Tech News

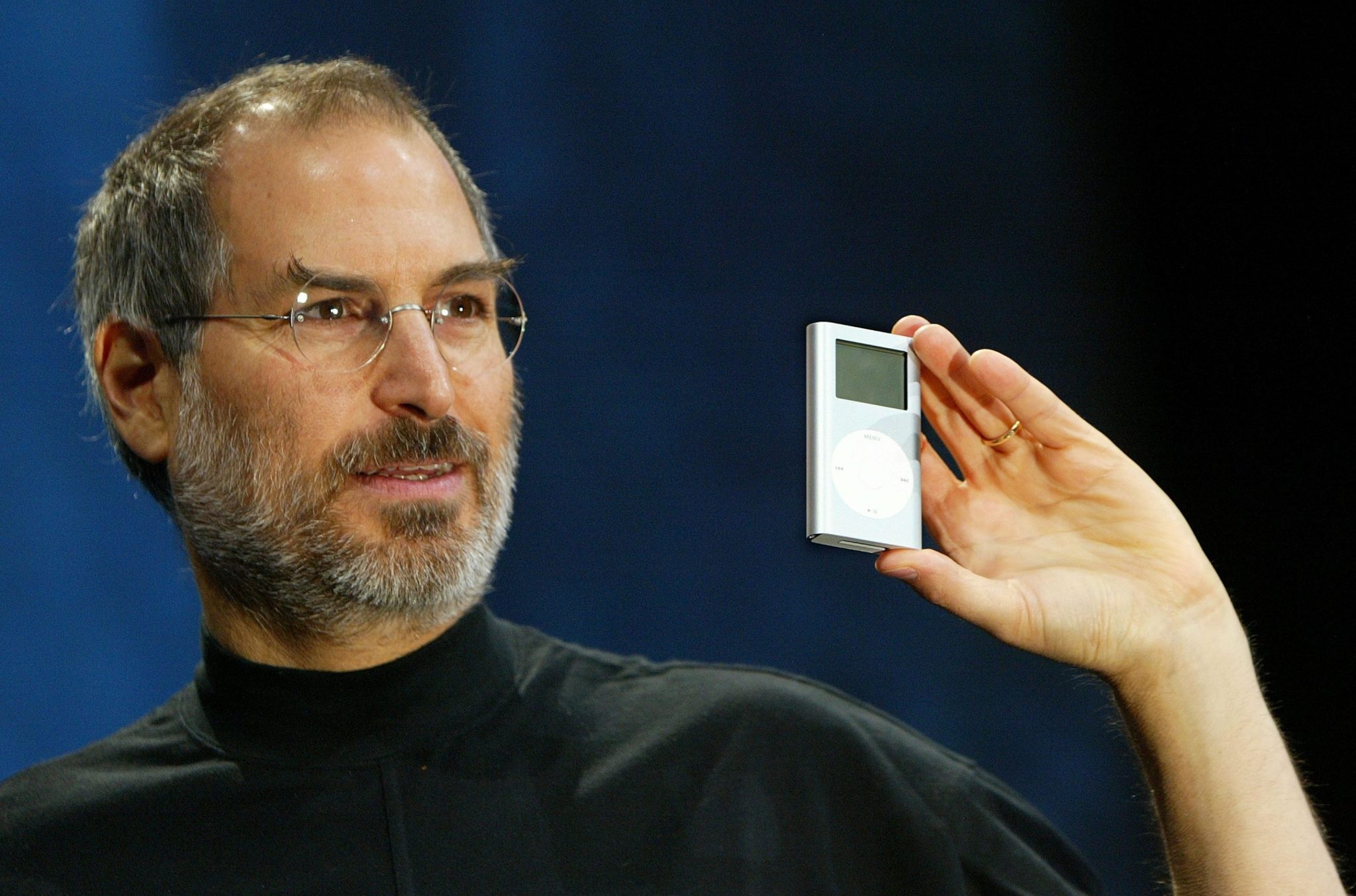

Steve Jobs was just 12 when he called HP’s cofounder. What happened next put him on the path to success at Apple

- When Steve Jobs was just 12 years old, he called up HP cofounder Bill Hewlett to ask for spare parts to build a frequency counter. That phone call got him the tools, and a job. His philosophy remained invaluable to his growth in founding Apple.

