Tech News

Scott Bessent says the U.S. economy is detoxing but that doesn’t mean there will be a recession: ‘I’m not concerned about a little bit of volatility over three weeks’

- Trump’s tariffs sparked recession fears, tilted inflation outlooks higher, sent stocks tumbling, and dimmed consumer sentiment—but his administration claims to be focused on the long-term.

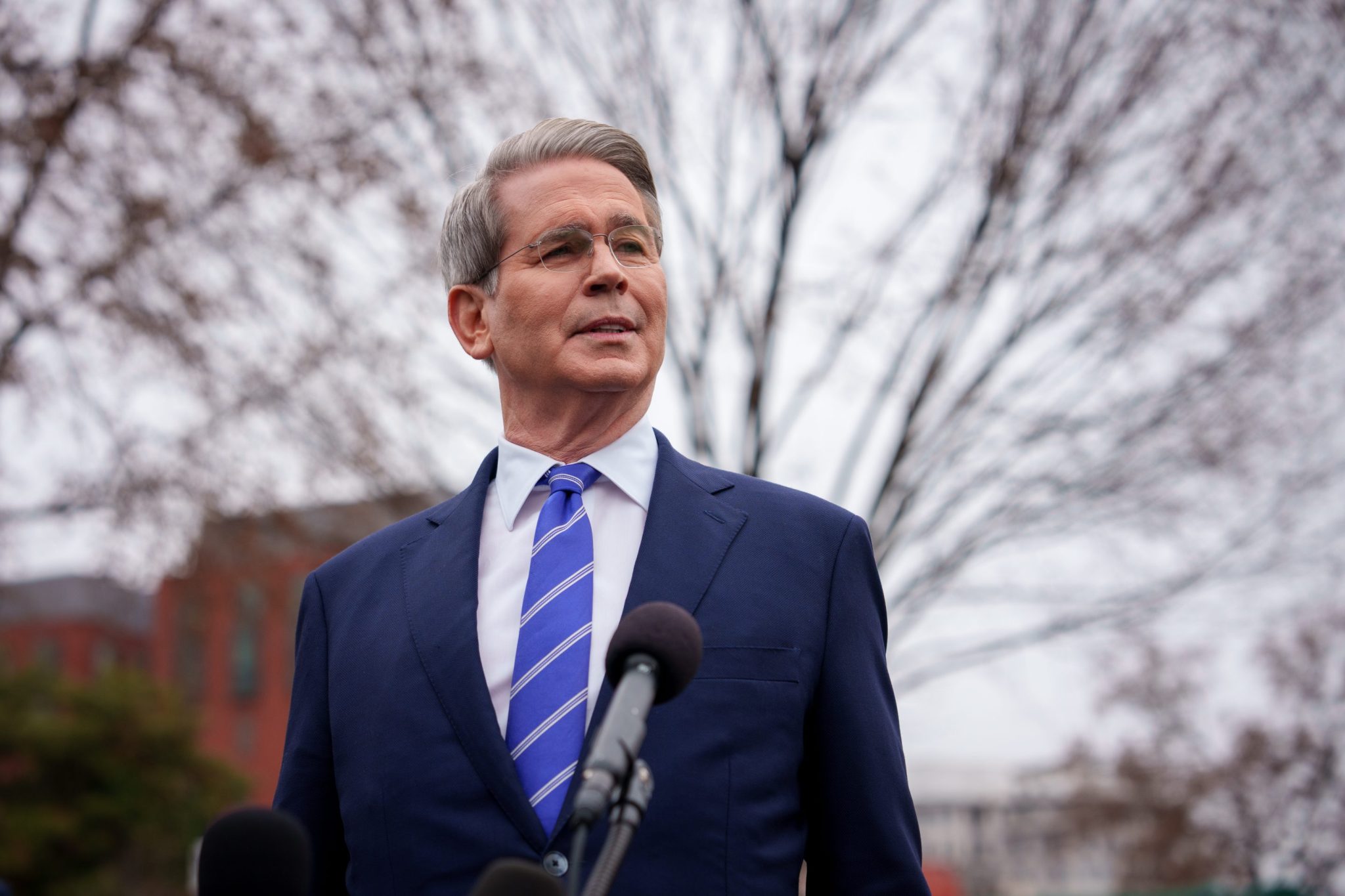

The S&P 500 lost $5 trillion in value in only three weeks after entering correction territory on Thursday over concerns surrounding President Trump’s tariff threats. But Treasury Secretary Scott Bessent, who was a hedge-fund chief prior to his political appointment, isn’t worried.

“I’m not concerned about a little bit of volatility over three weeks,” Bessent told CNBC on Thursday. He’s focused on the long-term.

Bessent previously warned of a “detox” for the economy —and he doubled down during his Thursday interview, claiming the economy was always going to have to transition. But when asked if that was a euphemism for a recession, Bessent said: “Not at all. It doesn’t have to be…Our goal is to have a smooth transition.”

Still, Americans are concerned. Consumer sentiment dipped 11% this month, the University of Michigan’s latest sentiment survey released Friday revealed. That marks the third straight month sentiment has declined. Consumer sentiment is down 22% from December, the month after Trump was elected.

The finance world mostly isn’t sold either, even after inflation cooled more than expected. Some economists suspect inflation could rise again once Trump’s tariffs have time to take effect. “The dizzying back-and-forth over tariffs is a large and unpredictable upside risk to the inflation outlook,” Bill Adams, chief economist at Comerica Bank, told Fortune in a statement after the data was released on Wednesday.

Investors are worried prolonged tariffs could fuel higher inflation while weighing on economic growth, which would result in stagflation, Evercore analysts wrote in a note earlier this month. JPMorgan economists also see higher inflation and slower growth resulting from Trump’s tariffs, according to a Wednesday research note.

The reason economists argue tariffs push inflation higher is because when companies are forced to pay extra taxes, they tend to pass those higher costs on to consumers, which could result in decreased economic activity, or slower growth.

