Tech News

Tariffs won’t make America great again: Export-Import Bank’s former chairman and president

In the rush toward what President Trump thinks of as a more realistic and transactional world of dealmaking in diplomacy, he has lost sight of the strategic advantages free trade continues to provide the U.S. While it remains to be seen whether these on-again, off-again tariffs will last, lasting damage has already been done.

As Trump doubles down on his “America First” rhetoric, he is, at best, ignoring the most crucial fact about the American economy: It runs on trade, that is Americans buying imported goods and American companies exporting to the rest of the world. The United States is the number two exporter in the world, which means that retaliatory tariffs will cause tremendous harm to American businesses and farmers and their workers. Our economy is powered not just by physical goods crossing borders, but by a vast service sector that relies on cooperation with other countries. By instigating a trade war against our geographical neighbors, closest allies, and economic partners, Trump risks stopping the engine of American prosperity.

We’re already seeing the consequences of this unpredictable environment play out with our northern neighbor. Canada—historically our closest ally and trading partners—is now being treated like an economic adversary. The result? Disruption to the deeply integrated economies and value chains on both sides of the border.

Take the automotive industry, a cornerstone of North American manufacturing, which stands to suffer significantly. Vehicles and components frequently cross the Canada-Mexico-U.S. border multiple times during production, with supply chains carefully optimized over decades. A 25% tariff could inflate the price of a new vehicle by as much as $12,000. This not only hurts American consumers, but also puts thousands of jobs at risk.

NAFTA, the predecessor to the United States-Mexico-Canada agreement, was originally proposed by Trump’s political idol Ronald Reagan, who correctly thought the U.S. needed a way to compete with an integrated European market. One of NAFTA’s follow-on effects has been allowing U.S. companies to compete with Asian automakers. By abandoning free trade, we abandon these long-term advantages, with no new strategic advantages to replace them, only Trump’s vague promises of a slate of better bi-lateral deals. As the car industry may go, so other industries may follow.

Beyond manufacturing, Trump’s tariffs will hurt a range of industries, from agriculture to technology. American farmers, already struggling with challenging market conditions, now face the prospect of losing access to crucial export markets. Meanwhile, innovative tech companies may find themselves cut off from global talent pools and collaborative research opportunities.

Trump has said he wants to make the U.S. more open to foreign direct investment (FDI). The bitter irony is that the chaos caused by his proposed tariffs is likely to discourage it. As Dave Cote once famously said, “capital is a coward,” meaning that investment always flows toward safety and predictability. Faced with Trump’s chaos and unpredictability, other nations looking to do business in North America may now choose to locate elsewhere, taking jobs and economic growth with them.

The near daily drama on proposed tariffs also distracts voters and policymakers from more effective ways to boost American competitiveness. Instead of erecting trade barriers, we should be investing in education, infrastructure, and research and development. These are the undisputed foundations of long-term economic growth and innovation—areas where America has historically excelled.

Treasury Secretary Scott Bessent’s recent comment that “access to cheap goods is not the essence of the American dream” entirely misses the point of free trade. So-called cheap goods are no trivial thing. Lower prices for food, clothing, and other essentials have alleviated economic pressure on American families for decades, and they have raised our collective standard of living and for many years helped keep inflation in check. That is, in fact, the essence of the American dream. Putting America first should mean having trade policies that consider the real interests of U.S. consumers, and not allegiance to an unproven, extreme ideology of purely transactional trade and diplomacy.

Instead, we should redefine what “America First” should really mean: fostering fair and transparent relationships, investing in our workforce and infrastructure, doubling down on innovation, and using trade to deepen our relationships with those long-standing allies in Europe and East Asia who share our values. When we build bridges to our allies, not walls, everyone stands to benefit.

The opinions expressed in Fortune.com commentary pieces are solely the views of their authors and do not necessarily reflect the opinions and beliefs of Fortune.

Read more:

- Trump tariffs: Stealing from the China playbook—to boost car making in America

- Are Trump’s trade and tariffs tantrums repairing market failures or eroding global trust?

