Tech News

DOGE has ‘broken into’ the U.S. Institute for Peace after repeatedly being denied entry. Its former leader is calling it an ‘illegal takeover’

- DOGE has entered the U.S. Institute for Peace in what its former leader is calling an “illegal takeover.” Officials say the Trump administration does not have the authority to gut the organization.

Elon Musk’s DOGE has “broken into” the U.S. Institute for Peace (USIP) after multiple failed attempts to enter the building, officials say.

The cost-cutting team gained access to the organization’s headquarters on Monday, despite officials arguing the Trump administration does not have the authority to gut the institute, the organization’s chief security officer, Colin O’Brien, told Fortune.

O’Brien said DOGE’s attempt to access the organization amounted to a “sustained effort over multiple days” that deployed “a range of tactics to gain entry.”

“It was unlike anything I have experienced in my professional career,” he said.

In a video shared online, D.C. police can be seen outside the institute’s headquarters in the Foggy Bottom neighborhood on Monday evening. O’Brien said USIP had contacted the police after DOGE tried to gain access to the building without permission.

In a statement shared with media on Monday, the organization’s former CEO, George Moose, said: “DOGE has broken into our building.”

He called the events “an illegal takeover by elements of the executive branch of a private non-profit.”

The organization has been in a standoff with Elon Musk’s cost-cutting team for several days, which escalated on Monday when DOGE staffers forced their way into the organization’s headquarters.

Congressman Don Beyer said the organization had been “stormed by DOGE, with the support of the D.C. police.” He said employees had been forced out and authorities had “picked the lock” on the Moose’s door and forced him to exit the building.

“This is not a federal agency, this is an agency that does not report to Donald Trump,” he said. “It’s a congressionally charted non-profit, and, like thousands of non-profits it gets some federal funding but that’s all subject to review by Congress, not the president of the United States.”

Beyer said he tried to gain access but was denied.

Representatives for the White House did not immediately respond to a request for comment from Fortune, made outside normal working hours.

In a statement on X, DOGE wrote: “Mr. Moose denied lawful access to Kenneth Jackson, the Acting USIP President (as approved by the USIP Board). @DCPoliceDept arrived onsite and escorted Mr. Jackson into the building. The only unlawful individual was Mr. Moose, who refused to comply, and even tried to fire USIP’s private security team when said security team went to give access to Mr. Jackson.”

Trump takes aim at foreign aid

Officials at the U.S. Institute for Peace have argued the Trump administration does not have proper authority to gut the organization since it’s not part of the executive branch.

According to its website, the U.S. Institute of Peace is a nonpartisan, independent organization committed to safeguarding U.S. interests by working to prevent violent conflicts and mediate peace agreements internationally.

The Trump administration removed most of the board of the U.S. Institute of Peace, per the AP, and replaced Moose as acting president with Kenneth Jackson, a State Department official who was involved in the dismantling of USAID, with the help of the remaining board members: Secretary of State Marco Rubio, Defense Secretary Pete Hegseth, and Peter A. Garvin, the president of the National Defense University.

The move appears to be part of a broader effort to dismantle the U.S.’s foreign aid programs.

Speaking to reporters after leaving the building, Moose said: “It was very clear that there was a desire on the part of the administration to dismantle a lot of what we call foreign assistance, and we are part of that family.”

Moose also said the organization had been in contact with DOGE since last month and had tried to explain its independent status.

This story was originally featured on Fortune.com

Tech News

Sequoia Capital to cut policy team and shutter Washington, D.C. office just as the tech industry increases its visibility under Trump

Sequoia Capital, one of Silicon Valley’s most prominent venture capital firms, is laying off its Washington, D.C.-based policy team and shuttering its office there, just as some tech-related companies try to increase their visibility in the U.S. capital after President Trump’s re-election.

The changes will take effect at the end of March and impact three full-time employees as well as policy fellows who worked with the firm. Sequoia confirmed the layoff while two sources familiar with the matter who requested anonymity because the topic is sensitive, said that the firm would close its Washington office.

Sequoia says it had set up its small policy team five years ago—during the first Trump Administration—to advise its investment team and portfolio companies on regulatory issues, deepen its knowledge of the policy landscape, and strengthen its connections with global policymakers, experts, and think tanks. Don Vieira, who had held senior national security positions at the Department of Justice and House Permanent Select Committee on Intelligence, opened the office, according to his LinkedIn. Vieria will leave the firm as part of the changes. He did not respond to requests for comment.