Other economists and analysts are more worried the U.S. could fall into a recession. Trump’s “changing stance on tariffs has sparked anxiety across financial markets for some time,” George Vessey, lead macro strategist at Convera, said in an analysis earlier this week. “More recently, it has heightened concerns that policy uncertainty could push the U.S. economy into a recession.”

Former Treasury Secretary Larry Summers also said there was a real possibility of a recession. He blamed what he called on-again, off-again tariffs, and put the odds of a recession near 50%.

But Bessent isn’t the only one in the Trump administration brushing off concerns over the economy, while choosing not to rule out a recession. When Vice President JD Vance was asked in a Thursday interview if he could rule out a recession, he replied: “You can never predict the future, but I think the fundamentals of the economy are quite strong right now, but we’ll see how this unfolds.” Vance, like Bessent, said the administration is focused on the long-haul.

In an interview on Sunday, Trump also did not rule out a recession, but instead said there would be a “period of transition”—an omen for what would come to pass in the week ahead. As of Friday at the time of writing, the S&P 500 is down 8.17%, the Dow is down 7.20%, and the tech-heavy Nasdaq is down 11.76%, all in the past month, despite a modest Friday rally.

This story was originally featured on Fortune.com

Tech News

Democratic Party fractures in government shutdown fight as activists back primary challenges to supporters of GOP bill

The Democratic Party was fracturing Friday as a torrent of frustration and anger was unleashed at Senate Democrats, led by Sen. Chuck Schumer, who faced what they saw as an awful choice: shut the government down or consent to a Republican funding bill that allows President Donald Trump to continue slashing the federal government.

After Schumer announced that he would reluctantly support the bill, he bore the brunt of that anger, including a protest at his office, calls from progressives that he be primaried in 2028 and suggestions that the Democratic Party would soon be looking for new leaders.

