Tech News

Education Department staff cuts could limit options for families of kids with disabilities

For parents of kids with disabilities, advocating for their child can be complicated, time-consuming — and expensive.

Changes at the Education Department are likely to make the process even more difficult, advocates for kids with disabilities say.

When a parent believes their child is not receiving proper services or school accommodations for a disability, they can seek remedies from their district. They can file complaints with their state, arguing the child’s rights have been taken away without due process of law, or even pursue litigation in state or federal courts.

Those processes often involve multiple sessions with hearing officers who are not required to be experts in disability law. Legal fees can cost tens of thousands of dollars for a single case. Legal aid and other advocacy organizations that can provide free assistance often have more demand for their services than they can meet.

But filing a complaint with the Education Department has long been an option for families who can’t afford a lawyer. They begin by filling out the Office for Civil Rights’ online form, documenting the alleged instances of discrimination. From there, the agency’s staff is supposed to investigate the complaint, often interviewing school district employees and examining district policies for broader possible violations.

“It’s known and has the weight of the federal government behind it,” said Dan Stewart, managing attorney for education and employment at the National Disability Rights Network. “The process, the complaint portal, as well as the processing manual are all in public, and it does not require or typically involve lawyers.”

That option seems increasingly out of reach, advocates say.

Under President Donald Trump, the Education Department’s staff has been cut approximately in half — including in the Office for Civil Rights, whose attorneys are charged with investigating complaints of discrimination against kids with disabilities. The staff has been directed to prioritize antisemitism cases. More than 20,000 pending cases — including those related to kids with disabilities, historically the largest share of the office’s work — largely sat idle for weeks after Trump took office. A freeze on processing the cases was lifted early this month, but advocates question whether the department can make progress on them with a smaller staff.

“The reduction in force is simply an evisceration of the Office for Civil Rights’ investigatory authority and responsibility,” Stewart said. “There’s no way that I can see that OCR can keep up with the backlog or with the incoming complaints.”

A federal lawsuit filed Friday challenges the layoffs at the Office for Civil Rights, saying they decimated the office’s ability to process and investigate complaints.

While the OCR process was not perfect, reducing the office’s investigative staff will only worsen the challenges families face when seeking support for their kids, said Nikki Carter, an advocate for kids with disabilities and one of the plaintiffs in the lawsuit.

“It makes them feel hopeless and helpless,” Carter said. “By reducing the number of employees to handle cases, by putting stipulations on certain cases, it only makes it feel intensified.”

Education Department officials insist the staff reductions will not affect civil rights investigations and the layoffs were “strategic decisions.”

In her state of Alabama, Carter said families face an uphill battle to finding legal representation.

“They don’t have the money for an attorney,” she said. “Or the representation they’re getting is not the representation they feel like will be best for their child.”

Even if families can afford the high costs, a limited number of attorneys have the expertise to take on disability discrimination cases. Programs that offer free representation often have limited capacity.

If the backlog of cases increases at the federal Office for Civil Rights, families may lose faith in how quickly the department will investigate their complaints, Stewart said. That may drive them to alternate pathways, such as filing state complaints.

But state and local agencies haven’t always had the capacity or understanding to handle education disability complaints, Stewart said, since those cases so often went to the U.S. Education Department.

“They might not have the infrastructure or the knowledge or the staffing to take on the influx of cases,” Stewart said.

In a separate federal lawsuit filed Thursday, Democratic attorneys general argued the staff reductions at the Education Department may embolden school districts to ignore complaints of discrimination or harassment.

“Students with current complaints will likely see no meaningful resolution, with cases backlogged due to the shortage of employees to resolve them,” the lawsuit said. “Students facing discrimination, sexual harassment or sexual assault will lose a critical avenue to report their case.”