- The best psych-out artists know how to mess with your mind, but Trump’s push for tariffs shows how this strategy can backfire

This story was originally featured on Fortune.com

Tech News

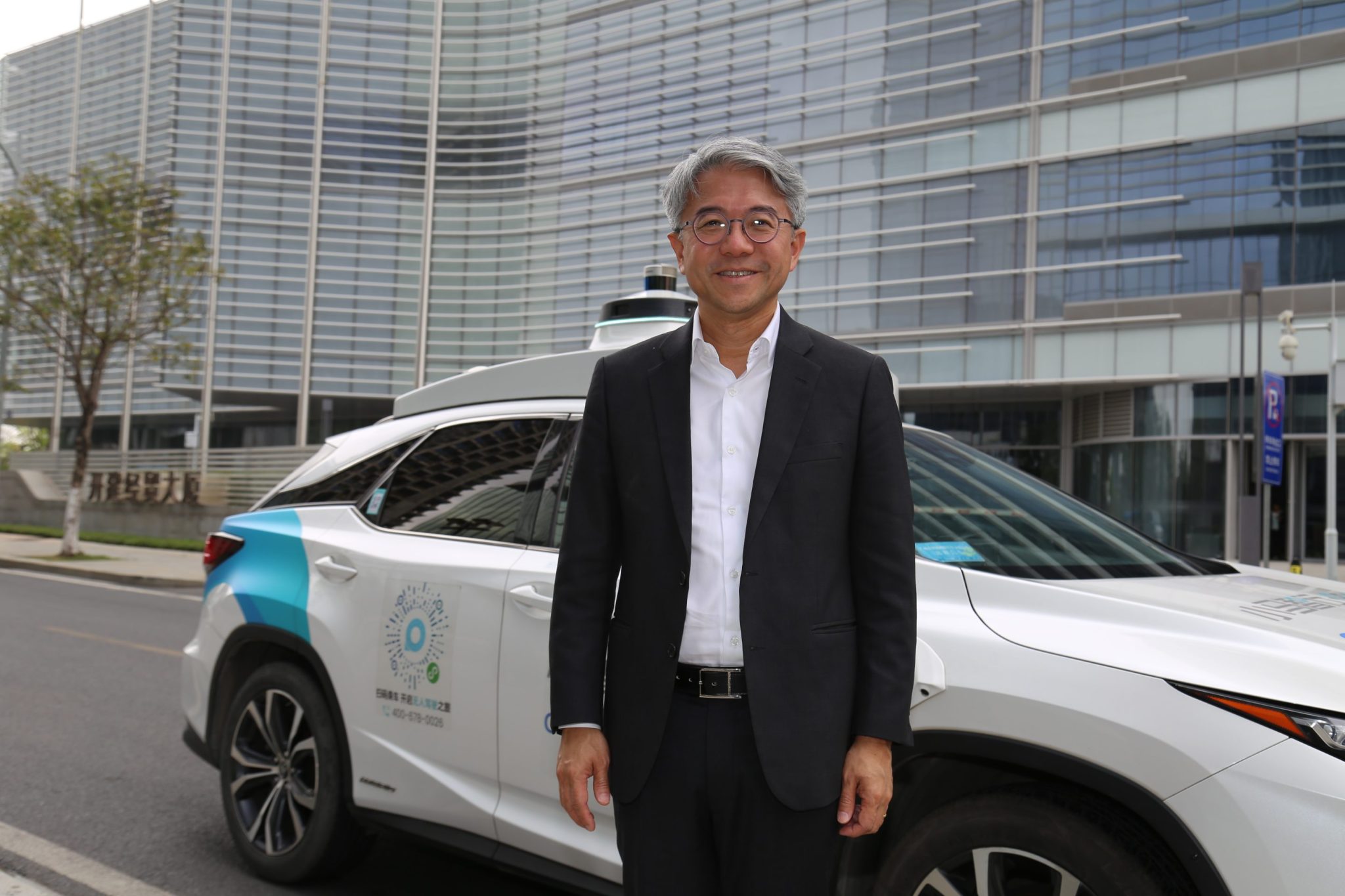

Singaporean taxi operator ComfortDelGro hopes robotaxis can future-proof the industry, as aging populations lead to fewer drivers

Singapore’s largest taxi operator is debuting its first robotaxis in China to help with “future-proofing” the industry, as rising incomes and ageing populations makes it harder for companies to find drivers.

ComfortDelGro, No. 128 on the Southeast Asia 500, will partner with Chinese autonomous vehicle startup Pony.ai to launch self-driving cars in the Chinese city of Guangzhou. The two-year pilot is starting with a small fleet of Lexus RX450 vehicles, and will expand to other models over the course of the program.

The company, which also operates bus and subway services, both in Singapore and overseas, hopes the partnership will help it prepare for coming labor shortages.

“The development of autonomous vehicle technology is crucial in future-proofing the transport industry,” ComfortDelGro’s CEO Cheng Siak Kian said in a statement. “With continuing driver shortages a global issue, we are exploring innovation solutions to ensure mobility remains accessible and efficient.”

ComfortDelGro, through its Pony.ai partnership, hopes to gain experience in managing a fleet of autonomous taxis. The company operates a global fleet of over 33,000 taxis and private hire cars worldwide, including more than 9,500 in China.

