Tech News

EVs may help the environment but because their owners don’t buy gas they’re starving states of tax money to fix potholes and build roads

The pothole outside Timothy Taylor’s home was so deep, he could hear the clunk of cars hitting it from inside his house.

The Portland, Oregon, resident could sympathize with those drivers: He knew to avoid his own neighborhood pothole, but another one damaged his car’s suspension to the tune of $1,000.

“Hearing that awful sound of your car bottoming out — it’s horrible,” he said.

Oregon transportation officials say that without more funding, residents like Taylor could see further declines in the quality of roads, highways and bridges starting this year. But revenues from gas taxes paid by drivers at the pump are projected to decrease as more people adopt electric and fuel-efficient cars, forcing officials to look for new ways to fund transportation infrastructure.

States with aggressive climate goals like Oregon are facing a conundrum: EVs can help reduce emissions in the transportation sector, the nation’s largest source of greenhouse gas emissions, but they also mean less gas tax revenue in government coffers.

“We now find ourselves right now in a position where we want to address fuel use and drive down reliance on gases and internal combustion engines. But we need the funds to operate our roads that EVs need to use as well,” said Carra Sahler, director of the Green Energy Institute at Lewis & Clark Law School.

Gas tax revenue is set to fall

Motor fuel taxes are the largest source of transportation revenue for states, according to the National Association of Budget Officers’ most recent report on state expenditures. But the money they bring in has fallen: Gas taxes raised 41% of transportation revenue in fiscal year 2016, compared with roughly 36% in fiscal year 2024, the group found.

In California, where zero-emission vehicles accounted for about a quarter of all car sales last year, legislative analysts predict gas tax collections will decrease by $5 billion — or 64% — by 2035, in a scenario where the state successfully meets its climate goals. California and Oregon are among the multiple states that will require all new passenger cars sold to be zero-emission vehicles by 2035.

The downward revenue trend is already playing out in Pennsylvania, where gas tax revenues dropped an estimated $250 million last year compared with 2019, according to the state’s independent fiscal office.

Inflation has also driven up the cost of transportation materials, further exacerbating budget concerns.

What is going on in Oregon?

The Oregon Department of Transportation — citing inflation, projections of declining gas tax revenues and certain spending limitations — has estimated a budget shortfall topping $350 million for the next budget cycle.

That could mean cuts to winter snow plowing and the striping and paving of roads, as well as layoffs of as many as 1,000 transportation employees.

Republican lawmakers say the gas tax revenue issue has been compounded by the department mismanaging its money. An audit released in January found the department overestimated its revenue for the current budget cycle by over $1 billion and failed to properly track certain funds.

“It really is about making sure that the existing dollars that are being spent by the department are being spent efficiently and effectively,” said state Sen. Bruce Starr, GOP co-vice chair of the joint transportation committee.

How states are boosting transportation funding

To make up for lost revenue, 34 states have raised their gas tax since 2013, according to the National Conference of State Legislatures. California has the highest gas tax at over 69 cents a gallon when including other taxes and fees, while Alaska has the lowest at 9 cents a gallon, according to figures from the U.S. Energy Information Administration. In Oregon — which in 1919 became the first state to implement a gas tax — it is 40 cents a gallon.

The federal gas tax of 18 cents a gallon, which isn’t adjusted for inflation, hasn’t been raised in over three decades.

In Oregon, where there is no sales tax and tolling has met fierce opposition, lawmakers are debating next steps.

Other states have taken steps ranging from indexing their gas tax to inflation, to raising registration fees for EVs, to taxing EV charging stations.

To bolster transportation dollars, some have reorganized their budgets: In Michigan, where Gov. Gretchen Whitmer was first elected using the slogan “Fix the Damn Roads,” some revenues from marijuana taxes and personal income taxes now go toward transportation. In Connecticut, the sales tax now brings in more money for its special transportation fund than gas tax revenues, a 2024 fiscal report shows.

Another concept that could provide a long-term solution is a so-called road user charge. Under such a system, drivers pay a fee based on the distance they travel.

In 2023, Hawaii established a road usage charge program for EV drivers that will phase in starting this July. In 2028, all EV drivers will be automatically enrolled, with odometers read at annual vehicle inspections.

Three other states — Oregon, Utah and Virginia — have voluntary road usage fee programs. Drivers can opt to use GPS tools to track and report their mileage.

This story was originally featured on Fortune.com

Tech News

Wiz founders’ bold bet: Rejecting Google’s original offer leads to $32 billion buyout deal—and $9 billion in extra cash

Google owner Alphabet will buy cybersecurity firm Wiz for $32 billion — in a deal set to boost the tech giant’s in-house cloud computing amid burgeoning artificial intelligence growth.

If closed, the-cash transaction, announced Tuesday, will become Google’s most expensive acquisition in the company’s 25-year history. The purchase gives Google new momentum in its efforts to compete in the cloud-computing business by offering more security for its services.

“Wiz and Google Cloud are both fueled by the belief that cloud security needs to be easier, more accessible, more intelligent, and democratized, so more organizations can adopt and use cloud and AI securely,” Wiz CEO Assaf Rappaport said in a blog post.

