Tech News

The Fed is expected to hold rates steady, as investors white-knuckle it through a brutal selloff and recession fears. ‘Policymakers aren’t providing any encouragement’

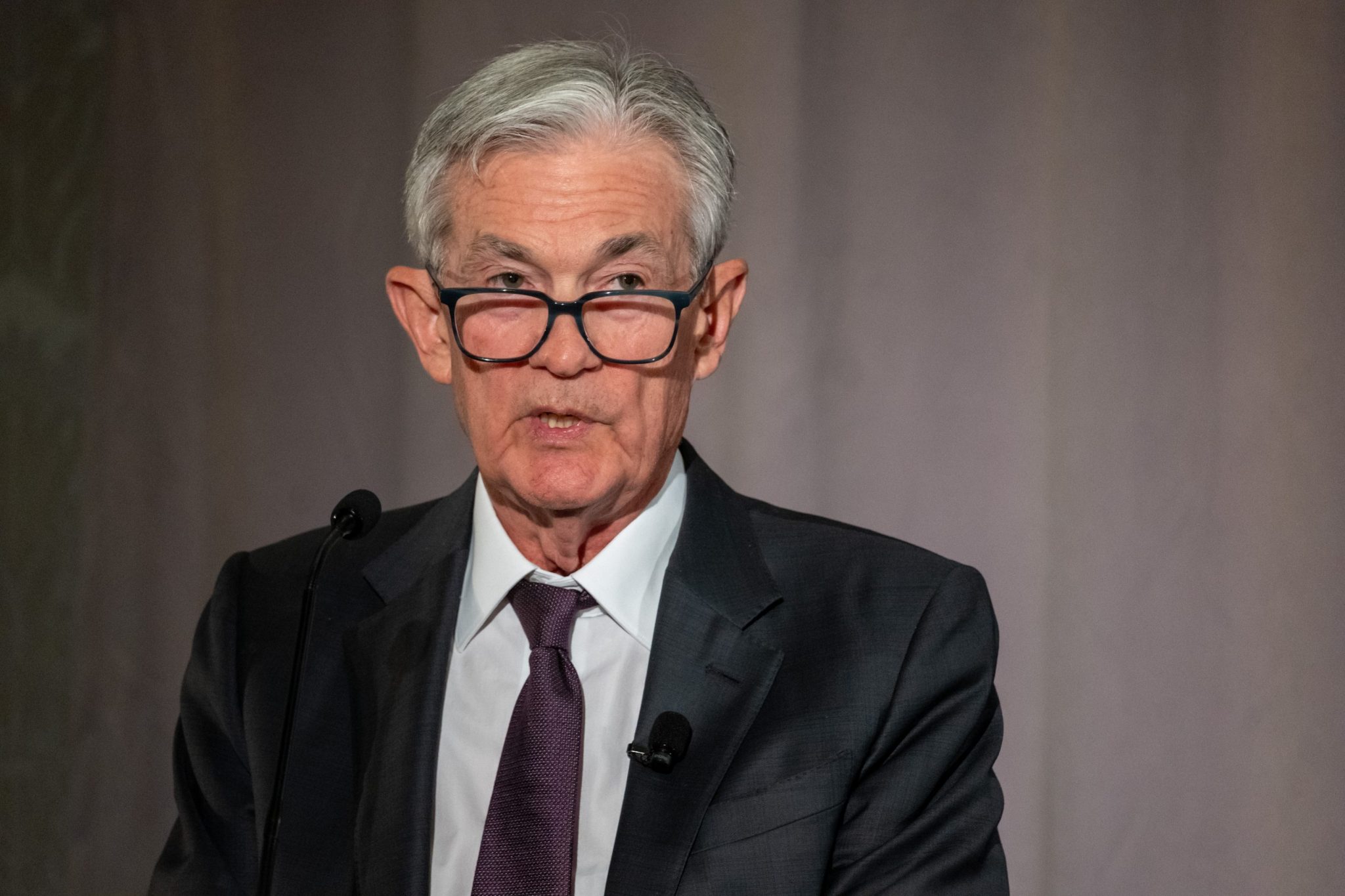

- The Federal Reserve will likely keep interest rates steady at its upcoming meeting. However, this time around investors, will be listening even more closely than usual to any hints from Jerome Powell about where he thinks the economy is headed. President Donald Trump’s recent tariff policies and the ensuing stock market rout raised fears the U.S. could be headed for a downturn.

After a tumultuous couple of weeks in the markets, investors can expect the Federal Reserve to remain steady after the conclusion of its two-day meeting on Wednesday.