This story was originally featured on Fortune.com

Tech News

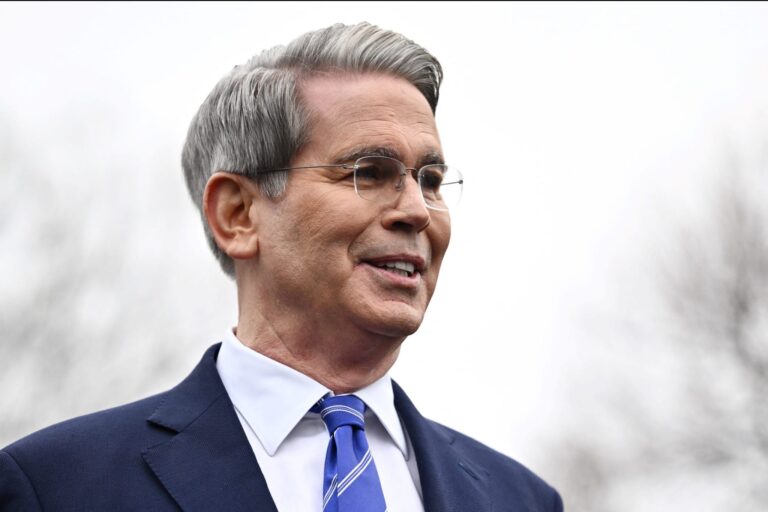

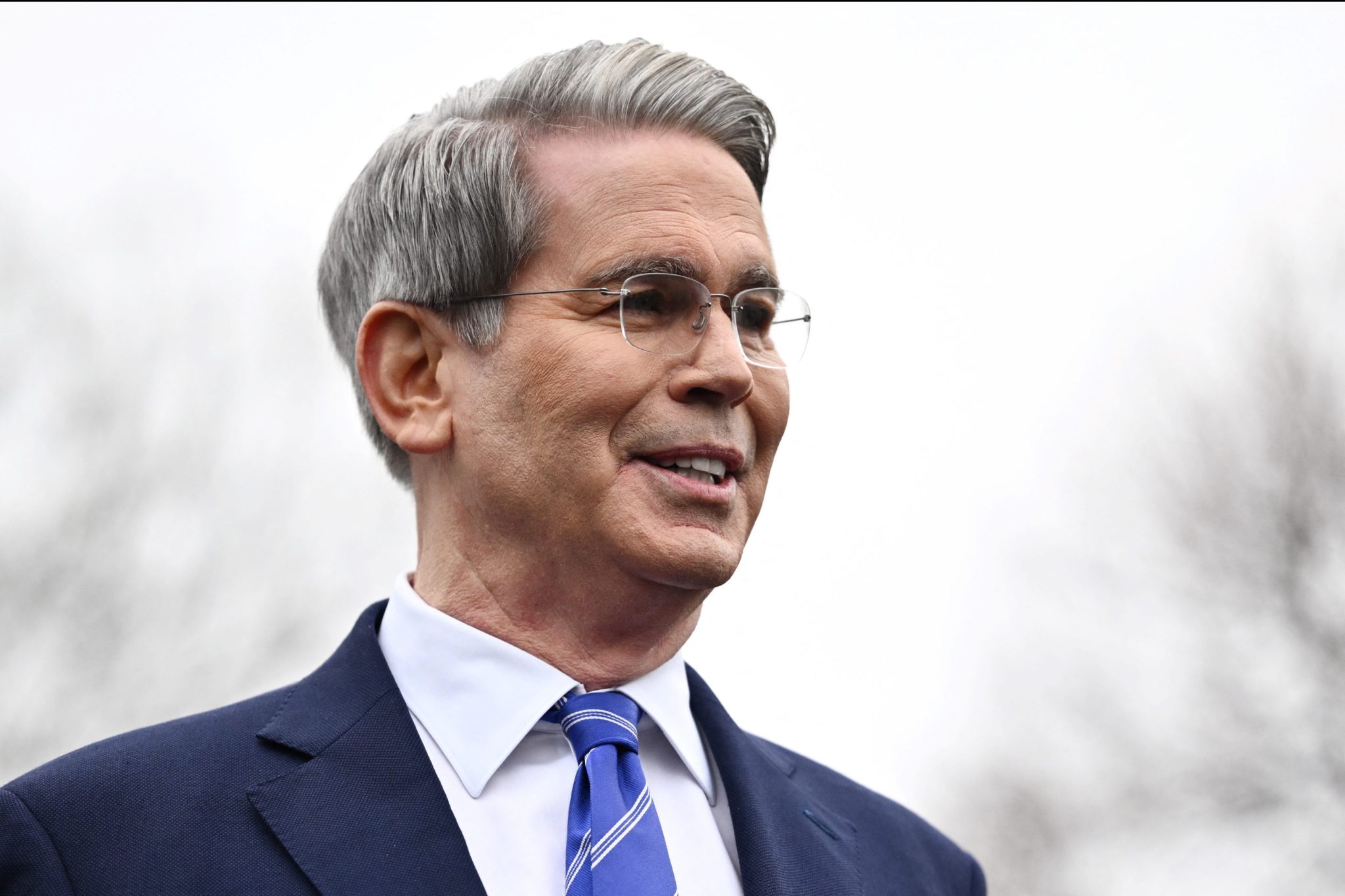

Bessent not worried about market, calls corrections healthy

Treasury Secretary Scott Bessent, a former hedge fund manager, said he’s not worried about the recent downturn that’s wiped trillions of dollars from the equities market as the US seeks to reshape its economic policies.

“I’ve been in the investment business for 35 years, and I can tell you that corrections are healthy, they are normal,” Bessent said Sunday on NBC’s Meet The Press. “I‘m not worried about the markets. Over the long term, if we put good tax policy in place, deregulation and energy security, the markets will do great.”

The selloff that took the S&P 500 Index into a correction last week came amid investor concerns about the economic effects of the Trump administration’s moves around tariffs, immigration and cuts to the federal government. Losses in equity markets have deepened with mounting growth concerns and souring consumer sentiment.

“We are putting the policies in place that will make the affordability crisis go down, inflation moderate and as we set the sails I am confident that the American people will come our way,” said Bessent, who ran Key Square Group before joining the administration.

As the scope of President Donald Trump’s tariff policy broadens, consumers across the political spectrum have become increasingly concerned that the extra duties will lead to higher costs. Global tariffs are now in place on steel and aluminum and there’s an April 2 deadline pending for even broader levies.

Read More: Here’s a Running Tally of Trump’s Tariff Threats and Actions

While inflation cooled last month, any sustained pickup in price pressures risks causing households to limit discretionary purchases.