Pony.ai is allowed to operate autonomous driving mobility services in the Chinese cities of Beijing, Shanghai, Guangzhou and Shenzhen, and is also exploring a launch in Hong Kong.

“Guangdong is China’s most populous province and gives us the opportunity to build our capabilities in autonomous vehicles in a mature ecosystem,” a ComfortDelGro spokesperson told Fortune.

Tackling a labor shortage

During an interview with Fortune last September, Cheng expressed worries about a shortage of taxi drivers due to aging populations. “Now is the time to start looking at it,” he said, as the technology becomes “reasonably robust [and] reasonably mature.” The ComfortDelGro CEO suggested that robotaxis could supplement, rather than replace, human drivers by filling gaps in coverage.

Asia has some of the world’s lowest fertility rates, particularly in countries like Singapore, Japan, South Korea and China. Working-age populations are shrinking, posing a threat to businesses and industries that rely on human labor.

In 2022, ComfortDelGro invested 30 million Singapore dollars ($22.5 million) to develop its capability to operate and maintain autonomous vehicles, and to build a tech platform to support robotaxi services.

Other companies are turning to robotaxis as a response to aging Asian populations. Honda and Nissan are partnering with Japanese taxi operators to launch self-driving taxi services, also due to a shortage of drivers.

This story was originally featured on Fortune.com

Tech News

The Fed is expected to hold rates steady, as investors white-knuckle it through a brutal selloff and recession fears. ‘Policymakers aren’t providing any encouragement’

