Tech News

U.K. economy shrinks in January in fresh setback for Starmer

The UK economy unexpectedly shrank at the start of 2025, piling fresh pressure on Prime Minister Keir Starmer’s government over the lack of momentum since Labour returned to power last summer.

Gross domestic product fell 0.1% in a storm-hit January, driven by declines in manufacturing and construction, the Office for National Statistics said Friday. Economists had expected a 0.1% increase. It means output is still barely larger than when Labour won a landslide election victory in July.

Chancellor of the Exchequer Rachel Reeves pointed to the global turbulent backdrop for the weakness, warning that “the world has changed and across the globe we are feeling the consequences.”

Reeves is under pressure to start delivering on her promise to boost growth after a dismal run of economic indicators under Labour. She is preparing to announce what’s expected to be a sobering economic update on March 26, when official growth forecasts may be trimmed.

Friday’s figures mean the economy has contracted in four out of the seven months since Labour took office. GDP is only 0.3% higher than it was in June.

The pound extended losses, dropping as much as 0.2% to $1.2924 as traders incrementally added to expectations for more interest-rate cuts. Traders now see 57 basis points of reductions this year.

The weakness in January was partly driven by the UK being hit by the strongest storm for 10 years, suggesting that some sectors could rebound in February.

While economists are predicting a return to steady growth this year, risks to the outlook are mounting with Donald Trump’s escalating trade war sending stocks crashing and triggering fears of a global downturn. The hope is that Britain’s plans for big spending on infrastructure will underpin growth.

“Following the lackluster performance in the second half of 2024, growth remains fragile due to global and domestic uncertainty,” said Hailey Low, economist at the National Institute of Economic and Social Research. “It is crucial that the upcoming Spring Statement provides stability rather than adding to domestic uncertainty.”

What Bloomberg Economics Says…

“The surprise drop in January’s GDP still leaves the UK economy on course for a modest rebound in the first quarter after a sharp slowdown in the second half of 2024. Our view is growth will strengthen a little over the course of 2025. If data continues to disappoint, though, it will be hard for the Bank of England to stick with its gradual approach to policy easing. We still think the risk is for the central bank cutting rates faster than we’re expecting.”

—Read Ana Andrade and Dan Hanson’s REACT on the Terminal

Labour has unveiled a raft of policies to help it meet its promise of boosting growth, including unblocking building projects and green-lighting controversial developments. However, growth was patchy in the second half of last year and sentiment indicators nosedived after a tax-heavy budget in October.

The ONS said that output fell in eight of the 13 manufacturing sectors in January, with the production of metals and pharmaceuticals experiencing the largest declines. Anecdotal evidence points to construction being hit by storms, rain and snow during the month, it said. Oil and gas production also declined.

The falls were partly offset by 0.1% growth in services, the largest part of the UK economy. Retailers recorded a strong January thanks to people eating more frequently at home, according to the ONS.

The BOE expects the economy to continue expanding at a tepid pace, predicting a 0.7% expansion in 2025 after last year’s 0.9% rise. Facing an uncertain outlook, BOE rate-setters are expected to leave interest rates on hold next Thursday and warn markets of only gradual cuts.

“We doubt the bad news on GDP will be enough to convince the Bank of England to cut interest rates at its meeting next week,” said Thomas Pugh, economist at RSM UK. “Smooth out the month-to-month volatility and the economy is picking up some momentum, which should allay fears about the UK slipping back into recession.”

Officials are balancing the need to support a stagnant economy against signs of stubborn inflationary pressures and heightened uncertainty. They have flagged the threat of tariffs and the impact of Labour’s increase in employer payroll taxes on the jobs market and prices.

This story was originally featured on Fortune.com

Tech News

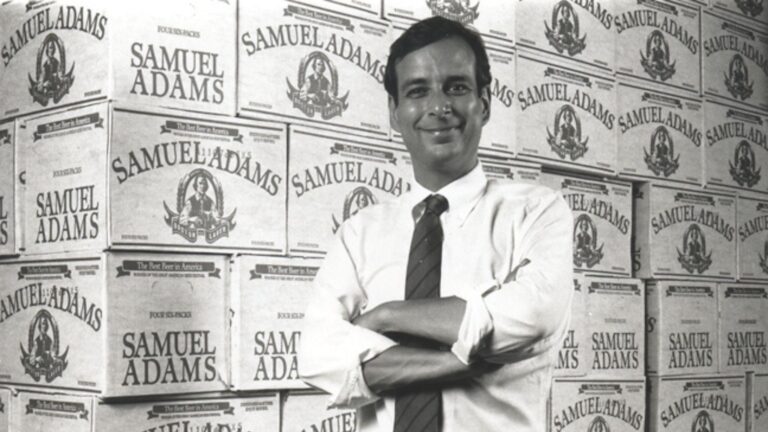

The founder behind $3 billion beer giant Samuel Adams dropped out of Harvard because the school of life taught him more about entrepreneurialism

Mark Zuckerberg isn’t the only entrepreneur who ditched Harvard in pursuit of something bigger. Samuel Adams founder Jim Koch built a $3 billion alcohol empire, but it wasn’t the Ivy League school that set him on that path.