In the interview, Bessent said the American Dream isn’t contingent on being able to buy cheap goods from China. Families instead want to afford a home and see their children do better than they are.

“It’s mortgages, it’s cars, it’s real wage gains,” he said.

As questions about the US economy build, Federal Reserve officials are due to meet this week. Fed Chair Jerome Powell emphasized earlier this month that the central bank doesn’t need to be in a hurry to cut rates but he will likely be pressed about the uncertainty and risks emerging.

This story was originally featured on Fortune.com

Tech News

Trump administration deports hundreds as judge orders their removals be stopped with planes already in the air

The Trump administration has transferred hundreds of immigrants to El Salvador even as a federal judge issued an order temporarily barring the deportations under an 18th century wartime declaration targeting Venezuelan gang members, officials said Sunday. Flights were in the air at the time of the ruling.

U.S. District Judge James E. Boasberg issued an order Saturday blocking the deportations, but lawyers told him there were already two planes with immigrants in the air — one headed for El Salvador, the other for Honduras. Boasberg verbally ordered the planes be turned around, but they apparently were not and he did not include the directive in his written order.

In a court filing Sunday, the Department of Justice, which has appealed Boasberg’s decision, said the immigrants “had already been removed from U.S. territory” when the written order was issued at 7:26 pm.

Trump’s allies were gleeful over the results.

“Oopsie…Too late,” Salvadoran President Nayib Bukele, who agreed to house about 300 immigrants for a year at a cost of $6 million in his country’s prisons, wrote on the social media site X above an article about Boasberg’s ruling. That post was recirculated by White House communications director Steven Cheung.

