Tech News

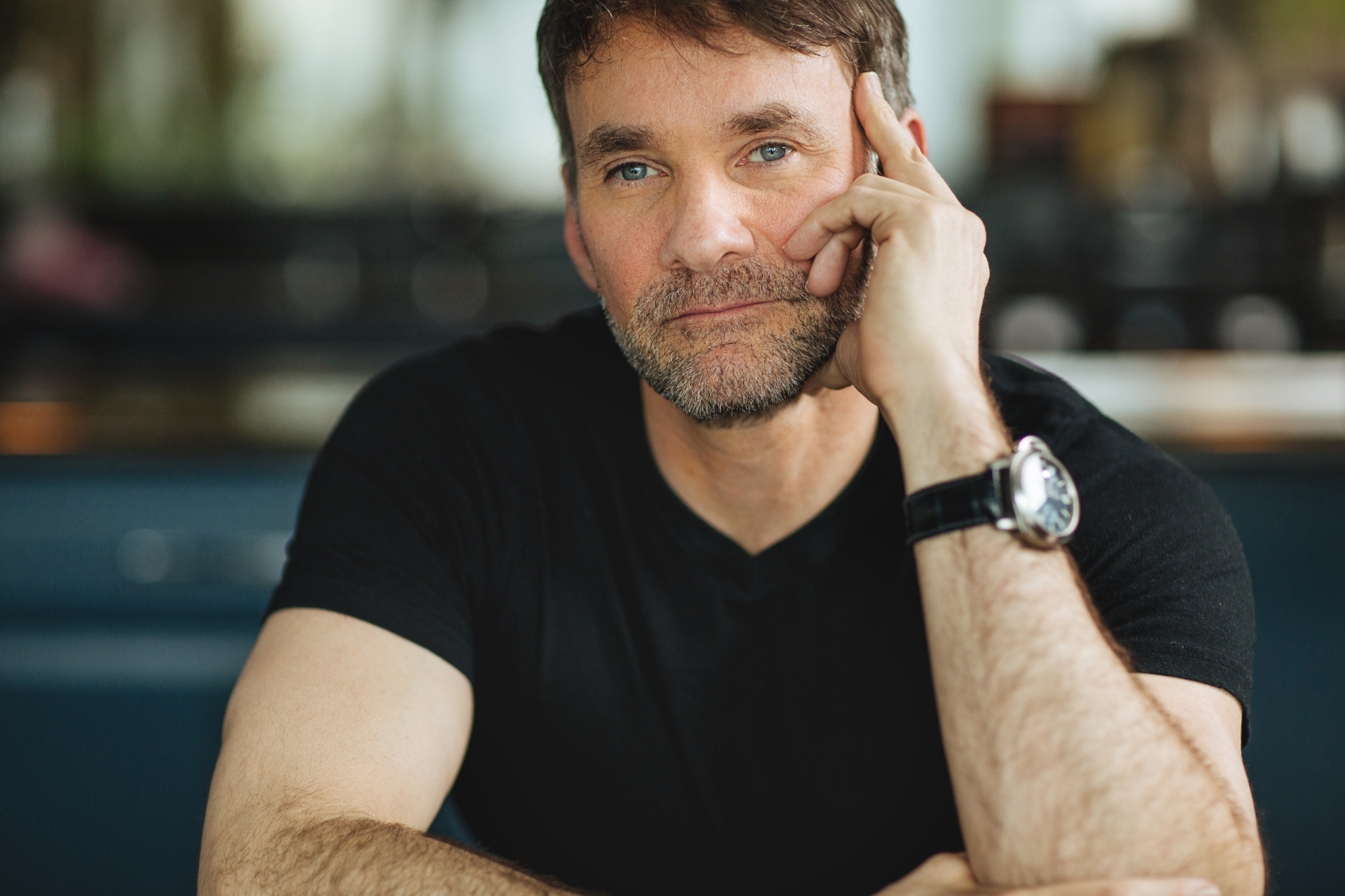

I’ve seen companies fail for want of honest feedback. Here’s how to build a culture of candor

“I’m waiting for you to retire so we can get a divorce.”

