Tech News

A victim of potential housing department cuts: domestic violence survivors who need homes

- One provider of permanent housing is concerned that a crucial funding program for domestic violence survivors might be next on the federal cost-cutting hit list. The Department of Housing and Urban Development, under Trump-appointed Secretary Scott Turner, has launched its own task force to assess spending.

The Department of Housing and Urban Development announced a cost-cutting task force a month ago and said it found more than $260 million in savings, while Elon Musk’s Department of Government Efficiency claimed it recovered $1.9 billion of “HUD money” that had been misplaced during the prior administration.

Warnings about more cuts for HUD have been circulating, whether it be its budget or staff; the Washington Post reported the department’s workforce is expected to be slashed in half, according to an internal memo it obtained. So it’s a waiting game for one nonprofit that provides permanent housing for domestic violence survivors and depends on HUD money.

“If we lose this funding, it will get people killed,” New Destiny Chief Executive Nicole Branca told Fortune.

Domestic violence survivors and their children often need housing assistance to escape their abusers, especially in places such as New York City, where her nonprofit is located, and where rent is 62% higher than the national average.

The Department of Housing and Urban Development and DOGE did not respond to Fortune’s request for comment.

New Destiny finds apartments for survivors throughout the city and pays those landlords via funding that comes from HUD’s Continuum of Care program. The nonprofit receives about $3.5 million in HUD Continuum of Care grants for that, a third of its budget. This year, New Destiny has helped about 300 households through this funding, all survivors of domestic violence, who are mostly women. Some years it’s as much as 400 survivors and their families.

HUD Secretary Scott Turner recently said that funds from Continuum of Care were not being used as intended—to end homelessness—but “as a tool by the left to push a woke agenda,” which makes Branca nervous about what will happen to the program.

“We’re very concerned because if we lost funding we would have to immediately stop paying rent,” she said. “In a city where rent is as high as it is and the vacancy rate for new apartments is as low as it is, we absolutely without any exaggeration would see a huge percentage of our families go almost immediately either back into shelter or back to their abuser.”

If HUD’s headcount is slashed, there won’t be anyone to reimburse New Destiny, and it would slow everything down because they don’t have enough cash on hand, Branca said. NPR reported HUD’s Office of Community Planning and Development, which administers the Continuum of Care funding, is expected to lose 84% of its staff, according to a document it reviewed.

Once you lose trust with landlords because you miss a rent payment, they won’t rent to you again, Branca said—and it is already difficult to get landlords to accept tenants on rental assistance, though they’re required to by law. Even a suspicion that the money might be going away could push landlords to pull back. Not to mention, it’s more expensive to house survivors in shelters, where many would be without permanent housing.

It costs about $11,000 a year to put a survivor in permanent housing versus $100,000 a year in shelters, according to New Destiny. That’s because of New York City’s right to shelter, which allows anyone who shows up asking for a place to sleep to get a bed somewhere, even if it’s an expensive hotel in midtown, New Destiny explained. But the shelter system comes with more bureaucracy, too, so that requires staff, contracts, and other things that add up. Even so, being in a shelter means they’re still homeless.

Still, it goes beyond New Destiny. The Continuum of Care program provides $3 billion for homelessness across the country; New York City receives $175 million in that amount for 165 homeless initiatives that help 11,000 households, according to Branca. And it isn’t only for survivors of domestic violence. It’s to house those subjected to stalking and sexual assault, each disproportionately affects women.

This story was originally featured on Fortune.com

Tech News

Wiz founders’ bold bet: Rejecting Google’s original offer leads to $32 billion buyout deal—and $9 billion in extra cash

Google owner Alphabet will buy cybersecurity firm Wiz for $32 billion — in a deal set to boost the tech giant’s in-house cloud computing amid burgeoning artificial intelligence growth.

If closed, the-cash transaction, announced Tuesday, will become Google’s most expensive acquisition in the company’s 25-year history. The purchase gives Google new momentum in its efforts to compete in the cloud-computing business by offering more security for its services.

“Wiz and Google Cloud are both fueled by the belief that cloud security needs to be easier, more accessible, more intelligent, and democratized, so more organizations can adopt and use cloud and AI securely,” Wiz CEO Assaf Rappaport said in a blog post.

The company says Wiz will join Google Cloud — and that this deal represents a company investment “to accelerate two large and growing trends in the AI era: improved cloud security and the ability to use multiple clouds.”

Together, Google CEO Sundar Pichai said in a statement, Google Cloud and Wiz “will turbocharge improved cloud security and the ability to use multiple clouds.”

Assaf Rappaport, Co-Founder & CEO, added that the deal will “bolster our mission to improve security and prevent breaches by providing additional resources and deep AI expertise.”

Wiz, based in New York, was founded in 2020, makes security tools designed to shield the information stored in remote data centers from intruders.