Nine other members of the Democratic Caucus — a contingent of mostly swing-state and retiring senators — eventually joined Schumer in voting to advance the Republican funding proposal, providing crucial support to bring it to a final vote. It passed late Friday with Sens. Jeanne Shaheen of New Hampshire and Angus King of Maine voting with Republicans in favor.

Since their election losses, Democrats have been hunkered against a barrage of Trump’s early actions in office, locked out of legislative power and left searching for a plan to regain political momentum. But as Schumer let pass one of the rare moments when the party might regain leverage in Washington, the Democratic Party erupted in a moment of anger that had been building for months.

Many in the party felt the New York Democrat was not showing sufficient fight, arguing that a government shutdown would have forced Trump and Republicans to the negotiating table. Yet for Schumer, who has led Senate Democrats since Trump took office in 2016, the choice ultimately came down to preventing a shutdown that he believed would only hand Trump more power and leave his party with the blame for disruptions to government services.

“A shutdown would allow DOGE to shift into overdrive,” Schumer warned on the Senate floor Friday, referring to the Department of Government Efficiency effort led by Elon Musk.

Schumer voted no on the final vote for the funding bill, which only needed a simple majority to pass. Nonetheless, House Democrats released a stream of angry statements and social media posts aimed at Schumer.

Democratic Rep. Troy Carter of Louisiana shared a photo of Trump and Schumer engaged in conversation with the caption, “A picture is worth a thousand words!”

Even in the Senate, hardly any Democrats were speaking up in support of Schumer’s strategy Friday. It was a remarkable turn for the longtime Democratic leader, leaving him standing practically alone.

Speaker Emerita Nancy Pelosi, his longtime ally and partner in funding fights of the past, said in a statement, “Let’s be clear: neither is a good option for the American people. But this false choice that some are buying instead of fighting is unacceptable.”

Pelosi added that the senators should listen to the women who lead appropriations for Democrats, Rep. Rosa DeLauro of Connecticut and Sen. Patty Murray of Washington. They had proposed a 30-day stopgap plan instead of the Republican proposal that provides funding until September. The Republican bill will trim $13 billion in non-defense spending from the levels in the 2024 budget year and increase defense spending by $6 billion.

As House Democrats, who almost all voted against the bill earlier this week, concluded a retreat in northern Virginia Friday, they also called for their Senate colleagues to show more fight. House Democratic leadership rushed back to the Capitol to hold a news conference and urge senators to reject the bill.

“We do not want to shutdown the government. But we are not afraid of a government funding showdown,” Jeffries said.

He also repeatedly declined to answer questions about whether he had confidence in Schumer.

Other Democrats, such as Kentucky Gov. Andy Beshear, who is seen as a potential presidential candidate in 2028 and also visited the Democratic retreat, called for a broader movement. He mentioned the recent 60th anniversary of peaceful civil rights protests in Selma, Alabama, and argued that Democrats need to find “collective courage.”

“When those individuals marched, there wasn’t one voice,” Beshear said. “There was a collective courage of that group that changed the world. That day opened up the eyes of the country to what was really going on.”

Some were ready to start marching.

“We’re ready to get out of this building and head back to the Capitol at any moment and prevent the government from shutting down,” said Rep. Greg Casar of Texas, chair of the Congressional Progressive Caucus.

“Now is the moment for Democrats to draw a line in the stand and say that we stand very firmly on the side of working class people and against the ultra-rich that are trying to corrupt our government for themselves,” he added.

Meanwhile, some of the nation’s most influential progressive groups warned of serious political consequences for Senate Democrats and predicted a fierce backlash when members of Congress return home next week.

Ezra Levin, co-founder of Indivisible, which has organized hundreds of protests across the nation, said that nearly 8 in 10 of the group’s activists support primary challenges against “Senate Dems who cave on the GOP bill.”

