Tech News

U.K. economy shrinks in January in fresh setback for Starmer

The UK economy unexpectedly shrank at the start of 2025, piling fresh pressure on Prime Minister Keir Starmer’s government over the lack of momentum since Labour returned to power last summer.

Gross domestic product fell 0.1% in a storm-hit January, driven by declines in manufacturing and construction, the Office for National Statistics said Friday. Economists had expected a 0.1% increase. It means output is still barely larger than when Labour won a landslide election victory in July.

Chancellor of the Exchequer Rachel Reeves pointed to the global turbulent backdrop for the weakness, warning that “the world has changed and across the globe we are feeling the consequences.”

Reeves is under pressure to start delivering on her promise to boost growth after a dismal run of economic indicators under Labour. She is preparing to announce what’s expected to be a sobering economic update on March 26, when official growth forecasts may be trimmed.

Friday’s figures mean the economy has contracted in four out of the seven months since Labour took office. GDP is only 0.3% higher than it was in June.

The pound extended losses, dropping as much as 0.2% to $1.2924 as traders incrementally added to expectations for more interest-rate cuts. Traders now see 57 basis points of reductions this year.

The weakness in January was partly driven by the UK being hit by the strongest storm for 10 years, suggesting that some sectors could rebound in February.

While economists are predicting a return to steady growth this year, risks to the outlook are mounting with Donald Trump’s escalating trade war sending stocks crashing and triggering fears of a global downturn. The hope is that Britain’s plans for big spending on infrastructure will underpin growth.

“Following the lackluster performance in the second half of 2024, growth remains fragile due to global and domestic uncertainty,” said Hailey Low, economist at the National Institute of Economic and Social Research. “It is crucial that the upcoming Spring Statement provides stability rather than adding to domestic uncertainty.”

What Bloomberg Economics Says…

“The surprise drop in January’s GDP still leaves the UK economy on course for a modest rebound in the first quarter after a sharp slowdown in the second half of 2024. Our view is growth will strengthen a little over the course of 2025. If data continues to disappoint, though, it will be hard for the Bank of England to stick with its gradual approach to policy easing. We still think the risk is for the central bank cutting rates faster than we’re expecting.”

—Read Ana Andrade and Dan Hanson’s REACT on the Terminal

Labour has unveiled a raft of policies to help it meet its promise of boosting growth, including unblocking building projects and green-lighting controversial developments. However, growth was patchy in the second half of last year and sentiment indicators nosedived after a tax-heavy budget in October.

The ONS said that output fell in eight of the 13 manufacturing sectors in January, with the production of metals and pharmaceuticals experiencing the largest declines. Anecdotal evidence points to construction being hit by storms, rain and snow during the month, it said. Oil and gas production also declined.

The falls were partly offset by 0.1% growth in services, the largest part of the UK economy. Retailers recorded a strong January thanks to people eating more frequently at home, according to the ONS.

The BOE expects the economy to continue expanding at a tepid pace, predicting a 0.7% expansion in 2025 after last year’s 0.9% rise. Facing an uncertain outlook, BOE rate-setters are expected to leave interest rates on hold next Thursday and warn markets of only gradual cuts.

“We doubt the bad news on GDP will be enough to convince the Bank of England to cut interest rates at its meeting next week,” said Thomas Pugh, economist at RSM UK. “Smooth out the month-to-month volatility and the economy is picking up some momentum, which should allay fears about the UK slipping back into recession.”

Officials are balancing the need to support a stagnant economy against signs of stubborn inflationary pressures and heightened uncertainty. They have flagged the threat of tariffs and the impact of Labour’s increase in employer payroll taxes on the jobs market and prices.