“Thanks to [the policy group’s] strategic guidance and efforts, Sequoia is now well-positioned to carry these relationships in the U.S. and Europe forward,” a Sequoia spokesperson said. “To that end, we are sunsetting the dedicated policy function and closing our D.C. office at the end of March. We are grateful to the team for their contributions and impact.”

The changes at Sequoia are in contrast to tech companies that have been increasing their visibility in Washington, D.C. since President Trump’s re-election. Meta in January hired Joel Kaplan, former deputy chief of staff to former President George W. Bush, to head its global policy team and CEO Mark Zuckerburg has visited Trump at the White House and Mar-a-Lago.

Some other venture capital firms have been beefing up their presence in Washington, D.C. to help portfolio companies that operate in highly regulated or political industries like defense, crypto, or AI. Venture capital firm Andreessen Horowitz, for example, which has had several of its partners take official or advisory positions in the White House, recently hired Patrick McHenry, the former North Carolina congressman, and Matt Cronin, former Chief Investigative Counsel and Deputy General Counsel for the U.S. House Select Committee on Strategic Competition, as senior advisors to the firm. Last fall, before the election, General Catalyst launched what it calls the “General Catalyst Institute” to influence AI, healthcare, defense and intelligence, manufacturing, and energy policy.

Sequoia Capital has historically remained politically neutral as a firm, even though many of its partners individually express political views or make large donations to presidential candidates. Top partner Roelof Botha said last summer that he is not registered with either political party, but that he is “more focused on the policies that will drive entrepreneurship, job creation, and making sure that the United States stays ahead.”

This story was originally featured on Fortune.com

Tech News

Is Google’s $32 billion Wiz acquisition a one-off—or a sign that Big Tech M&A is back?

Google plans to acquire cybersecurity company Wiz for $32 billion in the search giant’s largest-ever acquisition.

In a vacuum, that’s stunning, but it’s even more so in context. The last couple years have been an exhaustingly stalled time for venture capital-backed companies looking for a big ticket exit. Under former Federal Trade Commission Chair Lina Khan, acquisitions by Big Tech became a hazy exit lane because of antitrust concerns. Meanwhile, economic considerations and geopolitical pressures mostly froze the IPO market.

Cybersecurity was a sector that saw some acquisitions and even the occasional IPO amid broader industry consolidation (Wiz itself did a number of acquisitions in 2024, including Dazz and Gem Security). At the same time, Wiz’s fortunes have risen in tandem with the increasing importance of cybersecurity across the global economy—as cyberattacks increased, so has investment in cybersecurity companies.

In short, Wiz, founded about five years ago, is both riding the cybersecurity and cloud adoption waves and has simultaneously defied the exit odds. The blockbuster deal, by extension, presents more questions than answers for the broader landscape.

The first question is perhaps the most obvious: Is Big Tech M&A back? During her tenure, Khan actively blocked Big Tech deals large and small, from Meta’s acquisition of VR company Within (deal value was reported at $400 million) to Microsoft’s $69 billion mega-deal for Activision Blizzard. Under the Trump administration, is it now open season for major deals? Or will another FTC-sized hammer drop?

This leads implicitly to a second question: Is Wiz a one-off? There are certainly signs the broader environment for tech is warming, especially given Klarna and CoreWeave’s recent IPO filings in quick succession. And Rubrik’s IPO last year and a steady stream of smaller intra-industry cybersecurity deals proves that cybersecurity is still hot.

But here is the situation where Wiz is fundamentally a one-off—that other cybersecurity companies now look at Wiz and have higher expectations of what an exit might look like, expectations prospective buyers aren’t willing to meet. In other words, Wiz isn’t the bellwether for the industry so much as an incredibly successful anomaly.

In that sense, Wiz’s high-flying outcome presents more questions than answers for the broader ecosystem—for now.