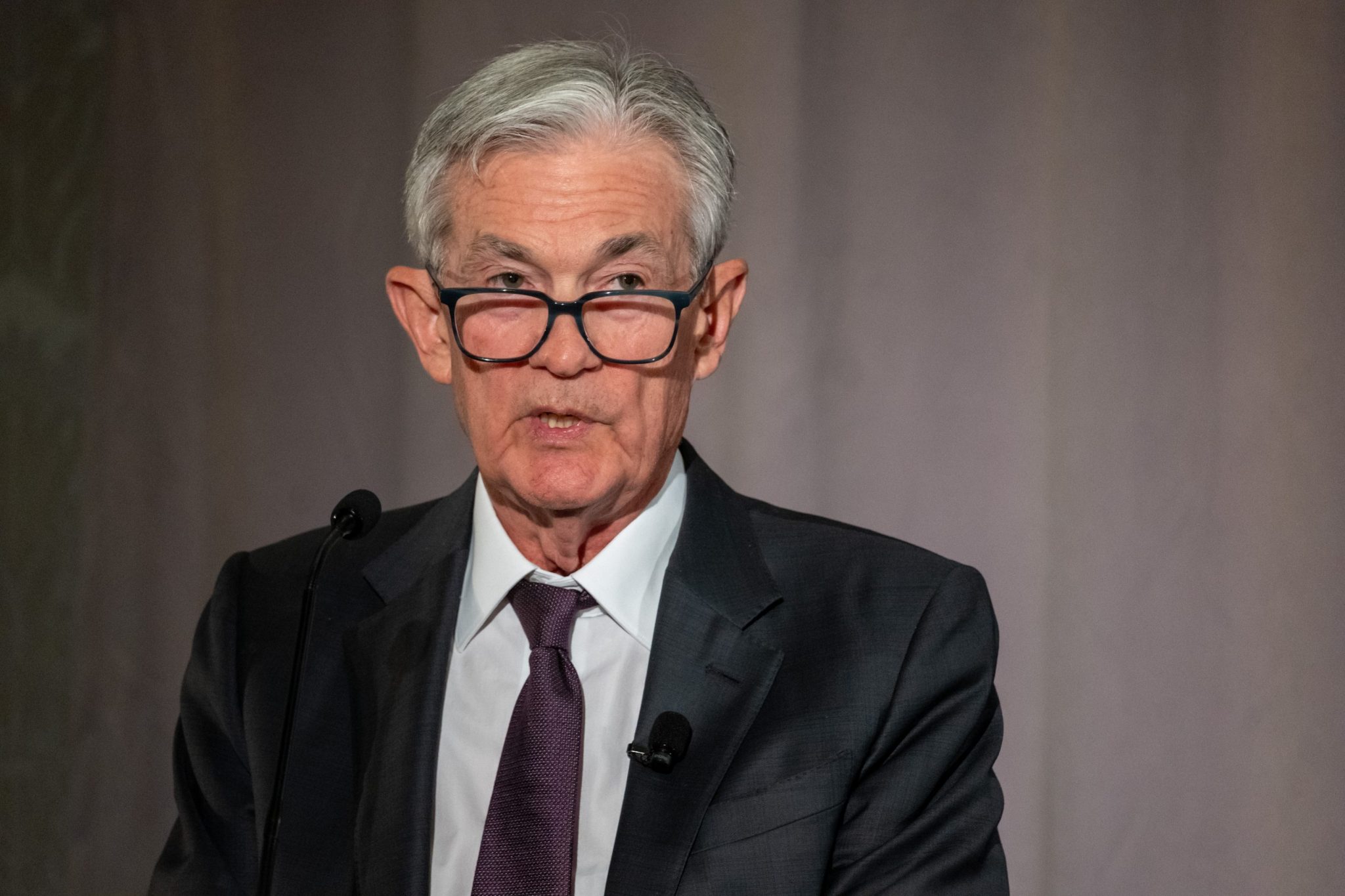

- The Federal Reserve will likely keep interest rates steady at its upcoming meeting. However, this time around investors, will be listening even more closely than usual to any hints from Jerome Powell about where he thinks the economy is headed. President Donald Trump’s recent tariff policies and the ensuing stock market rout raised fears the U.S. could be headed for a downturn.

After a tumultuous couple of weeks in the markets, investors can expect the Federal Reserve to remain steady after the conclusion of its two-day meeting on Wednesday.

The central bank will likely hold rates at their current level of 4.25%-4.5%, just as it did during its last meeting in January. Since then, Federal Reserve Chair Jerome Powell had said publicly he did not believe the current state of the economy warranted further rate cuts. Without a need to cut, he preferred to wait, given heightened levels of unpredictability in the markets.

“’Uncertainty’ is central bankers’ new policy-outlook mantra,” Maquiarie global foreign exchange and rates strategist Thierry Wizman wrote in a note.

Most of the lack of clarity stems from the new administration of President Donald Trump, who has pledged a series of unorthodox fiscal and trade policies. Early implementation of some of those policies, in particular a hardline tariff regime, has already roiled markets.

As of last Friday, the stock market lost $5 trillion in value after stocks tanked over investor fears the U.S. was walking into a trade war with both its allies and adversaries. Matters weren’t helped when Trump wouldn’t rule out a recession and Treasury Secretary Bessent said he wasn’t worried about the recent stock slump.

“U.S. policymakers aren’t providing any encouragement to the growth or equities story,” Wizman wrote.

With little reassurance from the executive branch, investors will be even more attuned to Powell’s words as well as the Fed’s forward guidance and outlook on the economy.

This time around, the range of options is especially wide. Most investors expect two or three rate cuts mostly in the back half of the year. However, Trump’s proposed policies of widespread tariffs and possible mass deportations would be inflationary, meaning that rate hikes are also possible, according to Melissa Brown investment firm SimCorp.

“These threats not only counter the need for cuts, but suggest that increases could be in order,” he told Fortune in an email. “We will have to listen closely to the language they use for any insight into what direction they might choose—if they choose to make changes at all.”

Brown will be on the lookout for one word above all. “The word I am listening for and dreading the most is stagflation,” she said.

While there are no current signs of stagflation, its specter looms over the economy. In recent weeks, several investors have warned of the possibility the U.S. could enter the dreaded scenario of high inflation and low growth that can trap economies for years.

Buoying investors’ hopes is the fact that the economy and the stock market are coming off a strong 2024. Inflation came under control, though never hit the Fed’s 2% target. At the same time, unemployment didn’t rise unexpectedly, and the S&P 500 hit record highs. But the economy is teetering on the brink of a downturn, making Powell and the Fed’s decision critical.

“We see mounting downside risks to the economy that could require the Fed to reduce rates in 2025,” Deutsche Bank wrote to investors in an analyst note. “Like the Fed, we hope to get a better sense of the details around policies before deciding whether an adjustment is needed. However, the data and financial markets might not allow us or the Fed to be so patient.”

Powell himself preached patience during a speech earlier this month. “The costs of being cautious are very, very low,” he said. “The economy’s fine. It doesn’t need us to do anything, really. And so we can wait, and we should wait.”

Over the subsequent week, the S&P 500 fell roughly 250 points and the Dow Jones a further 1,988, as investor panic rippled through the market. Though stocks started to rebound Friday and Monday, investors will still be looking to the Federal Reserve to keep them out of any more choppy waters.

This story was originally featured on Fortune.com

Tech News

Trump says Xi will visit Washington in ‘not too distant future’

President Donald Trump said Chinese leader Xi Jinping would visit Washington soon, as trade tensions build between the world’s two largest economies.