At the age of 12, most people are worrying about their school crush or a science project that’s due next week. But Steve Jobs had his mind on something else as a tween: spare parts needed to build a frequency counter. So he found Hewlett Packard (HP) cofounder Bill Hewlett’s phone number in the yellow pages and called him up for a favor.

“I never found anybody that didn’t want to help me if I asked them for help. I always call them up,” Jobs said in a 1994 interview, archived by the Silicon Valley Historical Association.

Jobs recalled that Hewlett laughed when Jobs introduced himself as a 12-year-old highschooler in need of the parts. But ultimately, he offered him the components—and a job. The HP cofounder was so impressed by his drive that he set him up with a summer job at the company, putting nuts and bolts together on frequency counters.

“He got me a job in the place they built them, and I was in heaven,” Jobs said. “I’ve never found anyone who says ‘no,’ or hung up the phone when I called. I just asked.”

That opportunity was the launchpad for Jobs’ wider career success, eventually cofounding $3.5 trillion company Apple with Steve Wozniak and Ronald Wayne in 1976. And Jobs has carried that learning experience with him, saying he had tried to repay that debt of gratitude by helping others when they were in need of an opportunity.

The hardest part for many might be plucking up the courage to reach out—it can be daunting to hit up a company and hope that a leader is able to give an opportunity. And it could seem like the late 1960’s, when Jobs reached out to Hewlett about the spare parts, could have been an easier time to get that support. After all, most Fortune 500 CEOs’ phone numbers are extremely tricky to find now. But Jobs contends that leaders are more willing to help than people may expect.

“Most people never pick up the phone and call, most people never ask. And that’s what separates sometimes the people that do things from the people that just dream about them,” Jobs said. “You gotta act. And you’ve got to be willing to fail.”

Billionaires taking a chance, and finding early success

Jobs wasn’t the only billionaire CEO who jump-started their career as a teenager chasing their dreams of success.

Microsoft cofounder Bill Gates used to sneak out of the house when he was 13 to practice coding at a local company, Computer Center Corp., across town. At the time, computers weren’t a household staple yet. So he’d be at the Seattle-based business until the wee hours of the morning, sometimes as late as 2 a.m., testing out his own bespoke code in exchange for his services fixing programming bugs for Computer Center Corp.

Without that access and early on-hands experience, Gates said he might not have advanced forward in his career and launched a $3.1 billion tech company.

“We were kids…none of us had any real computer experience,” Gates wrote in his memoir, Source Code: My Beginnings. “Without that lucky break of free computer time—call it my first 500 hours—the next 9,500 hours might not have happened at all.”

Warren Buffett, CEO of Berkshire Hathaway, also discovered his entrepreneurial passion early on in life. At the age of six he started selling gum in his neighborhood; when Buffett was 13, he got his first job as a paperboy—and even deducted the bike from his taxes. He got the itch to start his own company, so he launched a pinball business as a teenager for just $25. It later sold for over $1,000 after just one year. It may pale in comparison to Berkshire Hathaway’s $989 billion market cap—but it laid the foundation for him to be the worshipped entrepreneur he is today.

This story was originally featured on Fortune.com

Tech News

Rheinmetall’s stock has soared over 1,000%, and the German defense giant sees growth ‘that we have never experienced before’

- German defense contractor Rheinmetall’s stock price has skyrocketed more than 1,000% since Russia invaded Ukraine in 2022. As the EU plans a €800 billion boost in defense spending, Rheinmetall expects growth to remain strong.

German defense contractor Rheinmetall sees unprecedented gains ahead as Europe embarks on a massive military buildup, even after reporting already-strong growth.

Headquartered in Düsseldorf, Germany, the company reported 2024 total revenue of €9.8 billion on Wednesday, up 36% from 2023. The defense business led the company’s sales growth last year, surging 50% to €7.6 billion. Additionally, the backlog increased 44% to €55 billion a new record high.

Last year’s growth was helped by Europe’s continued military aid for Ukraine. Since Russia invaded Ukraine in 2022, Rheinmetall’s stock price has climbed more than 1,000%.

Meanwhile, the European Union recently announced plans to increase its defense spending by €800 billion ($867 billion) as historic US allies seek to take more responsibility for their security.