Secretary of State Marco Rubio, who negotiated an earlier deal with Bukele to house immigrants, posted on the site: “We sent over 250 alien enemy members of Tren de Aragua which El Salvador has agreed to hold in their very good jails at a fair price that will also save our taxpayer dollars.”

Steve Vladeck, a professor at the Georgetown University Law Center, said that Boasberg’s verbal directive to turn around the planes was not technically part of his final order but that the Trump administration clearly violated the “spirit” of it.

“This just incentivizes future courts to be hyper specific in their orders and not give the government any wiggle room,” Vladeck said.

The immigrants were deported after Trump’s declaration of the Alien Enemies Act of 1798, which has been used only three times in U.S. history.

The law, invoked during the War of 1812 and World Wars I and II, requires a president to declare the United States is at war, giving him extraordinary powers to detain or remove foreigners who otherwise would have protections under immigration or criminal laws. It was last used to justify the detention of Japanese-American civilians during World War II.

A Justice Department spokesperson on Sunday referred to an earlier statement from Attorney General Pam Bondi blasting Boasberg’s ruling and didn’t immediately answer questions about whether the administration ignored the court’s order.

Venezuela’s government in a statement Sunday rejected the use of Trump’s declaration of the law, characterizing it as evocative of “the darkest episodes in human history, from slavery to the horror of the Nazi concentration camps.”

Tren de Aragua originated in an infamously lawless prison in the central state of Aragua and accompanied an exodus of millions of Venezuelans, the overwhelming majority of whom were seeking better living conditions after their nation’s economy came undone during the past decade. Trump seized on the gang during his campaign to paint misleading pictures of communities that he contended were “taken over” by what were actually a handful of lawbreakers.

The Trump administration has not identified the immigrants deported, provided any evidence they are in fact members of Tren de Aragua or that they committed any crimes in the United States. It also sent two top members of the Salvadoran MS-13 gang to El Salvador who had been arrested in the United States.

Video released by El Salvador’s government Sunday showed men exiting airplanes onto an airport tarmac lined by officers in riot gear. The men, who had their hands and ankles shackled, struggled to walk as officers pushed their heads down to have them bend down at the waist.

The video also showed the men being transported to prison in a large convoy of buses guarded by police and military vehicles and at least one helicopter. The men were shown kneeling on the ground as their heads were shaved before they changed into the prison’s all-white uniform — knee-length shorts, T-shirt, socks and rubber clogs — and placed in cells.

The immigrants were taken to the notorious CECOT facility, the centerpiece of Bukele’s push to pacify his once violence-wracked country through tough police measures and limits on basic rights

The Trump administration said the president actually signed the proclamation contending Tren de Aragua was invading the United States on Friday night but didn’t announce it until Saturday afternoon. Immigration lawyers said that, late Friday, they noticed Venezuelans who otherwise couldn’t be deported under immigration law being moved to Texas for deportation flights. They began to file lawsuits to halt the transfers.

“Basically any Venezuelan citizen in the US may be removed on pretext of belonging to Tren de Aragua, with no chance at defense,” Adam Isacson of the Washington Office for Latin America, a human rights group, warned on X.

The litigation that led to the hold on deportations was filed on behalf of five Venezuelans held in Texas who lawyers said were concerned they’d be falsely accused of being members of the gang. Once the act is invoked, they warned, Trump could simply declare anyone a Tren de Aragua member and remove them from the country.

Boasberg barred those Venezuelans’ deportations Saturday morning when the suit was filed, but only broadened it to all people in federal custody who could be targeted by the act after his afternoon hearing. He noted that the law has never before been used outside of a congressionally declared war and that plaintiffs may successfully argue Trump exceeded his legal authority in invoking it.

The bar on deportations stands for up to 14 days and the immigrants will remain in federal custody during that time. Boasberg has scheduled a hearing Friday to hear additional arguments in the case.