This story was originally featured on Fortune.com

Tech News

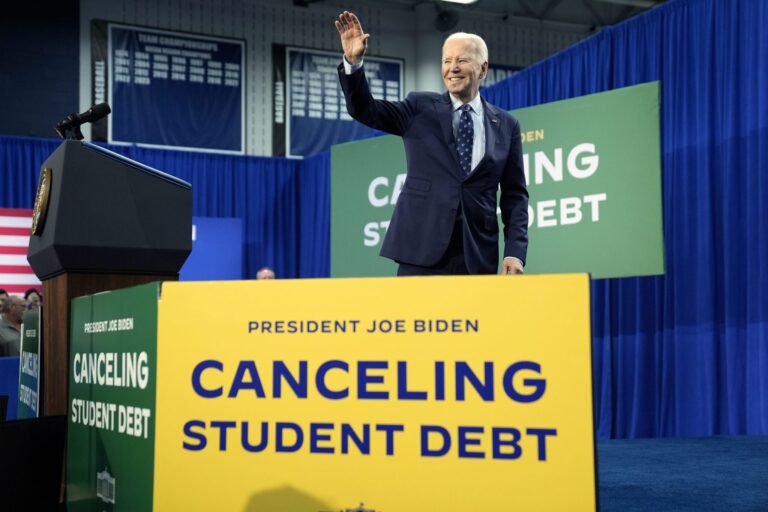

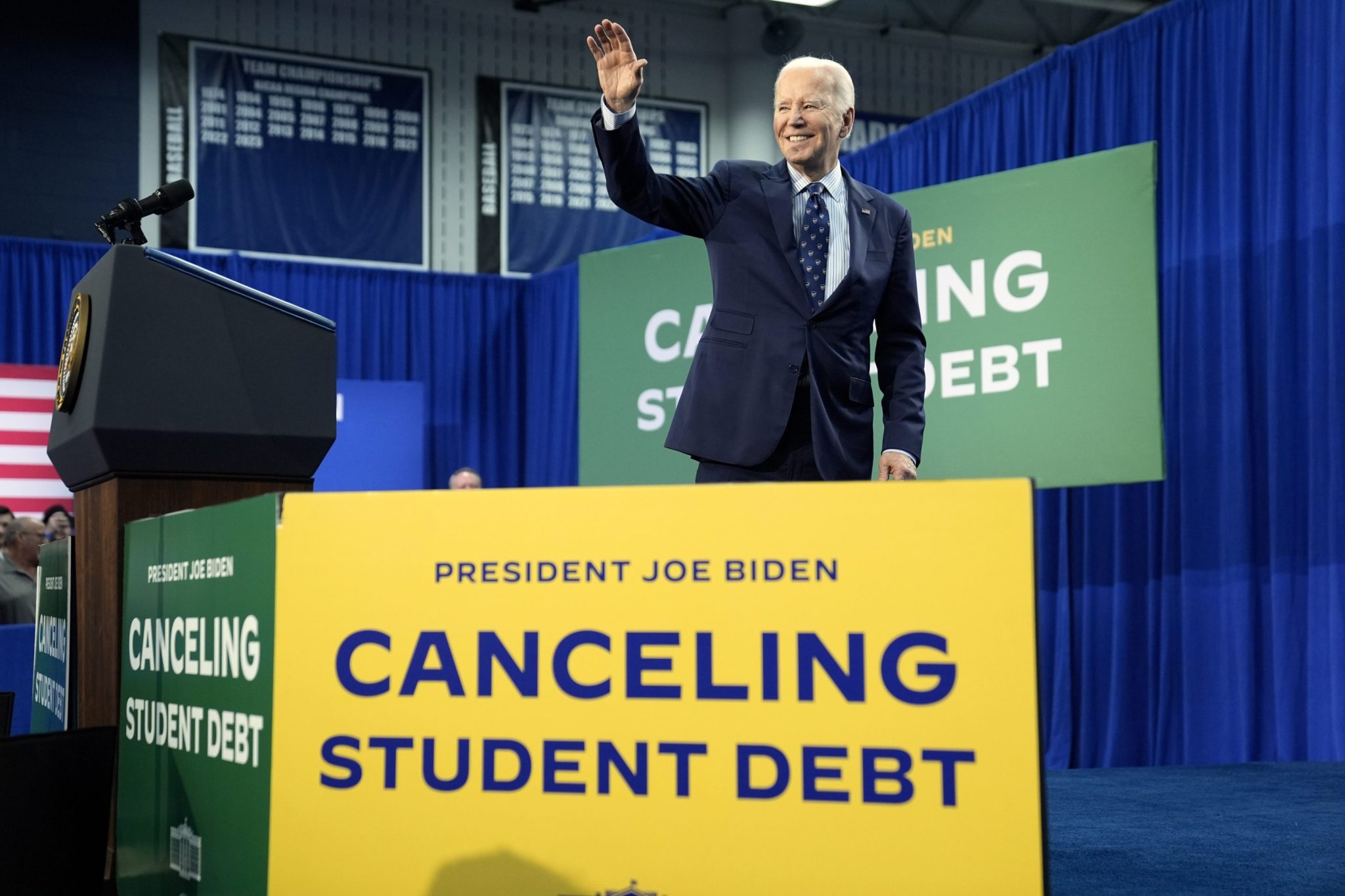

The Education Department has suspended some income-driven student loan repayment plans. Here’s what borrowers should know