The central bank will likely hold rates at their current level of 4.25%-4.5%, just as it did during its last meeting in January. Since then, Federal Reserve Chair Jerome Powell had said publicly he did not believe the current state of the economy warranted further rate cuts. Without a need to cut, he preferred to wait, given heightened levels of unpredictability in the markets.

“’Uncertainty’ is central bankers’ new policy-outlook mantra,” Maquiarie global foreign exchange and rates strategist Thierry Wizman wrote in a note.

Most of the lack of clarity stems from the new administration of President Donald Trump, who has pledged a series of unorthodox fiscal and trade policies. Early implementation of some of those policies, in particular a hardline tariff regime, has already roiled markets.

As of last Friday, the stock market lost $5 trillion in value after stocks tanked over investor fears the U.S. was walking into a trade war with both its allies and adversaries. Matters weren’t helped when Trump wouldn’t rule out a recession and Treasury Secretary Bessent said he wasn’t worried about the recent stock slump.

“U.S. policymakers aren’t providing any encouragement to the growth or equities story,” Wizman wrote.

With little reassurance from the executive branch, investors will be even more attuned to Powell’s words as well as the Fed’s forward guidance and outlook on the economy.

This time around, the range of options is especially wide. Most investors expect two or three rate cuts mostly in the back half of the year. However, Trump’s proposed policies of widespread tariffs and possible mass deportations would be inflationary, meaning that rate hikes are also possible, according to Melissa Brown investment firm SimCorp.

“These threats not only counter the need for cuts, but suggest that increases could be in order,” he told Fortune in an email. “We will have to listen closely to the language they use for any insight into what direction they might choose—if they choose to make changes at all.”

Brown will be on the lookout for one word above all. “The word I am listening for and dreading the most is stagflation,” she said.

While there are no current signs of stagflation, its specter looms over the economy. In recent weeks, several investors have warned of the possibility the U.S. could enter the dreaded scenario of high inflation and low growth that can trap economies for years.

Buoying investors’ hopes is the fact that the economy and the stock market are coming off a strong 2024. Inflation came under control, though never hit the Fed’s 2% target. At the same time, unemployment didn’t rise unexpectedly, and the S&P 500 hit record highs. But the economy is teetering on the brink of a downturn, making Powell and the Fed’s decision critical.

“We see mounting downside risks to the economy that could require the Fed to reduce rates in 2025,” Deutsche Bank wrote to investors in an analyst note. “Like the Fed, we hope to get a better sense of the details around policies before deciding whether an adjustment is needed. However, the data and financial markets might not allow us or the Fed to be so patient.”

Powell himself preached patience during a speech earlier this month. “The costs of being cautious are very, very low,” he said. “The economy’s fine. It doesn’t need us to do anything, really. And so we can wait, and we should wait.”

Over the subsequent week, the S&P 500 fell roughly 250 points and the Dow Jones a further 1,988, as investor panic rippled through the market. Though stocks started to rebound Friday and Monday, investors will still be looking to the Federal Reserve to keep them out of any more choppy waters.

This story was originally featured on Fortune.com

Tech News

Wiz founders’ bold bet: Rejecting Google’s original offer leads to $32 billion buyout deal—and $9 billion in extra cash

Google owner Alphabet will buy cybersecurity firm Wiz for $32 billion — in a deal set to boost the tech giant’s in-house cloud computing amid burgeoning artificial intelligence growth.

If closed, the-cash transaction, announced Tuesday, will become Google’s most expensive acquisition in the company’s 25-year history. The purchase gives Google new momentum in its efforts to compete in the cloud-computing business by offering more security for its services.