It was not the answer the chief financial officer of one of America’s largest public companies expected when he tried a workplace candor exercise on his wife. He had written her a dinner invitation suggesting they have a conversation about everything they never spoke about.

“Let’s talk about the things we need to say but we may not be talking about today,” he wrote. “How is our partnership? How am I supporting you? What can I do better? I promise, I truly want to hear how you are thinking and feeling.”

The honesty of her reply—and the candor of the discussion that followed—saved their marriage.

Waiting for dramatic moments to give feedback misses daily opportunities to help each other grow. Feedback should not be saved for annual reviews at work or family interventions at home. It is a gift we can give every day to those we care about.

Most of us would rather avoid such truths. We let important things go unsaid in our relationships, at home, and at work. We watch colleagues struggle rather than offer perspectives that could help them grow. We let frustrations with loved ones simmer until they boil over. Half of Americans say no one in their personal lives tells them hard truths—in the workplace, that figure rises to 71%.

This kind of feedback requires rewiring how we think about criticism. Most of us are conditioned from childhood to hear feedback as a directive; our parents weren’t offering suggestions when they said, “Don’t touch that!” or “Sit up straight!” But feedback can be a gift of perspective, one that the recipient is free to accept, modify, or decline. Like research data that helps companies make better decisions, the feedback we receive is simply datapoints that helps us see our areas we might work on and consider new possibilities.

I learned this lesson the hard way. Growing up as a gay kid in blue-collar Catholic Pittsburgh in the 1970s left me with deep insecurities and an obsession with success at any cost. My defensive walls and inability to give or receive honest feedback contributed to failed relationships, both personal and professional. I was the partner who couldn’t hear criticism without deflecting, the leader who avoided difficult conversations until it was too late.

But I’ve also seen what’s possible when people commit to everyday candor. At a cosmetics company I work with, two senior executives demonstrate this daily. The chief financial officer noticed her colleague, a marketing star, could benefit from deeper financial knowledge to advance her career. Rather than stay in her lane, she actively brought her peer into earnings calls and investor meetings. Meanwhile, her colleague coached the CFO on storytelling and presentation skills, and their mutual investment in each other’s growth helped drive their company’s success.

I saw this with my foster son Daniel. Traditional parent-child directives got nowhere. But one day, I tried a different approach: “Daniel, I’m curious. Do you eat that way at school in front of the girl you’re always talking about?” Offering observations tied to something he cared about often sparked curiosity instead of defensiveness.

The same approach works in any relationship. “I have some thoughts that might help you be even more effective. Would you like to hear them? It’s totally your call what you do with this input—it’s just my perspective, one data point for you to consider alongside others.” When we frame feedback this way, we remove the pressure of demanded change. More importantly, when we make offering these perspectives an everyday practice rather than saving them for formal conversations, we create an ongoing dialogue that strengthens relationships and helps everyone grow.

Simple practices can help build this muscle. In Guatemala, we’ve helped to teach children in the poorest communities to be each other’s coaches, transforming educational outcomes through daily peer feedback. In workplaces, I encourage teams to regularly offer thoughts on each other’s ideas, competencies (like leadership), skills (like use of technology), and performance (holding each other accountable for delivery). Even families can benefit from regular check-ins about what’s working and what is not.

One powerful practice is what I call the “Open 360″—I have used this practice countless times in a team setting and recently among a family office that included the grand matriarch of the family, the parents, and their three girls and their spouses. Each person takes turns receiving two kinds of feedback from everyone else: “What I most admire about you is…” followed by “Because I care about your success, what I might suggest is…” The structure makes it easier to give and receive candid input, but it’s just a starting point for making feedback part of daily family life.