The Trump administration’s recent changes to student loans are causing frustration and confusion for some borrowers.

In response to a February court ruling that blocked some Biden-era programs, the Education Department has taken down online and paper applications for income-driven repayment plans.

“This especially hurts anyone who’s lost their jobs, including federal workers,” said Natalia Abrams, founder and president of the Student Debt Crisis Center. “A few months ago, they would have been able to get on a zero-dollar income-driven repayment plan.”

The removal of application materials also has caused confusion around the recertification process for borrowers already enrolled in repayment plans, experts say. Income-driven repayment plans take a borrower’s finances and family size into account when calculating monthly payments, but borrowers must periodically demonstrate they still qualify.

Adding to the uncertainty are layoffs at the Education Department, which oversees the federal loan system. The federal website for student loans and financial aid, StudentAid.gov, suffered an hours-long outage Wednesday, but the department has said it will continue to deliver on its commitments.

“It’s been wave after wave of bad news for student borrowers,” said Aissa Canchola Bañez, policy director at the Student Borrower Protection Center.

Here’s some guidance for those with student loans.

Check with your loan servicer and know your options

All borrowers currently enrolled in income-driven repayment plans should “get a sense of when your recertification deadline is and get a sense of what options are available to you if the form is not available online to recertify your income,” Bañez said.

Recertification confirms a borrower’s financial situation. With some forms not currently available, borrowers who are unable to complete that process could be in jeopardy.

If borrowers are already on an income-driven repayment plan, they should still be allowed to remain on that repayment plan if they are able to recertify their income.

Abrams said it’s also a good idea to take screenshots of your account’s current status on the student aid website.

What other resources are available?

State-specific and state-level resources are available for student borrowers. Congress members have teams charged with helping constituents if they are having trouble with a federal agency or struggling to contact a federal student loan servicer.

Borrowers may contact their representatives in Congress and open a casework file by going onto their website or calling their office.

“Try saying something like, ‘I need your help to understand how to get into an affordable repayment option, which I’m entitled to under the law,’” Bañez said. “‘Even though this federal department has taken down these applications, I need your help.’”

Despite the thinning of the Education Department and President Donald Trump’s dismantling of the Consumer Financial Protection Bureau, loan servicers still must consider a borrower’s financial situation, Bañez said.

“You can see if you can get temporary forbearance or a deferment of payments for financial hardship,” she said.

State attorneys general also take inquiries from student borrowers.

What are affected borrowers saying?

Jessica Fugate, a government relations manager for the city of Los Angeles, said she was a less than a year from student loan forgiveness under the Biden-era Public Service Loan Forgiveness program, which forgives outstanding loans after 120 payments.

With an ongoing court challenge to her former SAVE payment plan, though, Fugate hoped to switch to an income-driven plan before Trump took office. She applied in January.

“It’s the most affordable option to repay my loans while living in Los Angeles working for the government on a government salary,” said Fugate, 42. “And it would mean my payments counted towards forgiveness.”

As of February, Fugate notified that her application was received and she had been notified of its status, but they didn’t say when she would know if she was approved.

“And when I called recently, the machine said there was a four hour wait,” she said.

With income-driven repayment plans in limbo, Fugate isn’t sure what her options are and hopes to one day have her federal loans behind her.

“I’ve been working for government for almost 10 years. After that much time, you don’t do it for the glory,” she said. “I’ve spent most of my career giving back to other people. I don’t mind serving people. I just feel this was an agreement they made with the public, and so we’re owed that. And it’s a lot of us. And we’re not just numbers.”

Debbie Breen, 56, works at an agency on healthy aging in Spokane, Washington. Breen said she has worked in the nonprofit sector for more than 10 years and that nearly all those years counted toward Public Service Loan Forgiveness.