“An era of rearmament has begun in Europe that will demand a lot from all of us,” CEO Armin Papperger said in a statement. “However, it also brings us at Rheinmetall growth prospects for the coming years that we have never experienced before.”

For this year, Rheinmetall expects total sales to increase 25%-30% and defense sales to climb 35%-40%. While those numbers would fall short of 2024’s, actual sales by the end of the year could turn out to be even bigger.

Rheinmetall noted in its report the outlook does not take into account “geopolitical developments in recent weeks,” saying updates to its forecasts could come later as requirements of its military customers become clearer.

“With a 50% sales growth in the defence business, Rheinmetall is on its way from being a European systems supplier to a global champion,” Papperger said.

In recent years, the European leader in munition production invested nearly €8 billion in new manufacturing facilities, acquisitions, and supply-chain security. In January, Rheinmetall announced it acquired a majority share in a Bavarian software developer that specializes in digitizing warfare.

In addition to manufacturing missiles and bombs, Rheinmetall also makes tanks, air-defense systems, and autonomous ground vehicles. Most notably, it produces the Panther KF51 main battle tank. A major supplier to Ukraine, Rheinmetall has plants in the war-torn country along with Lithuania, Hungary, and Romania.

Additionally, the company looks to continue its growth in Germany and is reportedly interested in a Volkswagen plant in Osnabrük.

On Wednesday, Papperger said the facility would be “very suitable” for the company’s expansion plans and would be more affordable than building a factory from the ground up.

Papperger cautioned that while there was no concept for Rheinmetall to move onto Volkswagen’s turf, things could still move quickly.

“One thing is clear: before I’ll build a new tank factory in Germany, we’ll of course take a look at it,” he said.

This story was originally featured on Fortune.com

Tech News

Wall Street’s recession odds are starting to look like a coin flip as Trump refuses to back down on his trade war

- Wall Street is raising the probability that the US economy will slip into a recession, with some economists seeing 50-50 odds. That’s as President Donald Trump shows no signs of backing down on his aggressive tariff plans, including reciprocal duties set to take effect in a few weeks.

The likelihood that the US economy will slip into a recession is rising on Wall Street, with some economists even seeing 50-50 odds.

JPMorgan chief economist Bruce Kasman told reporters in Singapore on Wednesday that he now sees a roughly 40% recession risk, up from about 30% at the start of the year.

But he added that recession odds would rise to 50% or above if President Donald Trump’s planned reciprocal tariffs, which are due to take effect April 2, meaningfully come in to force.

“If we would continue down this road of what would be more disruptive, business-unfriendly policies, I think the risks on that recession front would go up,” Kasman said.

Meanwhile, former Treasury Secretary Larry Summers warned that the chances of a recession are about 50%, citing Trump’s tariffs, immigration crackdown, and mass federal layoffs, which are combining to cause sharp reductions in consumer and business spending plans.

When economic forecasts start being revised in a certain direction, there tends to be momentum, he told Bloomberg TV on Tuesday. And all the revisions are going toward less growth.

“I think we’ve got a real uncertainty problem,” Summers added. “I think it’s going to be hard to fix that. And we’re looking at a slowdown relative to what was forecast almost for sure and serious near-50% prospect of recession.”

Moody’s Analytics chief economist Mark Zandi raised his recession odds to 35% from 15% at the start of the, citing tariffs.

But if Trump follows through with his tariff plans and stays there for more than a few months, that would be enough to push the economy into recession, he told Bloomberg TV on Wednesday.

For now, he has hope that negotiations will lead to tariffs getting reeled back in, which is keeping his forecast below 50%.

“But I don’t say that with any confidence with each passing day,” Zandi said. “And of course, the uncertainty around all of this is doing damage.”

In fact, surveys of consumers and businesses show that they are turning increasingly gloomy about the economy amid tariff uncertainty and mass federal layoffs. Even executives in deep-red states that voted for Trump say seeing business conditions are collapsing.

Elsewhere on Wall Street, recession probabilities aren’t as high, but they are rising sharply. Market gurus Ed Yardeni and Eric Wallerstein said earlier this month that they see odds of a bear market and a tariff-induced recession at 35%, up from 20%.

And Allianz chief economic advisor Mohamed El-Erian lifted his recession probability to 25%-30% from 10% at the beginning of the year.