The alternative to honest feedback—conflict avoidance—is far worse than momentary discomfort. I’ve watched relationships wither from withheld truths.I’ve seen businesses fail because people wouldn’t speak up.In an era of polarization and rapid change, our ability to give and receive honest feedback may determine not just our professional success, but the health of our most important relationships.

Would you be surprised if you invited more honest feedback from those closest to you? The truth might save more than a marriage, it could transform how we connect with everyone in our lives. The key is remembering that feedback is simply information freely given and freely received, best shared not in dramatic moments but in the small, everyday interactions that build stronger relationships.

The opinions expressed in Fortune.com commentary pieces are solely the views of their authors and do not necessarily reflect the opinions and beliefs of Fortune.

This story was originally featured on Fortune.com

Tech News

Singaporean taxi operator ComfortDelGro hopes robotaxis can future-proof the industry, as aging populations lead to fewer drivers

Singapore’s largest taxi operator is debuting its first robotaxis in China to help with “future-proofing” the industry, as rising incomes and ageing populations makes it harder for companies to find drivers.

ComfortDelGro, No. 128 on the Southeast Asia 500, will partner with Chinese autonomous vehicle startup Pony.ai to launch self-driving cars in the Chinese city of Guangzhou. The two-year pilot is starting with a small fleet of Lexus RX450 vehicles, and will expand to other models over the course of the program.

The company, which also operates bus and subway services, both in Singapore and overseas, hopes the partnership will help it prepare for coming labor shortages.

“The development of autonomous vehicle technology is crucial in future-proofing the transport industry,” ComfortDelGro’s CEO Cheng Siak Kian said in a statement. “With continuing driver shortages a global issue, we are exploring innovation solutions to ensure mobility remains accessible and efficient.”

ComfortDelGro, through its Pony.ai partnership, hopes to gain experience in managing a fleet of autonomous taxis. The company operates a global fleet of over 33,000 taxis and private hire cars worldwide, including more than 9,500 in China.

Pony.ai is allowed to operate autonomous driving mobility services in the Chinese cities of Beijing, Shanghai, Guangzhou and Shenzhen, and is also exploring a launch in Hong Kong.

“Guangdong is China’s most populous province and gives us the opportunity to build our capabilities in autonomous vehicles in a mature ecosystem,” a ComfortDelGro spokesperson told Fortune.

Tackling a labor shortage

During an interview with Fortune last September, Cheng expressed worries about a shortage of taxi drivers due to aging populations. “Now is the time to start looking at it,” he said, as the technology becomes “reasonably robust [and] reasonably mature.” The ComfortDelGro CEO suggested that robotaxis could supplement, rather than replace, human drivers by filling gaps in coverage.

Asia has some of the world’s lowest fertility rates, particularly in countries like Singapore, Japan, South Korea and China. Working-age populations are shrinking, posing a threat to businesses and industries that rely on human labor.

In 2022, ComfortDelGro invested 30 million Singapore dollars ($22.5 million) to develop its capability to operate and maintain autonomous vehicles, and to build a tech platform to support robotaxi services.

Other companies are turning to robotaxis as a response to aging Asian populations. Honda and Nissan are partnering with Japanese taxi operators to launch self-driving taxi services, also due to a shortage of drivers.

This story was originally featured on Fortune.com

Tech News

The Fed is expected to hold rates steady, as investors white-knuckle it through a brutal selloff and recession fears. ‘Policymakers aren’t providing any encouragement’

- The Federal Reserve will likely keep interest rates steady at its upcoming meeting. However, this time around investors, will be listening even more closely than usual to any hints from Jerome Powell about where he thinks the economy is headed. President Donald Trump’s recent tariff policies and the ensuing stock market rout raised fears the U.S. could be headed for a downturn.

After a tumultuous couple of weeks in the markets, investors can expect the Federal Reserve to remain steady after the conclusion of its two-day meeting on Wednesday.