Breen also was on the Biden-era SAVE plan, which means she was placed in forbearance when the court challenge to that plan was upheld. Like Fugate, she had planned to switch to an income-driven repayment plan to have her payments count towards forgiveness.

“I was months away from ending this nightmare,” she said. “Now I don’t think that’s going to happen. I’m kind of in panic mode because I know that if they stop income-driven repayment plans, I don’t know that I’m going to be able to afford the payments each month.”

Breen said she has two kids who also have student loans.

“They’re dealing with the same thing,” she said. “It’s scary. It’s absolutely scary.”

This story was originally featured on Fortune.com

Tech News

Tesla may have no new car coming after all as report reveals plan to launch a stripped down Model Y

- The much touted $25,000 entry level Tesla, known colloquially as the Model 2, may not be built, dashing investor hopes. Instead, future sales growth may have to come from a car without steering wheel or pedals—the CyberCab.

The biggest mystery surrounding Tesla’s product roadmap may have been lifted on Thursday, with news trickling out of China that suggests there may be no Model 2 after all.

First reported by local tech website 36kr and later confirmed by Reuters, Tesla is developing a low-priced version of the Model Y, its best seller with roughly 1.1 million units sold. This suggests that hopes of a coming entry level compact car, possibly a hatchback rather than a sedan, will not come to fruition.

The car codenamed “E41” will start production next year in Shanghai and will be at least 20% cheaper to produce than the current refreshed Model Y known as “Juniper”, according to Reuters. It could come even earlier if Juniper disappoints, sources told 36kr.

Tesla did not respond to a request by Fortune for comment.

Since many institutional investors put a premium on tangible sales of EVs over hazier dreams of building humanoid robots, a key growth assumption for many was Tesla entering a new segment, like the compact car, where it could expand its total addressable market.

These hopes persisted largely because Tesla has been coy about its actual product roadmap ever since last April. “Plans for new vehicles, including more affordable models, remain on track for start of production in the first half of 2025” is the most explicit it has gone in its comments.

Chief executive Elon Musk kept these embers of hope burning late last year when he promised in October that Tesla EV sales would surge this year.

“With our lower-cost vehicles, with the advent of autonomy, something like a 20 to 30 percent growth next year is my best guess,” he said.

This was not repeated in January’s fourth quarter investor call, however. Officially Tesla is only aiming to increase sales. Analysts are now slashing their forecasts to reflect ongoing boycotts and a lack of compelling new product.

Growth story in doubt

First teased as costing $25,000 back in September 2020, the low-cost car has long been for many investors a bigger strategic priority than the Cybertruck, with estimated annual sales in the millions.

No carmaker had ever achieved such a feat. If Tesla managed to turn an expensive mid-size electric vehicle into the world’s most popular car, then it was trusted to build a smaller, low-cost model that could breach the 2 million unit ceiling in a single year.

But the last supposed spy photographs of what some believed to be a Model 2 came in early 2023, prior to a Reuters report last April that revealed plans for a low-cost car built on the next-gen platform it would share with the CyberCab had been scrapped.

The stock tanked on that news, but Musk was able to restore faith that Tesla’s growth story was intact by saying he had accelerated plans for a new more affordable model by six months to the first half of this year.

‘Having a regular 25k model is pointless’

Yet he never got more specific. During the same October call when Musk predicted growth of up to 30% in 2025, he then made a comment whose significance may have been underappreciated at the time.

“Having a regular 25k model is pointless, it would be silly, like it would be completely at odds with what we believe,” he said.

At the time that was interpreted to mean Musk simply would not launch a new product that was so cheap as to not come equipped with its Full Self Driving hardware, an AI inference computer known as AI4 (previously HW4).

Now it seems increasingly clear the explosive growth Tesla forecasts will come from only one model: the CyberCab. The silver lining is Musk estimates its sales could amount to 2 million a year, or even 4 million.

But that is little consolation for investors because of one key concern: the CyberCab has no steering wheel or pedals. It requires a full legal and regulatory framework in place in order to be sold and operated on public roads.

Nor can Tesla simply convert the CyberCab into a car for sale by adding human controls, because the market for two-door cars seating a maximum of three people is minuscule. The vehicle as it is conceived and designed is likley only financially viable as a vehicle for robotaxi fleets.