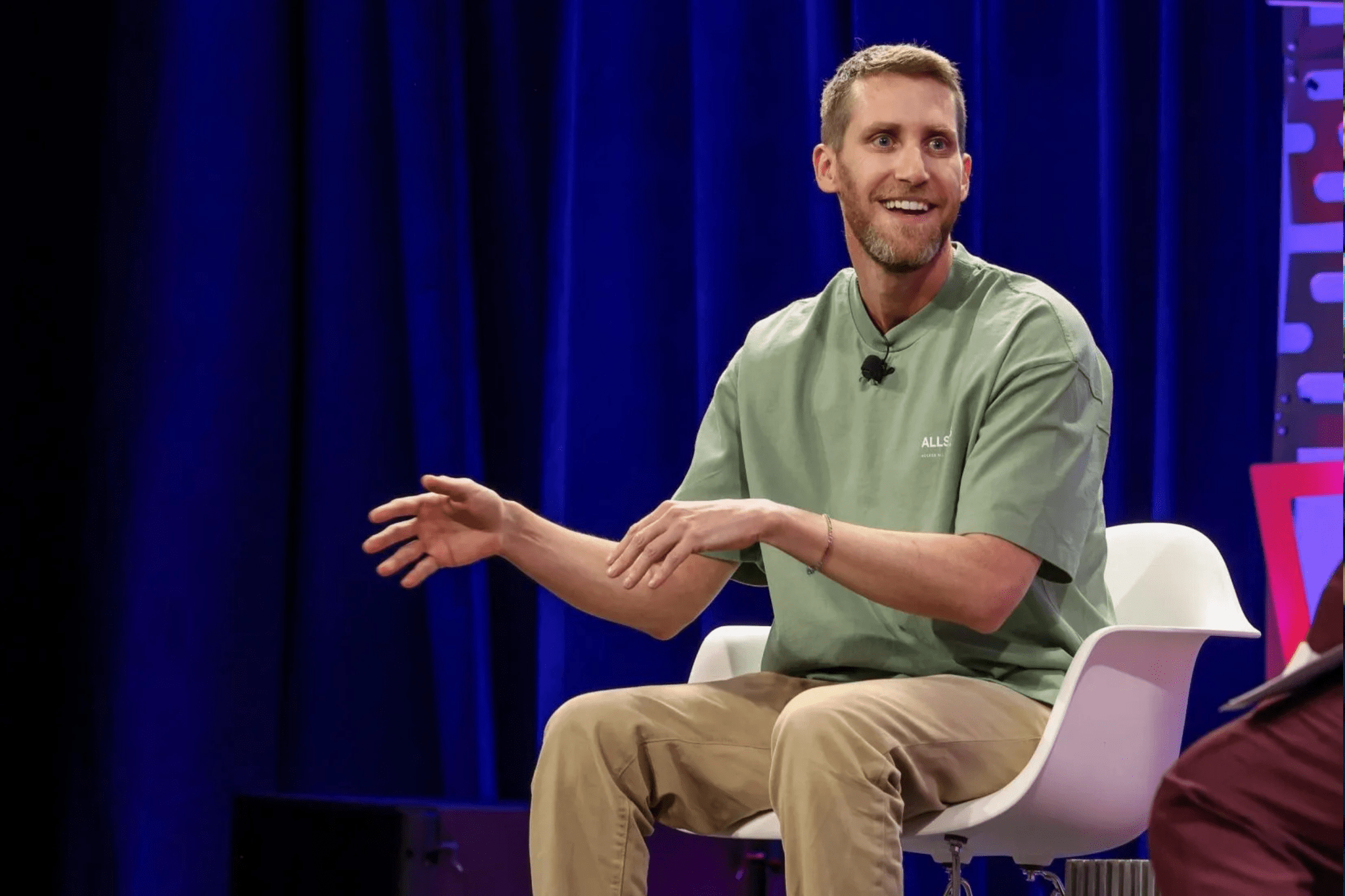

“Wiz and Google Cloud are both fueled by the belief that cloud security needs to be easier, more accessible, more intelligent, and democratized, so more organizations can adopt and use cloud and AI securely,” Wiz CEO Assaf Rappaport said in a blog post.

The company says Wiz will join Google Cloud — and that this deal represents a company investment “to accelerate two large and growing trends in the AI era: improved cloud security and the ability to use multiple clouds.”

Together, Google CEO Sundar Pichai said in a statement, Google Cloud and Wiz “will turbocharge improved cloud security and the ability to use multiple clouds.”

Assaf Rappaport, Co-Founder & CEO, added that the deal will “bolster our mission to improve security and prevent breaches by providing additional resources and deep AI expertise.”

Wiz, based in New York, was founded in 2020, makes security tools designed to shield the information stored in remote data centers from intruders.

Google has had its eyes on Wiz for some time. The purchase price announced Tuesday surpasses a reported $23 billion buyout proposal that Wiz rejected last July.

The proposed buyout will get a close look from antitrust regulators. While many expect the Trump administration to be more friendly to business deals, it has also shown skepticism of big tech.

Also, the new Federal Trade Commission Chair Andrew Ferguson has vowed to maintain a tough review process for mergers and acquisitions.

This story was originally featured on Fortune.com

Tech News

This leader is making AI accessible across the world’s languages

Good morning! Poppi to be acquired by PepsiCo for almost $2 billion, Forever 21’s U.S. operator files for bankruptcy, and Sara Hooker talks AI language accessibility.

– AI accessibility. Language is an incredibly powerful tool—but not all languages are represented equally in technology. Cohere for AI is tackling this disparity, focusing on making AI accessible to more languages. “I think people forget—we can build the best model in the world, but what matters is how people feel about it and whether it works for them,” Sara Hooker, head of Cohere for AI, tells Fortune’s Sharon Goldman. Their conversation is the second in a series of profiles of women in tech for Fortune.