The company says Wiz will join Google Cloud — and that this deal represents a company investment “to accelerate two large and growing trends in the AI era: improved cloud security and the ability to use multiple clouds.”

Together, Google CEO Sundar Pichai said in a statement, Google Cloud and Wiz “will turbocharge improved cloud security and the ability to use multiple clouds.”

Assaf Rappaport, Co-Founder & CEO, added that the deal will “bolster our mission to improve security and prevent breaches by providing additional resources and deep AI expertise.”

Wiz, based in New York, was founded in 2020, makes security tools designed to shield the information stored in remote data centers from intruders.

Google has had its eyes on Wiz for some time. The purchase price announced Tuesday surpasses a reported $23 billion buyout proposal that Wiz rejected last July.

The proposed buyout will get a close look from antitrust regulators. While many expect the Trump administration to be more friendly to business deals, it has also shown skepticism of big tech.

Also, the new Federal Trade Commission Chair Andrew Ferguson has vowed to maintain a tough review process for mergers and acquisitions.

This story was originally featured on Fortune.com

Tech News

This leader is making AI accessible across the world’s languages

Good morning! Poppi to be acquired by PepsiCo for almost $2 billion, Forever 21’s U.S. operator files for bankruptcy, and Sara Hooker talks AI language accessibility.

– AI accessibility. Language is an incredibly powerful tool—but not all languages are represented equally in technology. Cohere for AI is tackling this disparity, focusing on making AI accessible to more languages. “I think people forget—we can build the best model in the world, but what matters is how people feel about it and whether it works for them,” Sara Hooker, head of Cohere for AI, tells Fortune’s Sharon Goldman. Their conversation is the second in a series of profiles of women in tech for Fortune.

Cohere for AI, the nonprofit research lab of $5.5 billion AI company Cohere, has been among the first to offer AI models for languages like Korean and Swahili. And through an initiative that the organization launched two years ago, 3,000 researchers from all around the world collaborated with Cohere for AI on multilingual AI research. “From the beginning, we doubled the number of languages that were covered by generative AI,” Hooker says. This accessibility is the company’s “North Star.”

Hooker’s interest in languages stems from her upbringing. She and her family moved around a lot—Mozambique, Eswatini, Kenya, and Liberia—and so she was exposed to a lot of languages. “There’s this really powerful idea that when you speak in the language of someone, you really connect with their heart, not their head,” she shares.

She didn’t always intend to work in AI, though: “I didn’t set out wanting to do artificial intelligence, but I had always wanted to work on interesting problems,” Hooker says. After roles at Udemy and Google Brain and after working with Geoffrey Hinton and Samy Bengio—big names in the AI space—she was asked by the Cohere cofounders to lead its new research lab.

“We chose a problem which was critically underserved, but now everyone else is scrambling to catch up,” says Hooker. Read Sharon’s full story here.

Nina Ajemian

nina.ajemian@fortune.com

The Most Powerful Women Daily newsletter is Fortune’s daily briefing for and about the women leading the business world. Today’s edition was curated by Nina Ajemian. Subscribe here.

This story was originally featured on Fortune.com

Tech News

Blockchain payments company Halliday raises $20 million from Andreessen Horowitz

Halliday, a startup that helps financial institutions automate services with blockchain and AI technology, has raised $20 million from venture capital giant Andreessen Horowitz.