It was 1978, and Koch had just completed his second year of Harvard Business School’s JD/MBA program. He said the program allowed students to do law school and business school at the same time, and often led to a career as a corporate lawyer or working for a big company. But by the end of his second year, Koch was questioning if that path was truly for him.

“I’ve been going to school since I was five years old,” Koch said of the dilemma in an interview with Fortune. “I’ve never really done anything in the real world and yet, I’m on this path leading me to a place I’m not sure I want to be.”

His push to explore the world and get hands-on experience ended up leading him on the path to founding Samuel Adams. But now looking back, Koch realized that one crucial skill he learned while building the company isn’t even found in a textbook at Harvard.

How to sell a company

Koch’s path towards success didn’t start in the classroom. In fact, he said that the selling skills he learned aren’t even taught at Harvard. The Ivy League institution offers students courses in marketing, sales management, and business analytics, yet a course on basic selling tactics is nowhere to be found.

“Selling is this really, really important skill that business schools don’t teach to this day,” Koch said.

It’s a skill he had to learn on the ground—literally. When Koch launched Samuel Adams in 1984, he couldn’t find a distributor who would agree to sell his beer. Which meant he had to sell it himself.

Armed with a family recipe and a dream, the then 34-year-old set out walking door-to-door with a briefcase of beer, hoping to convince bar owners and managers to stock the brew. In one briefcase, he could fit seven beers, two ice packs, and a sleeve of cups for sampling. Koch says he had “about a 5% success rate,” meaning for every 20 bars he visited, he’d open one new account.

“If I didn’t go from bar to bar with the cold beer in my briefcase and get people to carry it, I was going to go broke really quickly,” he said.

The determination and door-knocking paid off: Samuel Adams launched with an investment of $140,000 and two employees before skyrocketing into a $3 billion business over the course of 40 years. The decades-old brand is staying modern too: Koch expanded his alcohol empire under the umbrella of Boston Beer Co. to include bar favorites like hard seltzer brand Truly, hard iced tea brand Twisted Tea, and hard cider brand Angry Orchard.

Now, four decades later, Koch is sharing his biggest business lessons, and wants entrepreneurs to understand the importance of one core function that may seem obvious: selling.

“Nobody goes to college because they want to be a salesman,” he said. “It has a negative connotation.”

Citing pop culture classics like The World of Wall Street and Death of a Salesman, Koch explained that in pop culture, particularly among white-collar and educated workers, “salespeople are portrayed as kind of sleazy.”

“But what I learned is, done right, it’s a very noble activity,” he said, adding that exemplary salespeople demonstrate how their products can help consumers with their daily lives and goals. Conversely, salespeople shepherding “crappy,” non-beneficial products are “charlatans.”

“People are too smart to be fooled like that,” he said. “So to me, selling is not only necessary but noble.”

Success is a mindset

Koch’s path to building his empire wasn’t just hard work, he says: humility was a key building block. He says it’s one of the best pieces of business advice he ever received—and it came from his grandmother before he departed for Harvard.

She reminded him: “Jim, remember humility is a virtue.”

Approaching business with humility and gratitude for the success that you already have will lead you to a happy and rewarding life, Koch said.

Overall, success didn’t come Koch’s way traditionally. The entrepreneur used hands-on training from running wilderness courses to become a leader, taught himself how to sell when Harvard didn’t, and kept his grandmother’s words on humility in his head as his success grew.

Now, Koch helps pass on what he’s learned to entrepreneurs through his Brewing the American Dream program.

“I believe that my job as a businessperson is to try to pay forward, share the wealth, however you want to say it, because at the end of the day if you’re the only person who benefits from your success, you’re not going to have much of it.”

The program helps entrepreneurs with two things Koch didn’t have access to when he started Samuel Adams: loan money and coaching and counseling advice. While partnering with the ACCION opportunity fund, the program makes loans to businesses that no bank is going to touch. Koch says they look at the passions of the entrepreneurs and the quality of their products.

He says the program has a repayment rate of about 98%. And since then 2008, they’ve made $110 million in loans to 4,300 companies, provided coaching and counseling to around 20,000 companies, and those companies have saved or created almost 12,000 jobs in their communities.

This story was originally featured on Fortune.com

Tech News

China is ‘laughing’ at the U.S. trade wars and has the most to gain from Trump’s ongoing European tariffs, top diplomat says

- EU foreign policy chief Kaja Kallas told Bloomberg that China is the country that stands to benefit the most from a trade war between the U.S. and EU. Her comments come as the EU imposed 50% tariffs on American whiskey in retaliation for U.S. tariffs on steel and aluminum imports.

The only country benefiting from a trade war between the U.S. and the European Union is China, according to EU foreign policy chief Kaja Kallas.

Kallas, who until last year served as the first female prime minister of Estonia, said in an interview with Bloomberg that China is “laughing” at the tariff squabble.

“Who is laughing on the side or looking at the side is China,” Kallas told Bloomberg during a G7 meeting in Canada. “It’s really benefiting from the U.S. having a trade war with Europe.”