The central bank will likely hold rates at their current level of 4.25%-4.5%, just as it did during its last meeting in January. Since then, Federal Reserve Chair Jerome Powell had said publicly he did not believe the current state of the economy warranted further rate cuts. Without a need to cut, he preferred to wait, given heightened levels of unpredictability in the markets.

“’Uncertainty’ is central bankers’ new policy-outlook mantra,” Maquiarie global foreign exchange and rates strategist Thierry Wizman wrote in a note.

Most of the lack of clarity stems from the new administration of President Donald Trump, who has pledged a series of unorthodox fiscal and trade policies. Early implementation of some of those policies, in particular a hardline tariff regime, has already roiled markets.

As of last Friday, the stock market lost $5 trillion in value after stocks tanked over investor fears the U.S. was walking into a trade war with both its allies and adversaries. Matters weren’t helped when Trump wouldn’t rule out a recession and Treasury Secretary Bessent said he wasn’t worried about the recent stock slump.

“U.S. policymakers aren’t providing any encouragement to the growth or equities story,” Wizman wrote.

With little reassurance from the executive branch, investors will be even more attuned to Powell’s words as well as the Fed’s forward guidance and outlook on the economy.

This time around, the range of options is especially wide. Most investors expect two or three rate cuts mostly in the back half of the year. However, Trump’s proposed policies of widespread tariffs and possible mass deportations would be inflationary, meaning that rate hikes are also possible, according to Melissa Brown investment firm SimCorp.

“These threats not only counter the need for cuts, but suggest that increases could be in order,” he told Fortune in an email. “We will have to listen closely to the language they use for any insight into what direction they might choose—if they choose to make changes at all.”

Brown will be on the lookout for one word above all. “The word I am listening for and dreading the most is stagflation,” she said.

While there are no current signs of stagflation, its specter looms over the economy. In recent weeks, several investors have warned of the possibility the U.S. could enter the dreaded scenario of high inflation and low growth that can trap economies for years.

Buoying investors’ hopes is the fact that the economy and the stock market are coming off a strong 2024. Inflation came under control, though never hit the Fed’s 2% target. At the same time, unemployment didn’t rise unexpectedly, and the S&P 500 hit record highs. But the economy is teetering on the brink of a downturn, making Powell and the Fed’s decision critical.

“We see mounting downside risks to the economy that could require the Fed to reduce rates in 2025,” Deutsche Bank wrote to investors in an analyst note. “Like the Fed, we hope to get a better sense of the details around policies before deciding whether an adjustment is needed. However, the data and financial markets might not allow us or the Fed to be so patient.”

Powell himself preached patience during a speech earlier this month. “The costs of being cautious are very, very low,” he said. “The economy’s fine. It doesn’t need us to do anything, really. And so we can wait, and we should wait.”

Over the subsequent week, the S&P 500 fell roughly 250 points and the Dow Jones a further 1,988, as investor panic rippled through the market. Though stocks started to rebound Friday and Monday, investors will still be looking to the Federal Reserve to keep them out of any more choppy waters.

This story was originally featured on Fortune.com

Tech News

Trump says Xi will visit Washington in ‘not too distant future’

President Donald Trump said Chinese leader Xi Jinping would visit Washington soon, as trade tensions build between the world’s two largest economies.

Xi will be coming in the “not too distant future,” Trump said Monday while attending a board meeting at the John F. Kennedy Center for the Performing Arts, as he touted a string of recent visits by leaders from India, France, the UK and Ireland.

Trump has ramped up a trade fight with China since returning to office, twice hiking blanket tariffs on imports from the Asian country. The president has called those moves a response to Beijing’s failure to crack down on the flow of illegal fentanyl and the precursor chemicals used to make it.

The Wall Street Journal previously reported U.S. and Chinese officials were discussing a possible “birthday summit” in June that would see the two leaders—who both have birthdays in the middle of the month—meet for the first time since Trump returned to the White House. The U.S. president did not detail specific timing for the possible meeting.