Xi will be coming in the “not too distant future,” Trump said Monday while attending a board meeting at the John F. Kennedy Center for the Performing Arts, as he touted a string of recent visits by leaders from India, France, the UK and Ireland.

Trump has ramped up a trade fight with China since returning to office, twice hiking blanket tariffs on imports from the Asian country. The president has called those moves a response to Beijing’s failure to crack down on the flow of illegal fentanyl and the precursor chemicals used to make it.

The Wall Street Journal previously reported U.S. and Chinese officials were discussing a possible “birthday summit” in June that would see the two leaders—who both have birthdays in the middle of the month—meet for the first time since Trump returned to the White House. The U.S. president did not detail specific timing for the possible meeting.

Chinese Foreign Ministry spokeswoman Mao Ning said Tuesday at a regular briefing in Beijing that she had no information to provide on a potential Trump-Xi meeting.

Trump also said last month that he’d speak with Xi, “probably in the next 24 hours,” as his initial 10% tariff hike loomed. That tariff deadline passed without any public record of the two men talking.

Chinese and U.S. top leaders typically take turns visiting each others’ nations, a protocol that puts the onus on Trump to visit Beijing before hosting his counterpart. While Xi traveled to California in late 2023, Joe Biden became the first U.S. president since Jimmy Carter not to visit China while in office.

Discussions between the two countries that would typically set up a leaders’ meeting are stuck at lower levels, with both sides deadlocked on how to proceed. Beijing said Washington hasn’t outlined detailed steps it expects from China on fentanyl to have the tariffs lifted, according to people familiar with the issue. Trump’s team rejects that assertion, according to a person familiar with the matter, who said the White House had sent messages to China through diplomatic channels.

Republican Senator Steve Daines, a member of the Foreign Relations Committee, is expected to meet this weekend with a senior Chinese leader and representatives of U.S. businesses in China, according to people familiar with the matter. Daines said on social media that one of the issues he’d raise is the “the flow of deadly fentanyl into our country.”

‘Big Thank You’

China has accused Trump of using fentanyl as pretext to raise tariffs. A Foreign Ministry official last week said Washington should offer a “big thank you” for Beijing’s work cracking down on drug trafficking instead of slapping levies on imports, and urged the Trump administration to resume talks.

China has implemented retaliatory tariffs, but those measures have been more limited than its response to Trump’s trade actions in his first term. After Trump doubled the tariff on Chinese imports to 20% earlier this month, Beijing announced levies as high as 15% on U.S. agricultural goods and banned trade with some defense companies.

Trump has said he is open to talks on reaching a deal, even as he intensifies pressure on Beijing. In any such discussions, the U.S. will want to address more than fentanyl, according to a person familiar with the matter, who said China’s help creating jobs in the American heartland, ensuring the centrality of the dollar in global trade and Xi’s support in ending the war in Ukraine would be on the agenda.

Also in focus will be Beijing’s implementation of a trade deal struck during Trump’s first term, under which China promised to crack down on the theft of U.S. trade secrets and purchase an additional $200 billion in American products. A U.S. review into that agreement is set to wrap on April 1.

While Trump has often praised Xi, their relationship during his first term was derailed after the COVID-19 pandemic hit, a global public health crisis the U.S. leader blamed on China.

The two men last spoke in January, days before the U.S. president was inaugurated for his second term, in a discussion that touched on trade relations, a potential sale of the U.S. operations of ByteDance Ltd.’s TikTok app and efforts to curb fentanyl trafficking.

This story was originally featured on Fortune.com

-

Tech News3 months ago

Tech News3 months agoHow Costco’s formula for reaching uncertain consumers is pushing shares past $1,000 to all-time highs

-

Tech News3 months ago

Tech News3 months agoLuigi Mangione hires top lawyer—whose husband is representing Sean ‘Diddy’ Combs

-

Tech News3 months ago

Tech News3 months agoLego bricks have won over adults, growing its $10 billion toy market foothold—and there’s more to come

-

Tech News3 months ago

Quentin Tarantino thinks movies are still better than TV shows like Yellowstone

-

Tech News3 months ago

Tech News3 months agoInside the FOMC: Boston Fed President Susan Collins on changing her mind, teamwork, and the alchemy behind the base rate

-

Tech News3 months ago

Tech News3 months agoNancy Pelosi has hip replacement surgery at a US military hospital in Germany after falling at Battle of the Bulge ceremony

-

Tech News3 months ago

Tech News3 months agoTrump and members of Congress want drones shot down while more are spotted near military facilities

-

Tech News3 months ago

Tech News3 months agoHundreds of OpenAI’s current and ex-employees are about to get a huge payday by cashing out up to $10 million each in a private stock sale