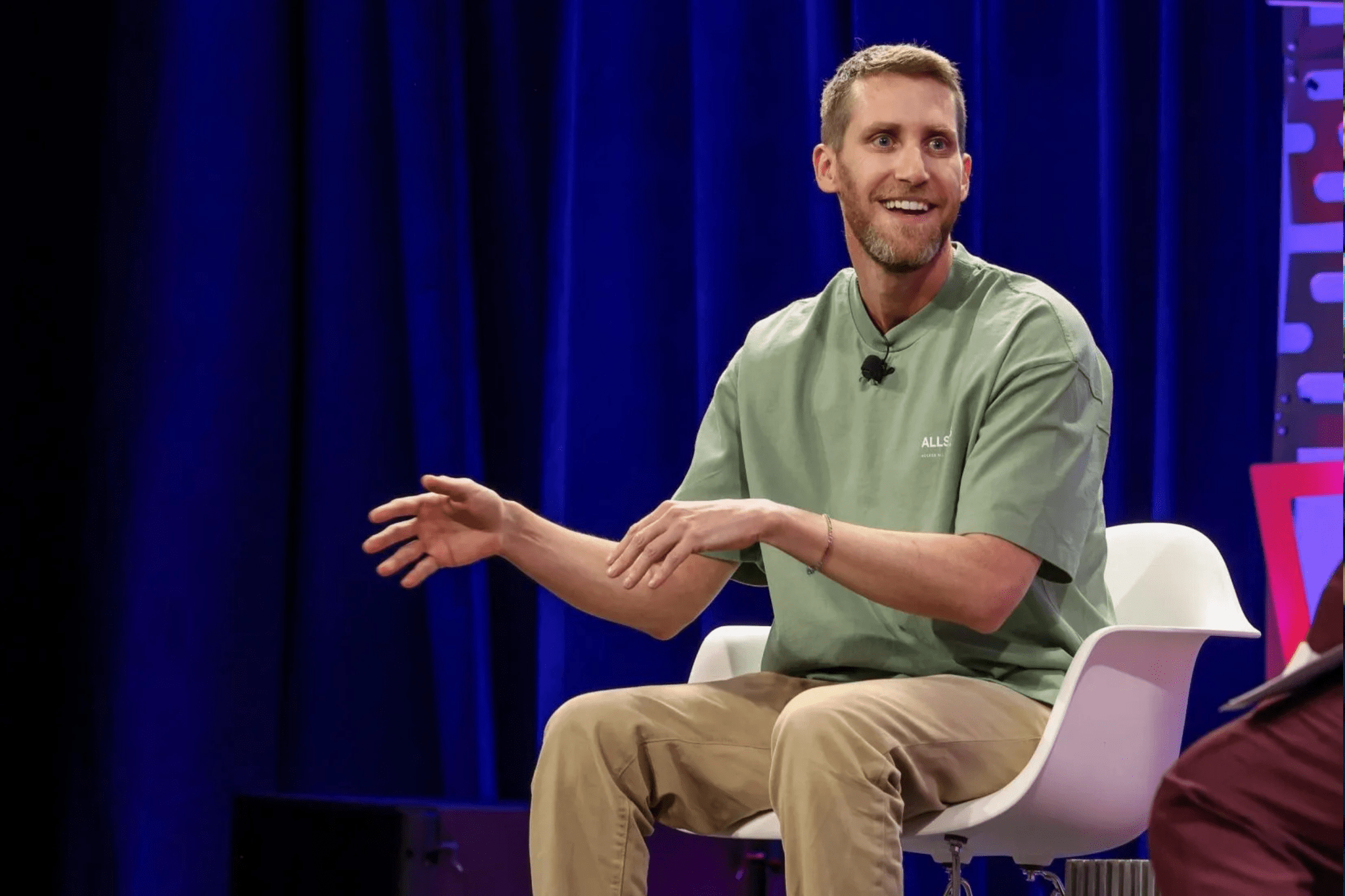

The company works with charter banks, payment service providers and other financial institutions that are interested in blockchain technology to help accelerate their entrance into the space by making it easier to design financial workflows, CEO and co-founder of Halliday Griffin Dunaif told Fortune.

Financial workflows—an organized sequence of steps required to move funds from one place to another—are integral to any company that handles money for their clients. In the crypto world, establishing these workflows requires engineers to program smart contracts, which can be a slow and arduous process, Dunaif said.

With Halliday’s Agentic Workflow Protocol, companies can easily connect services like verifying a transaction or issuing a payment, into one cohesive workflow. “It’s an engine that lets you stitch together services into workflows so that they can be automated,” Dunaif said.

Additionally, developers can implement agentic AI—a type of AI model that can solve problems and execute actions with limited supervision—within their workflows to automate decision-making. “We want to bring blockchain up to the agentic era, because no software will not be agentic as these technologies mature,” he said.

The San Francisco-based company is currently taking submissions for its early access program that will be rolled out during the second quarter. Since announcing the program in late February, Dunaif says the company has received over 11,000 requests to access the product.

Other crypto companies also work with financial institutions to make their payment systems more efficient. Consensys, a blockchain company founded in 2014, has a product called the CodeFi Blockchain Application Suite, which includes a service that helps financial institutions automate workflows.

Once Agentic Workflow Protocol is fully available, Halliday will make money from it by charging customers based on how much computing power their workflow requires.

The company declined to disclose its valuation in its latest funding round. It plans to use the money raised to accelerate deployment of the product and expand the team.

Other investors in this latest round included Avalanche Blizzard Fund, Credibly Neutral, and Alt Layer. Halliday previously raised $6 million from Andreessen Horowitz in 2022.

This story was originally featured on Fortune.com

-

Tech News3 months ago

Tech News3 months agoHow Costco’s formula for reaching uncertain consumers is pushing shares past $1,000 to all-time highs

-

Tech News3 months ago

Tech News3 months agoLuigi Mangione hires top lawyer—whose husband is representing Sean ‘Diddy’ Combs

-

Tech News3 months ago

Tech News3 months agoLego bricks have won over adults, growing its $10 billion toy market foothold—and there’s more to come

-

Tech News3 months ago

Quentin Tarantino thinks movies are still better than TV shows like Yellowstone

-

Tech News3 months ago

Tech News3 months agoInside the FOMC: Boston Fed President Susan Collins on changing her mind, teamwork, and the alchemy behind the base rate

-

Tech News3 months ago

Tech News3 months agoNancy Pelosi has hip replacement surgery at a US military hospital in Germany after falling at Battle of the Bulge ceremony

-

Tech News3 months ago

Tech News3 months agoTrump and members of Congress want drones shot down while more are spotted near military facilities

-

Tech News3 months ago

Tech News3 months agoHundreds of OpenAI’s current and ex-employees are about to get a huge payday by cashing out up to $10 million each in a private stock sale