After the U.S. imposed a 25% tariff on any imported steel and aluminum, the EU struck back with a 50% tariff on American whiskey. In response, President Donald Trump threatened a 200% tariff on EU-imported alcohol like champagne and wine.

On Thursday, Trump stood firm on his threat, telling reporters he will not reconsider upcoming tariffs that go into effect on April 2. He called on the EU to drop its tariffs on American whiskey or face reciprocal tariffs.

“I’m not going to bend at all,” he said.

Meanwhile, Kallas said the EU would also not back down from a tariff fight.

“We keep a cool head and of course we are ready to act and defend our interest when we need to,” she said.

A spokesperson for China’s foreign ministry, Mao Ning, said during a press conference Friday that she would not comment “on how the U.S. and Europer get along,” but China was not at issue.

“There will be no winner from a trade war or tech war,” she added.

Canada also hit the U.S. with billions of dollars of reciprocal tariffs in retaliation for its steel and aluminum tariffs, an action Commerce Secretary Howard Lutnick called “tone deaf.”

The latest escalation between the U.S. and EU comes as the U.S. stock market fell into a correction Thursday, with the S&P 500 falling more than 10% below the all-time-high it hit just three weeks ago. Uncertainty about tariffs and the threat of a recession have spooked investors, and the Atlanta Fed now predicts the U.S. GDP will decline by 2.4% in the first quarter.

This story was originally featured on Fortune.com

Tech News

How Jump and Solana vets are building a hyper fast internet for blockchains

High-frequency traders are the whiz kids of Wall Street. They either code scripts to execute quick trades to eke out small profits that, multiplied by one or ten thousand times over, result in serious cash. Or they’re able to act milliseconds faster than competitors to score big bets on market swings. Speed is paramount, which is why HFT traders have created their own private networks of internet cables—now, a crypto project called DoubleZero wants to do the same to speed up blockchains.

“We can use a whole different set of technologies that have basically been standard and de facto in the high-frequency trading world… but are not available over the public internet, so they’ve never been applied to blockchain before,” Austin Federa, cofounder of DoubleZero and a former executive at the Solana Foundation, told Fortune.

Federa’s project, which has the same obsession with speed as the firms in Michael Lewis’s famous HFT book Flash Boys, has already attracted capital. DoubleZero Foundation, one of the entities behind the project, announced in early March that it had raised $28 million in a seed round led by marquee crypto investors Multicoin Capital and Dragonfly Capital. Other venture capital firms that contributed were Foundation Capital, Reciprocal Ventures, DBA, Borderless Capital, Superscrypt, and Frictionless. In exchange for their cash, investors received token warrants, or promised allocations of a yet-to-be-launched cryptocurrency, Federa said.

CoinDesk Solana or Ethereum are like Amazon Web Services or Google Cloud—but decentralized.

And like any cloud computing network, blockchains have physical servers that process users’ transactions and run programmers’ apps. Currently, when servers that power the Solana blockchain, for example, need to communicate with each other, those signals run over public internet infrastructure, said Federa. DoubleZero aims to create a private network of cables to speed up a blockchain’s processing power.

Jump Crypto, the digital assets subsidiary of HFT firm Jump Trading, and Malbec Labs are the engineering entities behind DoubleZero. They won’t be laying down physical cables to construct the network, said Federa. Not yet, anyway. Rather, the company is cobbling together underutilized bandwidth from HFT firms, private companies, and even individuals to build out a faster physical network of cables than what is currently available for blockchains.

And to make sure that, just like a blockchain, this physical network is decentralized, Federa’s foundation plans to launch its own cryptocurrency to reward those who contribute bandwidth to the project.

Federa’s other cofounders are Mateo Ward and Andrew McConnell. Ward is the former CEO of Neutrona Networks, a portfolio company of Jump Trading that specialized in building private internet networks. And McConnell was a former top engineer at Jump.

This story was originally featured on Fortune.com

-

Tech News3 months ago

Tech News3 months agoHow Costco’s formula for reaching uncertain consumers is pushing shares past $1,000 to all-time highs

-

Tech News3 months ago

Tech News3 months agoLuigi Mangione hires top lawyer—whose husband is representing Sean ‘Diddy’ Combs

-

Tech News3 months ago

Tech News3 months agoLego bricks have won over adults, growing its $10 billion toy market foothold—and there’s more to come

-

Tech News3 months ago

Quentin Tarantino thinks movies are still better than TV shows like Yellowstone

-

Tech News3 months ago

Tech News3 months agoInside the FOMC: Boston Fed President Susan Collins on changing her mind, teamwork, and the alchemy behind the base rate

-

Tech News3 months ago

Tech News3 months agoNancy Pelosi has hip replacement surgery at a US military hospital in Germany after falling at Battle of the Bulge ceremony

-

Tech News3 months ago

Tech News3 months agoTrump and members of Congress want drones shot down while more are spotted near military facilities

-

Tech News3 months ago

Tech News3 months agoHundreds of OpenAI’s current and ex-employees are about to get a huge payday by cashing out up to $10 million each in a private stock sale