Cohere for AI, the nonprofit research lab of $5.5 billion AI company Cohere, has been among the first to offer AI models for languages like Korean and Swahili. And through an initiative that the organization launched two years ago, 3,000 researchers from all around the world collaborated with Cohere for AI on multilingual AI research. “From the beginning, we doubled the number of languages that were covered by generative AI,” Hooker says. This accessibility is the company’s “North Star.”

Hooker’s interest in languages stems from her upbringing. She and her family moved around a lot—Mozambique, Eswatini, Kenya, and Liberia—and so she was exposed to a lot of languages. “There’s this really powerful idea that when you speak in the language of someone, you really connect with their heart, not their head,” she shares.

She didn’t always intend to work in AI, though: “I didn’t set out wanting to do artificial intelligence, but I had always wanted to work on interesting problems,” Hooker says. After roles at Udemy and Google Brain and after working with Geoffrey Hinton and Samy Bengio—big names in the AI space—she was asked by the Cohere cofounders to lead its new research lab.

“We chose a problem which was critically underserved, but now everyone else is scrambling to catch up,” says Hooker. Read Sharon’s full story here.

Nina Ajemian

nina.ajemian@fortune.com

The Most Powerful Women Daily newsletter is Fortune’s daily briefing for and about the women leading the business world. Today’s edition was curated by Nina Ajemian. Subscribe here.

This story was originally featured on Fortune.com

Tech News

Blockchain payments company Halliday raises $20 million from Andreessen Horowitz

Halliday, a startup that helps financial institutions automate services with blockchain and AI technology, has raised $20 million from venture capital giant Andreessen Horowitz.

The company works with charter banks, payment service providers and other financial institutions that are interested in blockchain technology to help accelerate their entrance into the space by making it easier to design financial workflows, CEO and co-founder of Halliday Griffin Dunaif told Fortune.

Financial workflows—an organized sequence of steps required to move funds from one place to another—are integral to any company that handles money for their clients. In the crypto world, establishing these workflows requires engineers to program smart contracts, which can be a slow and arduous process, Dunaif said.

With Halliday’s Agentic Workflow Protocol, companies can easily connect services like verifying a transaction or issuing a payment, into one cohesive workflow. “It’s an engine that lets you stitch together services into workflows so that they can be automated,” Dunaif said.

Additionally, developers can implement agentic AI—a type of AI model that can solve problems and execute actions with limited supervision—within their workflows to automate decision-making. “We want to bring blockchain up to the agentic era, because no software will not be agentic as these technologies mature,” he said.

The San Francisco-based company is currently taking submissions for its early access program that will be rolled out during the second quarter. Since announcing the program in late February, Dunaif says the company has received over 11,000 requests to access the product.

Other crypto companies also work with financial institutions to make their payment systems more efficient. Consensys, a blockchain company founded in 2014, has a product called the CodeFi Blockchain Application Suite, which includes a service that helps financial institutions automate workflows.

Once Agentic Workflow Protocol is fully available, Halliday will make money from it by charging customers based on how much computing power their workflow requires.

The company declined to disclose its valuation in its latest funding round. It plans to use the money raised to accelerate deployment of the product and expand the team.

Other investors in this latest round included Avalanche Blizzard Fund, Credibly Neutral, and Alt Layer. Halliday previously raised $6 million from Andreessen Horowitz in 2022.

This story was originally featured on Fortune.com

-

Tech News3 months ago

Tech News3 months agoHow Costco’s formula for reaching uncertain consumers is pushing shares past $1,000 to all-time highs

-

Tech News3 months ago

Tech News3 months agoLuigi Mangione hires top lawyer—whose husband is representing Sean ‘Diddy’ Combs

-

Tech News3 months ago

Tech News3 months agoLego bricks have won over adults, growing its $10 billion toy market foothold—and there’s more to come

-

Tech News3 months ago

Quentin Tarantino thinks movies are still better than TV shows like Yellowstone

-

Tech News3 months ago

Tech News3 months agoInside the FOMC: Boston Fed President Susan Collins on changing her mind, teamwork, and the alchemy behind the base rate

-

Tech News3 months ago

Tech News3 months agoNancy Pelosi has hip replacement surgery at a US military hospital in Germany after falling at Battle of the Bulge ceremony

-

Tech News3 months ago

Tech News3 months agoTrump and members of Congress want drones shot down while more are spotted near military facilities

-

Tech News3 months ago

Tech News3 months agoHundreds of OpenAI’s current and ex-employees are about to get a huge payday by cashing out up to $10 million each in a private stock sale