This story was originally featured on Fortune.com

Tech News

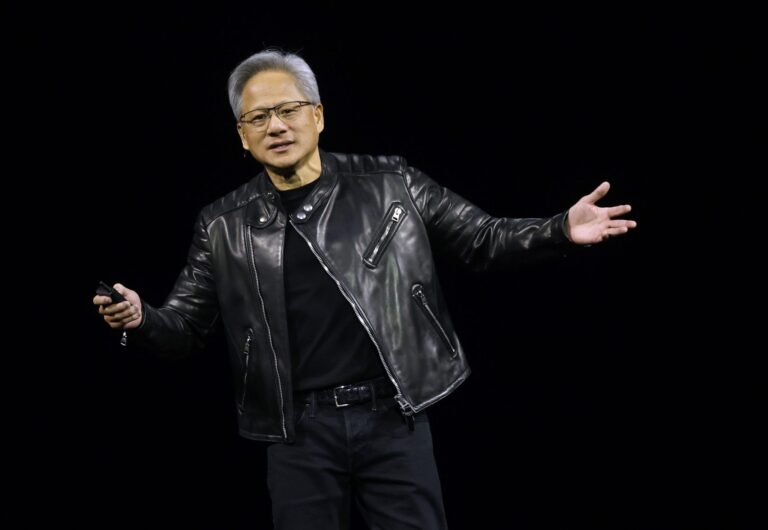

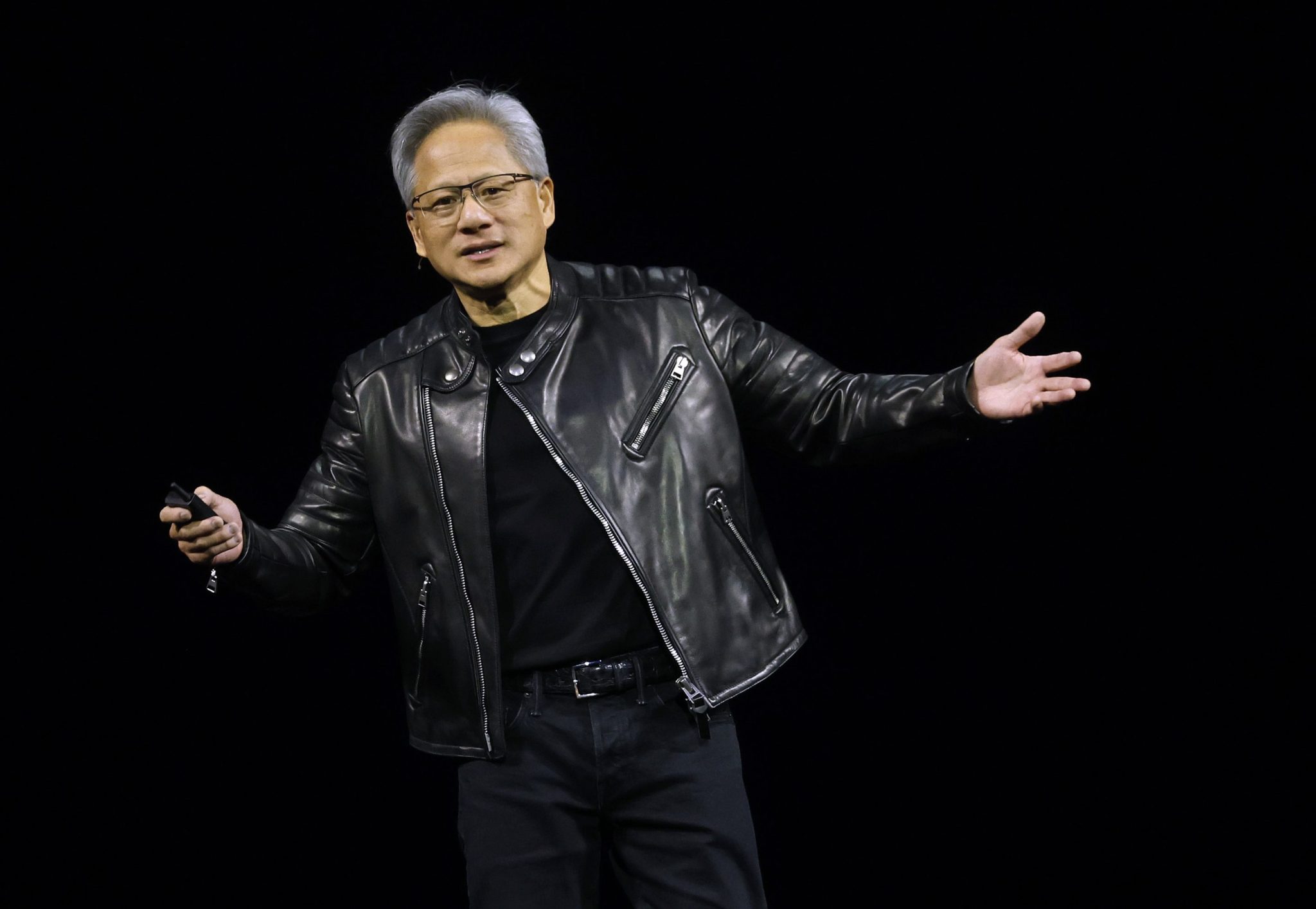

Nvidia CEO Jensen Huang called GTC a Super Bowl where there are no losers — then he tackled concerns about China’s DeepSeek

- Jensen Huang reaffirmed Nvidia’s starring role in the AI industry during a keynote address at Nvidia’s annual GTC conference on Tuesday. Through its new open-source software, Huang showed how Nvidia can ramp up DeepSeek R1’s efficiency 30-fold. Yet, while he spoke, Nvidia’s stock price dropped more than 3%—after the company announced its GPU timelines.

Clad in his signature black leather, Nvidia CEO Jensen Huang took center stage at Nvidia GTC on Tuesday, defending the chip maker’s dominance in the industry and touting the impact it could have on DeepSeek.

The event drew more than 25,000 people to the SAP Center’s National Hockey League arena, and Huang opened the keynote by launching t-shirts into the crowd and coronating this year’s GTC the “Super Bowl of AI.”

“The only difference is everybody wins at this Super Bowl, everybody’s a winner,” he joked. And like the Super Bowl, there were GTC watch parties and packed crowds to get a glimpse of Huang on stage.

With his address, Huang sought to dispel any uneasiness around AI investment, and said discussion about lower spending does not concern Nvidia. In January, apprehension engulfed the chip maker after it lost $589 billion in market cap in a single day after Chinese AI reasoning model Deepseek R1 claimed to operate at a fraction of the cost.

While large language models offer foundational knowledge, reasoning models offer more complex, analytical responses. Using the company’s new open source software Nvidia Dynamo, Huang said the tech giant’s Blackwell chips will be able to make DeepSeek R1 30 times faster. He then played a video demonstrating for the crowd how it could be done.