He wrote on social media that the vast majority of those Democratic activists plan to express their anger at town halls or other public events next week. MoveOn, another progressive group that claims nearly 10 million members nationwide, predicted that its activists would also demand answers from Democratic officials in the coming days

“Clearing the way for Donald Trump and Elon Musk to gut Social Security, Medicare and Medicaid is unacceptable. It’s past time for Democrats to fight and stop acting like it’s business as usual,” said Joel Payne, a spokesperson for MoveOn.

Senate Democrats were also mostly unwilling to speak up to defend Schumer’s move. Sen. Raphael Warnock, a Georgia Democrat, even suggested that the party should be looking for new leaders in the coming years.

“I think come ’26, ’28, we’ll get some new leadership,” he said. His office later said Warnock was answering the question broadly.

Mostly, though, senators just lamented that they had been jammed by a Republican Party that has found a new sense of unity under Trump. For years, House Republicans have not been able to muster votes for government funding on their own, forcing them into bipartisan negotiations. This time, they passed the bill on party lines and left Washington.

“We’re stuck with two bad choices presented by a unified Republican front,” said Sen. Mark Warner, a Virginia Democrat.

He voted against the bill, yet said of Schumer’s decision: “These are tough, tough calls.”

This story was originally featured on Fortune.com

Tech News

Intel’s new CEO gets pay package valued at about $69 million

Incoming Intel Corp. Chief Executive Officer Lip-Bu Tan, who was named to the position this week, will receive compensation valued at about $69 million if he reaches targets over the coming years.

The package includes a salary of $1 million, plus a 200% performance-based bonus, the chipmaker said in a filing Friday. It also includes $66 million in long-term equity awards and stock options and new-hire incentives.

Separately, Tan agreed to buy $25 million in Intel shares in the first 30 days of taking the job. “Lip-Bu’s purchase reflects his belief in Intel and commitment to creating shareholder value,” the company said in a statement.

Earlier this week, Intel announced Tan was filling the role left vacant when the board ousted his predecessor, Pat Gelsinger. The semiconductor industry veteran, who previously served as an Intel board member, is tasked with trying to return the company to the forefront of an industry that it dominated for decades.

Tan, 65, will assume the role on March 18, the company said Wednesday. He will rejoin the board as well after stepping down in August 2024.

Intel’s stock has rallied this year, gaining 20%, including a surge of 15% on Thursday following the announcement of Tan’s appointment.

This story was originally featured on Fortune.com

Tech News

Trump’s staff cuts at federal agencies overseeing US dams could put public safety at risk, critics warn

Trump administration workforce cuts at federal agencies overseeing U.S. dams are threatening their ability to provide reliable electricity, supply farmers with water and protect communities from floods, employees and industry experts warn.

The Bureau of Reclamation provides water and hydropower to the public in 17 western states. Nearly 400 agency workers have been cut through the Trump reduction plan, an administration official said.

“Reductions-in-force” memos have also been sent to current workers, and more layoffs are expected. The cuts included workers at the Grand Coulee Dam, the largest hydropower generator in North America, according to two fired staffers interviewed by The Associated Press.

“Without these dam operators, engineers, hydrologists, geologists, researchers, emergency managers and other experts, there is a serious potential for heightened risk to public safety and economic or environmental damage,” Lori Spragens, executive director of the Kentucky-based Association of Dam Safety Officials, told the AP.

White House spokesperson Anna Kelly said federal workforce reductions will ensure disaster responses are not bogged down by bureaucracy and bloat.

”A more efficient workforce means more timely access to resources for all Americans,” she said by email.

But a bureau hydrologist said they need people on the job to ensure the dams are working properly.

“These are complex systems,” said the worker in the Midwest, who is still employed but spoke on condition of anonymity for fear of possible retaliation.

Workers keep dams safe by monitoring data, identifying weaknesses and doing site exams to check for cracks and seepage.

“As we scramble to get these screenings, as we lose institutional knowledge from people leaving or early retirement, we limit our ability to ensure public safety,” the worker added. “Having people available to respond to operational emergencies is critical. Cuts in staff threaten our ability to do this effectively.”