Google has had its eyes on Wiz for some time. The purchase price announced Tuesday surpasses a reported $23 billion buyout proposal that Wiz rejected last July.

The proposed buyout will get a close look from antitrust regulators. While many expect the Trump administration to be more friendly to business deals, it has also shown skepticism of big tech.

Also, the new Federal Trade Commission Chair Andrew Ferguson has vowed to maintain a tough review process for mergers and acquisitions.

This story was originally featured on Fortune.com

Tech News

This leader is making AI accessible across the world’s languages

Good morning! Poppi to be acquired by PepsiCo for almost $2 billion, Forever 21’s U.S. operator files for bankruptcy, and Sara Hooker talks AI language accessibility.

– AI accessibility. Language is an incredibly powerful tool—but not all languages are represented equally in technology. Cohere for AI is tackling this disparity, focusing on making AI accessible to more languages. “I think people forget—we can build the best model in the world, but what matters is how people feel about it and whether it works for them,” Sara Hooker, head of Cohere for AI, tells Fortune’s Sharon Goldman. Their conversation is the second in a series of profiles of women in tech for Fortune.

Cohere for AI, the nonprofit research lab of $5.5 billion AI company Cohere, has been among the first to offer AI models for languages like Korean and Swahili. And through an initiative that the organization launched two years ago, 3,000 researchers from all around the world collaborated with Cohere for AI on multilingual AI research. “From the beginning, we doubled the number of languages that were covered by generative AI,” Hooker says. This accessibility is the company’s “North Star.”

Hooker’s interest in languages stems from her upbringing. She and her family moved around a lot—Mozambique, Eswatini, Kenya, and Liberia—and so she was exposed to a lot of languages. “There’s this really powerful idea that when you speak in the language of someone, you really connect with their heart, not their head,” she shares.

She didn’t always intend to work in AI, though: “I didn’t set out wanting to do artificial intelligence, but I had always wanted to work on interesting problems,” Hooker says. After roles at Udemy and Google Brain and after working with Geoffrey Hinton and Samy Bengio—big names in the AI space—she was asked by the Cohere cofounders to lead its new research lab.

“We chose a problem which was critically underserved, but now everyone else is scrambling to catch up,” says Hooker. Read Sharon’s full story here.

Nina Ajemian

nina.ajemian@fortune.com

The Most Powerful Women Daily newsletter is Fortune’s daily briefing for and about the women leading the business world. Today’s edition was curated by Nina Ajemian. Subscribe here.

This story was originally featured on Fortune.com

Tech News

Blockchain payments company Halliday raises $20 million from Andreessen Horowitz

Halliday, a startup that helps financial institutions automate services with blockchain and AI technology, has raised $20 million from venture capital giant Andreessen Horowitz.