Chinese Foreign Ministry spokeswoman Mao Ning said Tuesday at a regular briefing in Beijing that she had no information to provide on a potential Trump-Xi meeting.

Trump also said last month that he’d speak with Xi, “probably in the next 24 hours,” as his initial 10% tariff hike loomed. That tariff deadline passed without any public record of the two men talking.

Chinese and U.S. top leaders typically take turns visiting each others’ nations, a protocol that puts the onus on Trump to visit Beijing before hosting his counterpart. While Xi traveled to California in late 2023, Joe Biden became the first U.S. president since Jimmy Carter not to visit China while in office.

Discussions between the two countries that would typically set up a leaders’ meeting are stuck at lower levels, with both sides deadlocked on how to proceed. Beijing said Washington hasn’t outlined detailed steps it expects from China on fentanyl to have the tariffs lifted, according to people familiar with the issue. Trump’s team rejects that assertion, according to a person familiar with the matter, who said the White House had sent messages to China through diplomatic channels.

Republican Senator Steve Daines, a member of the Foreign Relations Committee, is expected to meet this weekend with a senior Chinese leader and representatives of U.S. businesses in China, according to people familiar with the matter. Daines said on social media that one of the issues he’d raise is the “the flow of deadly fentanyl into our country.”

‘Big Thank You’

China has accused Trump of using fentanyl as pretext to raise tariffs. A Foreign Ministry official last week said Washington should offer a “big thank you” for Beijing’s work cracking down on drug trafficking instead of slapping levies on imports, and urged the Trump administration to resume talks.

China has implemented retaliatory tariffs, but those measures have been more limited than its response to Trump’s trade actions in his first term. After Trump doubled the tariff on Chinese imports to 20% earlier this month, Beijing announced levies as high as 15% on U.S. agricultural goods and banned trade with some defense companies.

Trump has said he is open to talks on reaching a deal, even as he intensifies pressure on Beijing. In any such discussions, the U.S. will want to address more than fentanyl, according to a person familiar with the matter, who said China’s help creating jobs in the American heartland, ensuring the centrality of the dollar in global trade and Xi’s support in ending the war in Ukraine would be on the agenda.

Also in focus will be Beijing’s implementation of a trade deal struck during Trump’s first term, under which China promised to crack down on the theft of U.S. trade secrets and purchase an additional $200 billion in American products. A U.S. review into that agreement is set to wrap on April 1.

While Trump has often praised Xi, their relationship during his first term was derailed after the COVID-19 pandemic hit, a global public health crisis the U.S. leader blamed on China.

The two men last spoke in January, days before the U.S. president was inaugurated for his second term, in a discussion that touched on trade relations, a potential sale of the U.S. operations of ByteDance Ltd.’s TikTok app and efforts to curb fentanyl trafficking.

This story was originally featured on Fortune.com

-

Tech News3 months ago

Tech News3 months agoHow Costco’s formula for reaching uncertain consumers is pushing shares past $1,000 to all-time highs

-

Tech News3 months ago

Tech News3 months agoLuigi Mangione hires top lawyer—whose husband is representing Sean ‘Diddy’ Combs

-

Tech News3 months ago

Tech News3 months agoLego bricks have won over adults, growing its $10 billion toy market foothold—and there’s more to come

-

Tech News3 months ago

Quentin Tarantino thinks movies are still better than TV shows like Yellowstone

-

Tech News3 months ago

Tech News3 months agoInside the FOMC: Boston Fed President Susan Collins on changing her mind, teamwork, and the alchemy behind the base rate

-

Tech News3 months ago

Tech News3 months agoNancy Pelosi has hip replacement surgery at a US military hospital in Germany after falling at Battle of the Bulge ceremony

-

Tech News3 months ago

Tech News3 months agoTrump and members of Congress want drones shot down while more are spotted near military facilities

-

Tech News3 months ago

Tech News3 months agoHundreds of OpenAI’s current and ex-employees are about to get a huge payday by cashing out up to $10 million each in a private stock sale