tuesday. Through its new open-source software, Huang showed how Nvidia can ramp up DeepSeek R1’s efficiency 30-fold. Yet, while he spoke, Nvidia’s stock price dropped more than 3%—after the company announced its GPU timelines.

Clad in his signature black leather, Nvidia CEO Jensen Huang took center stage at Nvidia GTC on Tuesday, defending the chip maker’s dominance in the industry and touting the impact it could have on DeepSeek.

The event drew more than 25,000 people to the SAP Center’s National Hockey League arena, and Huang opened the keynote by launching t-shirts into the crowd and coronating this year’s GTC the “Super Bowl of AI.”

“The only difference is everybody wins at this Super Bowl, everybody’s a winner,” he joked. And like the Super Bowl, there were GTC watch parties and packed crowds to get a glimpse of Huang on stage.

With his address, Huang sought to dispel any uneasiness around AI investment, and said discussion about lower spending does not concern Nvidia. In January, apprehension engulfed the chip maker after it lost $589 billion in market cap in a single day after Chinese AI reasoning model Deepseek R1 claimed to operate at a fraction of the cost.

While large language models offer foundational knowledge, reasoning models offer more complex, analytical responses. Using the company’s new open source software Nvidia Dynamo, Huang said the tech giant’s Blackwell chips will be able to make DeepSeek R1 30 times faster. He then played a video demonstrating for the crowd how it could be done.

“Dynamo can capture that benefit and deliver 30 times more performance in the same number of GPUs in the same architecture for reasoning models like DeepSeek,” said Ian Buck, vice president and general manager of Nvidia’s hyperscale and HPC computing business.

From there, Huang’s keynote covered everything from the chip maker’s plans to roll out its newest chips— Blackwell Ultra later this year, Vera Rubin in 2026, and Feynman in 2027.

“We have an annual rhythm of roadmaps that has been laid out for you,” Huang said.

While Nvidia’s announced its strategic runway for years to come, that wasn’t enough to stop the stock’s slide. The chip maker’s share price tumbled 3.4% Tuesday.

This story was originally featured on Fortune.com

-

Tech News3 months ago

Tech News3 months agoHow Costco’s formula for reaching uncertain consumers is pushing shares past $1,000 to all-time highs

-

Tech News3 months ago

Tech News3 months agoLuigi Mangione hires top lawyer—whose husband is representing Sean ‘Diddy’ Combs

-

Tech News3 months ago

Tech News3 months agoLego bricks have won over adults, growing its $10 billion toy market foothold—and there’s more to come

-

Tech News3 months ago

Quentin Tarantino thinks movies are still better than TV shows like Yellowstone

-

Tech News3 months ago

Tech News3 months agoInside the FOMC: Boston Fed President Susan Collins on changing her mind, teamwork, and the alchemy behind the base rate

-

Tech News3 months ago

Tech News3 months agoNancy Pelosi has hip replacement surgery at a US military hospital in Germany after falling at Battle of the Bulge ceremony

-

Tech News3 months ago

Tech News3 months agoTrump and members of Congress want drones shot down while more are spotted near military facilities

-

Tech News3 months ago

Tech News3 months agoHundreds of OpenAI’s current and ex-employees are about to get a huge payday by cashing out up to $10 million each in a private stock sale