This story was originally featured on Fortune.com

Tech News

Volkswagen’s own-brand currywurst sausage proves almost as popular as its cars amid automotive sales decline

Caught at the most daunting crossroads in its history, fallen German carmaking giant Volkswagen can take solace in one segment of its business empire that continues to boom: sausages.

Volkswagen’s 2024 earnings, released on Tuesday, revealed a 3% decline in vehicle sales alongside a 30% drop in net profits. The carmaker’s rising costs and falling demand prompted the group to agree to up to 35,000 job cuts by 2030 and German factory closures in a bid to turn around its fortunes.

Volkswagen-branded currywurst, however, is showing no signs of a similar downturn.

The VW Currywurst, affectionately designated the component number 199 398 500 A, has been serving the company’s employees and locals around its Wolfsburg headquarters since 1973.

Made in-house by a Volkswagen-employed butcher, the currywurst feeds the company’s tens of thousands of employees across its German plants. It can also be found at the Wolfsburg football stadium and in supermarkets around Germany.

The IG Metall union, which represents Volkswagen’s German workers, confirmed that Volkswagen had sold 8.552 million portions of its currywurst last year.

That’s only slightly lower than the 9 million cars the entire Volkswagen group sold last year. The currywurst sales already dwarf those of the Volkswagen brand itself, which stood at 5.2 million vehicles last year.

The company sold 6.3 million of its original currywurst in 2024, of which one in ten were consumed by the company’s workers. Another 2.2 million were sold as a hot dog version of the currywurst via retail.

The group also managed to sell 42,000 units of a vegan version of its beloved sausages.

“Volkswagen stands for innovation – on two, four and many other wheels and yes – also on the plate!” Volkswagen HR director Gunnar Kilian posted on LinkedIn on Monday.

“With over 8 million Volkswagen Genuine Curry sausages sold, we are celebrating a new sales record. But we are not resting on our laurels: Our next currywurst coup is already in the works!”

The IG Metall Union, which sparred with Volkswagen for months last year to find a way out of the carmaker’s decline, made a point of highlighting the humble sausage’s growing significance compared with its vehicles.

“For years now, Volkswagen has sold more currywursts than vehicles bearing the VW logo—although such a comparison is, of course, a matter of taste.

“One thing is certain, however: With the current 8.6 million units, VW’s currywurst sales are not only once again outpacing the core passenger car brand’s sales (2024: 4.8 million units), but are also moving closer to the cross-brand vehicle sales of the entire Group.”

The group’s head of food production promised more innovations to the VW Currywurst, including a ready-to-eat version that comes complete with another Volkswagen product, the part number 00010 ZDK-259-101, known by its more common name: ketchup.

Volkswagen sold some 629,000 bottles of its VW spiced ketchup last year, in addition to 25,000 10-liter buckets. The company for the first time distributed its ketchup to customers in the U.S. last year, with the free-of-charge Gewürz Ketchup Brand flying off the carmaker’s shelves.

This story was originally featured on Fortune.com

-

Tech News3 months ago

Tech News3 months agoHow Costco’s formula for reaching uncertain consumers is pushing shares past $1,000 to all-time highs

-

Tech News3 months ago

Tech News3 months agoLuigi Mangione hires top lawyer—whose husband is representing Sean ‘Diddy’ Combs

-

Tech News3 months ago

Tech News3 months agoLego bricks have won over adults, growing its $10 billion toy market foothold—and there’s more to come

-

Tech News3 months ago

Quentin Tarantino thinks movies are still better than TV shows like Yellowstone

-

Tech News3 months ago

Tech News3 months agoInside the FOMC: Boston Fed President Susan Collins on changing her mind, teamwork, and the alchemy behind the base rate

-

Tech News3 months ago

Tech News3 months agoNancy Pelosi has hip replacement surgery at a US military hospital in Germany after falling at Battle of the Bulge ceremony

-

Tech News3 months ago

Tech News3 months agoTrump and members of Congress want drones shot down while more are spotted near military facilities

-

Tech News3 months ago

Tech News3 months agoHundreds of OpenAI’s current and ex-employees are about to get a huge payday by cashing out up to $10 million each in a private stock sale