A federal judge on Thursday ordered the administration to rehire fired probationary workers, but a Trump spokesperson said they would fight back, leaving unclear whether any would return.

The heads of 14 California water and power agencies sent a letter to the Bureau of Reclamation and the Department of Interior last month warning that eliminating workers with “specialized knowledge” in operating and maintaining aging infrastructure “could negatively impact our water delivery system and threaten public health and safety.”

The U.S. Army Corps of Engineers also operates dams nationwide. Matt Rabe, a spokesman, declined to say how many workers left through early buyouts, but said the agency hasn’t been told to reduce its workforce.

But Neil Maunu, executive director of the Pacific Northwest Waterways Association, said it learned more than 150 Army Corps workers in Portland, Oregon, were told they would be terminated and they expect to lose about 600 more in the Pacific Northwest.

The firings include “district chiefs down to operators on vessels” and people critical to safe river navigation, he said.

Their last day is not known. The Corps was told to provide a plan to the U.S. Office of Personnel Management by March 14, Maunu said.

Several other federal agencies that help ensure dams run safely also have faced layoffs and closures. The National Oceanic and Atmospheric Administration is laying off 10% of its workforce and the Federal Emergency Management Agency’s National Dam Safety Review Board was disbanded in January.

The cuts come at a time when the nation’s dams need expert attention.

An AP review of Army Corps data last year showed at least 4,000 dams are in poor or unsatisfactory condition and could kill people or harm the environment if they failed. They require inspections, maintenance and emergency repairs to avoid catastrophes, the AP found.

Heavy rain damaged the spillway at California’s Oroville Dam in 2017, forcing nearly 190,000 residents to evacuate, and Michigan’s Edenville Dam breached in storms in 2020, the AP found.

Stephanie Duclos, a Bureau of Reclamation probationary worker fired at the Grand Coulee Dam, said she was among a dozen workers initially terminated. The dam across the Columbia River in central Washington state generates electricity for millions of homes and supplies water to a 27-mile-long (43-kilometer) reservoir that irrigates the Columbia Basin Project.

“This is a big infrastructure,” she said. “It’s going to take a lot of people to run it.”

Some fired employees had worked there for decades but were in a probation status due to a position switch. Duclos was an assistant for program managers who organized training and was a liaison with human resources. The only person doing that job, she fears how others will cover the work.

“You’re going to get employee burnout” in the workers left behind, she said.

Sen. Alex Padilla, a California Democrat who pushed a bipartisan effort to ensure the National Dam Safety Program was authorized through 2028, said, “the safety and efficacy of our dams is a national security priority.

“Americans deserve better, and I will work to make sure this administration is held accountable for their reckless actions,” Padilla said.

This story was originally featured on Fortune.com

-

Tech News3 months ago

Tech News3 months agoHow Costco’s formula for reaching uncertain consumers is pushing shares past $1,000 to all-time highs

-

Tech News3 months ago

Tech News3 months agoLuigi Mangione hires top lawyer—whose husband is representing Sean ‘Diddy’ Combs

-

Tech News3 months ago

Tech News3 months agoLego bricks have won over adults, growing its $10 billion toy market foothold—and there’s more to come

-

Tech News3 months ago

Quentin Tarantino thinks movies are still better than TV shows like Yellowstone

-

Tech News3 months ago

Tech News3 months agoInside the FOMC: Boston Fed President Susan Collins on changing her mind, teamwork, and the alchemy behind the base rate

-

Tech News3 months ago

Tech News3 months agoNancy Pelosi has hip replacement surgery at a US military hospital in Germany after falling at Battle of the Bulge ceremony

-

Tech News3 months ago

Tech News3 months agoTrump and members of Congress want drones shot down while more are spotted near military facilities

-

Tech News3 months ago

Tech News3 months agoHundreds of OpenAI’s current and ex-employees are about to get a huge payday by cashing out up to $10 million each in a private stock sale