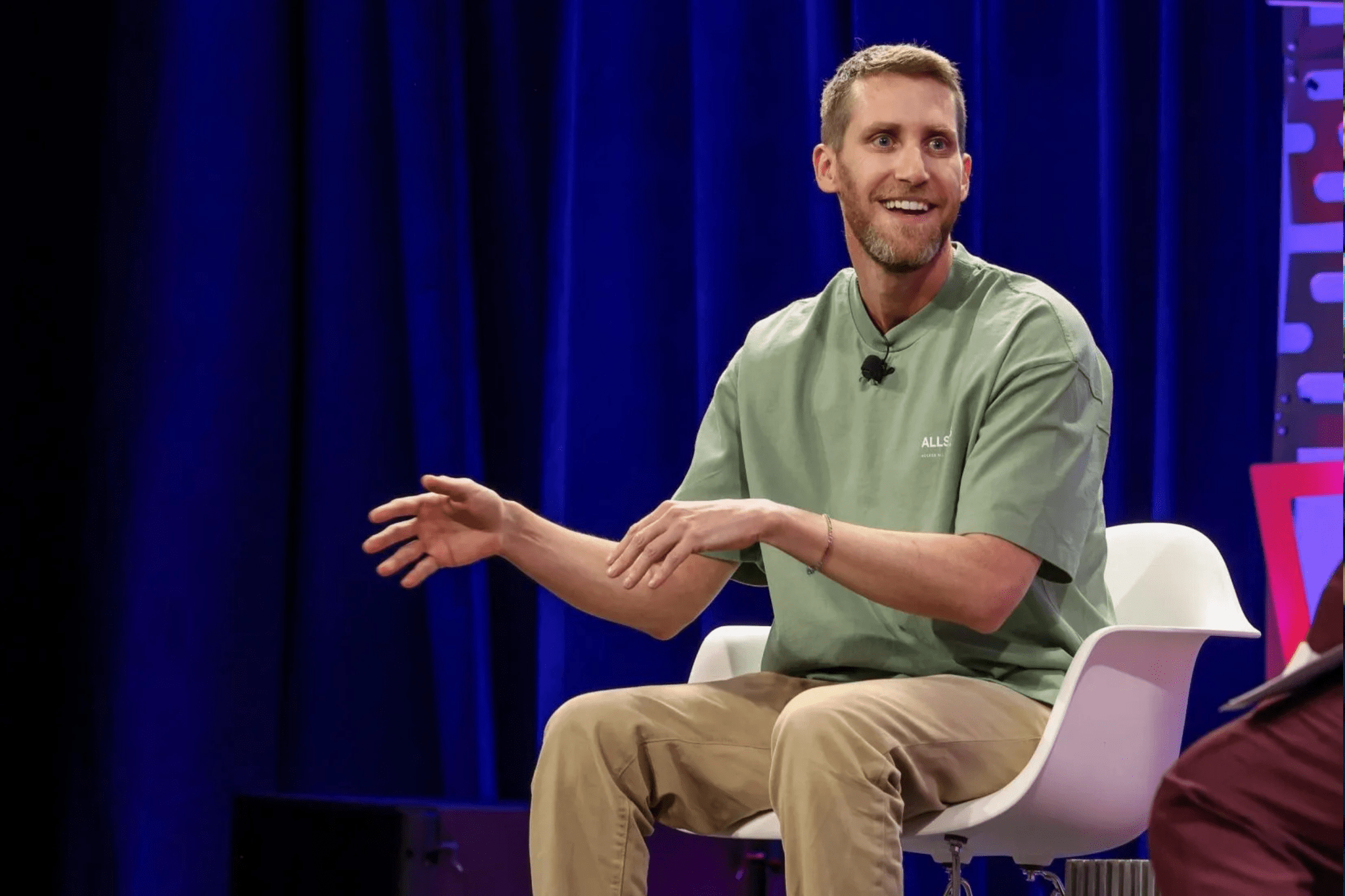

The company works with charter banks, payment service providers and other financial institutions that are interested in blockchain technology to help accelerate their entrance into the space by making it easier to design financial workflows, CEO and co-founder of Halliday Griffin Dunaif told Fortune.

Financial workflows—an organized sequence of steps required to move funds from one place to another—are integral to any company that handles money for their clients. In the crypto world, establishing these workflows requires engineers to program smart contracts, which can be a slow and arduous process, Dunaif said.

With Halliday’s Agentic Workflow Protocol, companies can easily connect services like verifying a transaction or issuing a payment, into one cohesive workflow. “It’s an engine that lets you stitch together services into workflows so that they can be automated,” Dunaif said.

Additionally, developers can implement agentic AI—a type of AI model that can solve problems and execute actions with limited supervision—within their workflows to automate decision-making. “We want to bring blockchain up to the agentic era, because no software will not be agentic as these technologies mature,” he said.

The San Francisco-based company is currently taking submissions for its early access program that will be rolled out during the second quarter. Since announcing the program in late February, Dunaif says the company has received over 11,000 requests to access the product.

Other crypto companies also work with financial institutions to make their payment systems more efficient. Consensys, a blockchain company founded in 2014, has a product called the CodeFi Blockchain Application Suite, which includes a service that helps financial institutions automate workflows.

Once Agentic Workflow Protocol is fully available, Halliday will make money from it by charging customers based on how much computing power their workflow requires.

The company declined to disclose its valuation in its latest funding round. It plans to use the money raised to accelerate deployment of the product and expand the team.

Other investors in this latest round included Avalanche Blizzard Fund, Credibly Neutral, and Alt Layer. Halliday previously raised $6 million from Andreessen Horowitz in 2022.

This story was originally featured on Fortune.com

-

Tech News3 months ago

Tech News3 months agoHow Costco’s formula for reaching uncertain consumers is pushing shares past $1,000 to all-time highs

-

Tech News3 months ago

Tech News3 months agoLuigi Mangione hires top lawyer—whose husband is representing Sean ‘Diddy’ Combs

-

Tech News3 months ago

Tech News3 months agoLego bricks have won over adults, growing its $10 billion toy market foothold—and there’s more to come

-

Tech News3 months ago

Quentin Tarantino thinks movies are still better than TV shows like Yellowstone

-

Tech News3 months ago

Tech News3 months agoInside the FOMC: Boston Fed President Susan Collins on changing her mind, teamwork, and the alchemy behind the base rate

-

Tech News3 months ago

Tech News3 months agoNancy Pelosi has hip replacement surgery at a US military hospital in Germany after falling at Battle of the Bulge ceremony

-

Tech News3 months ago

Tech News3 months agoTrump and members of Congress want drones shot down while more are spotted near military facilities

-

Tech News3 months ago

Tech News3 months agoHundreds of OpenAI’s current and ex-employees are about to get a huge payday by cashing out up to $10 million each in a private stock sale