He said he had to act because the immigrants whose deportations may actually violate the U.S. Constitution deserved a chance to have their pleas heard in court.

“Once they’re out of the country,” Boasberg said, “there’s little I could do.”

This story was originally featured on Fortune.com

Tech News

This US-based company warns revenue could suffer from ‘anti-American sentiment’ amid trade war backlash

- Beyond Meat recently flagged the risk that “anti-American sentiment” could hurt sales if it loses customers in other countries or faces other forms of retaliation that affect its sourcing and manufacturing. That’s as US tariffs trigger a global backlash against American products.

Beyond Meat, a producer of plant-based meat substitutes, recently warned that its status as a US company could hurt sales amid an international backlash against President Donald Trump’s tariffs.

The El Segundo, Calif.-based company filed a 10-K annual report with the SEC earlier this month that included a section on risk factors.

In regulatory filings, such sections are often a laundry list of a wide universe of potential headwinds, with some more likely than others. Beyond Meat’s flagged the possible risks associated with epidemics, natural disasters, severe weather, civil strife, war, terrorist activity and other geopolitical tensions.

It also mentioned Trump’s tariffs and plans for retaliation by US trade partners like Canada, saying the company may have to raise prices, increase inventory levels, or find new sourcing for products that it imports.

“There is no assurance that we would be able to pass on any cost increases, in full or at all, to our customers, and/or we could lose customers in countries such as Canada due to anti-American sentiment, any of which could materially affect our revenue, gross margin and results of operations,” Beyond Meat warned.

Any trade wars that feature “buy national” policies or other forms of retaliation against US tariffs could hurt the company’s supply chains, prices, demand, and macroeconomic markets, the filing added.

For example, Beyond Meat sources almost all of its pea protein from Canada and manufactures some of its products there.

“We cannot predict future trade policy and regulations in the United States and other countries, the terms of any renegotiated trade agreements or treaties, or tariffs and their impact on our business. A trade war could have a significant adverse effect on world trade and the world economy,” it said, noting that uncertainty on trade policy can also impact consumer confidence and spending.

The company didn’t immediately respond to a request for further comment.

To be sure, Beyond Meat’s sales had previously been in a slump before Trump returned to the White House as demand for meat substitutes waned more broadly.

But sales had recently started to turn around. Fourth-quarter revenue rose 4% to $76.7 million, marking the second consecutive quarter of annual growth, the company said last month.

Still, the backlash against US products is real, from alcohol to cutting-edge weapons. Canadians are pulling bottles of American liquor off shelves, and sales of Tesla cars are collapsing in Europe as CEO Elon Musk interjects himself in national elections and becomes more closely associated with Trump’s policies.

Even the F-35 stealth fighter is not immune. NATO allies Canada and Portugal are now having second thoughts about buying the fighter from the US and are taking a look at European alternatives.

This story was originally featured on Fortune.com

-

Tech News3 months ago

Tech News3 months agoHow Costco’s formula for reaching uncertain consumers is pushing shares past $1,000 to all-time highs

-

Tech News3 months ago

Tech News3 months agoLuigi Mangione hires top lawyer—whose husband is representing Sean ‘Diddy’ Combs

-

Tech News3 months ago

Tech News3 months agoLego bricks have won over adults, growing its $10 billion toy market foothold—and there’s more to come

-

Tech News3 months ago

Quentin Tarantino thinks movies are still better than TV shows like Yellowstone

-

Tech News3 months ago

Tech News3 months agoInside the FOMC: Boston Fed President Susan Collins on changing her mind, teamwork, and the alchemy behind the base rate

-

Tech News3 months ago

Tech News3 months agoNancy Pelosi has hip replacement surgery at a US military hospital in Germany after falling at Battle of the Bulge ceremony

-

Tech News3 months ago

Tech News3 months agoTrump and members of Congress want drones shot down while more are spotted near military facilities

-

Tech News3 months ago

Tech News3 months agoHundreds of OpenAI’s current and ex-employees are about to get a huge payday by cashing out up to $10 million each in a private stock sale