“Dynamo can capture that benefit and deliver 30 times more performance in the same number of GPUs in the same architecture for reasoning models like DeepSeek,” said Ian Buck, vice president and general manager of Nvidia’s hyperscale and HPC computing business.

From there, Huang’s keynote covered everything from the chip maker’s plans to roll out its newest chips— Blackwell Ultra later this year, Vera Rubin in 2026, and Feynman in 2027.

“We have an annual rhythm of roadmaps that has been laid out for you,” Huang said.

While Nvidia’s announced its strategic runway for years to come, that wasn’t enough to stop the stock’s slide. The chip maker’s share price tumbled 3.4% Tuesday.

This story was originally featured on Fortune.com

-

Tech News3 months ago

Tech News3 months agoHow Costco’s formula for reaching uncertain consumers is pushing shares past $1,000 to all-time highs

-

Tech News3 months ago

Tech News3 months agoLuigi Mangione hires top lawyer—whose husband is representing Sean ‘Diddy’ Combs

-

Tech News3 months ago

Tech News3 months agoLego bricks have won over adults, growing its $10 billion toy market foothold—and there’s more to come

-

Tech News3 months ago

Quentin Tarantino thinks movies are still better than TV shows like Yellowstone

-

Tech News3 months ago

Tech News3 months agoInside the FOMC: Boston Fed President Susan Collins on changing her mind, teamwork, and the alchemy behind the base rate

-

Tech News3 months ago

Tech News3 months agoNancy Pelosi has hip replacement surgery at a US military hospital in Germany after falling at Battle of the Bulge ceremony

-

Tech News3 months ago

Tech News3 months agoTrump and members of Congress want drones shot down while more are spotted near military facilities

-

Tech News3 months ago

Tech News3 months agoHundreds of OpenAI’s current and ex-employees are about to get a huge payday by cashing out up to $10 million each in a private stock sale