Treasury Secretary Scott Bessent was asked on NBC’s Meet the Press on Sunday if he could guarantee there won’t be a recession, and he replied that there are no guarantees, adding that his earlier comment of an economic adjustment doesn’t mean there has to be a recession.

“But I can tell you that if we kept on this track, what I could guarantee is we would have had a financial crisis,” he said. “I’ve studied it. I’ve taught it. And if we had kept up at these spending levels, that everything was unsustainable. So we are resetting and we are putting things on a sustainable path.”

For his part, Trump last weekend refused to rule out a recession, causing stocks to dive, then said days later that he doesn’t see one coming. But Trump isn’t budging on his trade policies, saying Thursday that “I’m not going to bend at all.”

And when asked about the sharp dive in approval in a recent CNN poll on how Americans view Trump’s handling of the economy, the White House defended his economic plans and pointed to his record during his first term.

“Since President Trump was elected, industry leaders have responded to President Trump’s America First economic agenda of tariffs, deregulation, and the unleashing of American energy with trillions in investment commitments that will create thousands of new jobs,” spokesman Kush Desai said in a statement. “President Trump delivered historic job, wage, and investment growth in his first term, and is set to do so again in his second term.”

This story was originally featured on Fortune.com

Tech News

Baidu releases reasoning AI model to take on DeepSeek

Baidu Inc. released a new artificial intelligence model that articulates its reasoning, in an apparent bid to regain momentum against up-and-coming rivals like DeepSeek.

The Ernie X1 model by China’s internet search leader works similarly to DeepSeek R1 — which shocked Silicon Valley by offering comparable performance to the world’s best chatbots at a fraction of their development cost. Baidu’s reasoning model excels in areas like daily dialogs, complex calculations and logical deduction, it said in a statement Sunday.

Baidu also upgraded its flagship foundation model to Ernie 4.5. It immediately made all tiers of its service — including the X1 model — free for its chatbot users, several weeks than earlier previously planned.

The Beijing-based company was the first in China’s trillion-dollar tech sector to launch a chatbot modeled after OpenAI’s ChatGPT, but rival chatbots from ByteDance Ltd. and Moonshot AI soon took over in popularity. Open-sourced models like Alibaba’s Qwen and then DeepSeek gained greater recognition within the global developer community.

Ernie 4.5 outperforms OpenAI’s latest GPT 4.5 in text generation, Baidu said, citing several industry benchmarks.

Baidu has declared that it will make Ernie AI models open-source from June 30, representing a major strategic shift after the rise of DeepSeek. It also integrated the R1 model into its search engine — its bread-and-butter business.

The generative AI boom showed up in Baidu’s December-quarter results via a 26% jump in cloud revenue. That rise, driven by services provided to developers chasing computing power, was overshadowed by weak advertising sales amid China’s economic malaise.

Baidu concluded last month a drawn-out deal to acquire the YY Live streaming platform Joyy Inc. The $2.1 billion takeover released some $1.6 billion that Baidu previously deposited into escrow accounts, which it plans to invest into AI and cloud infrastructure.

This story was originally featured on Fortune.com

-

Tech News3 months ago

Tech News3 months agoHow Costco’s formula for reaching uncertain consumers is pushing shares past $1,000 to all-time highs

-

Tech News3 months ago

Tech News3 months agoLuigi Mangione hires top lawyer—whose husband is representing Sean ‘Diddy’ Combs

-

Tech News3 months ago

Tech News3 months agoLego bricks have won over adults, growing its $10 billion toy market foothold—and there’s more to come

-

Tech News3 months ago

Quentin Tarantino thinks movies are still better than TV shows like Yellowstone

-

Tech News3 months ago

Tech News3 months agoInside the FOMC: Boston Fed President Susan Collins on changing her mind, teamwork, and the alchemy behind the base rate

-

Tech News3 months ago

Tech News3 months agoNancy Pelosi has hip replacement surgery at a US military hospital in Germany after falling at Battle of the Bulge ceremony

-

Tech News3 months ago

Tech News3 months agoTrump and members of Congress want drones shot down while more are spotted near military facilities

-

Tech News3 months ago

Tech News3 months agoHundreds of OpenAI’s current and ex-employees are about to get a huge payday by cashing out up to $10 million each in a private stock sale