Tech News

John Lewis profit jumps as turnaround wins back shoppers

Despite the stronger results, John Lewis said it will not make an extra annual payment to staff, known as a partnership bonus. It has now not paid a bonus to partners for the past three years. Read More

Tech News

Rex Woodbury’s Daybreak Ventures unveils $33 million first fund

How is AI like Betty Crocker?

Rex Woodbury has an answer, which he first laid out in 2024 in his “Digital Native” Substack. While many people wonder how much stuff can truly be automated by AI, Woodbury reckons this is the wrong question—especially when it comes to consumer behavior. To explain why, he looks at the history of cake mixes. First introduced to the public in the 1930s, cake mixes didn’t really grow in popularity until the 1950s, when General Mills and Betty Crocker offered a simple but significant tweak—encouraging consumers to add a fresh egg. AI may very well be the same way: Just because an AI agent can do everything on its own, that doesn’t mean that’s what consumers want.

“I love that example, because it’s a very concise one that speaks to a lot of the founders I meet,” said Woodbury. “When things change, we could probably automate away tons of these things, with AI companies looking at everything from gaming to law to commerce. It’s crazy what some of these products can do, but are people quite ready for that? I love that story with Betty Crocker and the cake mix, because I do think it reminds you that people like some semblance of control. That’s an example of a human behavior that has not changed—and probably never will.”

Woodbury—whose investing career has taken him from TPG Growth to Index Ventures—started Digital Native in 2020. The Substack now has more than 65,000 subscribers, built through Woodbury’s time at Index, where he worked on the firm’s investments in companies like identity verification startup Persona and creator-focused retail platform Flagship. Now, Woodbury is striking out on his own, launching Daybreak Ventures with a first fund closed at $33 million, Fortune has exclusively learned.

Woodbury sees his investing style as fundamentally ethnographic. “I think the earlier you get, the more you can be a bit more like an anthropologist,” he said. His overarching goal is to invest in companies that understand human behavior and, by extension, can transform intricate technologies into accessible solutions.

“Technology changes, but people don’t change that much,” said Woodbury. “Yes, there are shifts in human behavior, but at the end of the day, people want the same things. The story of technology and business is making things more accessible to people. It’s lowering costs, it’s making things more enjoyable and convenient. If you zoom out and look at big technology shifts—and obviously we have a huge technology shift right now with AI—usually the best businesses are built when technology shifts collide with behavior shifts.”

Daybreak will invest in both consumer and enterprise companies, writing checks ranging from $500,000 to $1 million. So far, some investments include animal health company Barnwell, legal automation startup Parambil, and resale commerce platform Hoop. Jade Hua, Hoop cofounder, who’s been working with Woodbury for one year, entered the partnership after Woodbury had been writing about resale for years.

“Rex’s blog signals to LPs and founders alike that he’s actively thinking about where the world is going, not just reacting to trends,” Hua told Fortune via email. “His thesis-led, content-driven approach to investing is rare, and it means that by the time he meets a founder, he’s already deeply informed about the problem space. That adds an extra layer of credibility and trust.”

Woodbury is clear—he’s an investor who writes, not a writer who invests.

“This is a job that’s about manufacturing serendipity,” said Woodbury. “What I mean by that is: The next generational founder, when she goes out to raise her round this week, does she think of Rex and Daybreak? When you’re showing up in the inboxes of 65,000-70,000 people every day, hopefully someone is saying: ‘Oh, you’re building in healthcare? Rex wrote about that last week.'”

Lisa Cawley, managing director at LP Screendoor, describes Woodbury as a “founder magnet” and expects that success for the firm in five years will come down to strategic evolution. (Other Daybreak LPs include Spheres, Atacama Ventures, and Reference Capital.)

“Rex isn’t using early-stage as just an entry point—for him, it’s where he wants to live long term,” Cawley said via email. “We could definitely see Rex expanding the team in strategic ways…Growing from fund to firm to franchise means you’ve deepened your competitive edge with focus and discipline.”

Woodbury’s goal of building Daybreak into an enduring firm relies on drawing non-obvious connections. For example, Woodbury is a Taylor Swift fan (he especially loves her albums evermore and folklore), and thinks there’s something technologists can learn from her.

“What Taylor does really well is a version of what the best technology founders do—they evoke a feeling, they evoke an emotion,” he said. “Products should be personal to you, and she does a great job of tapping into people’s emotions, which is what the best tech companies do, too.”

See you Monday,

Allie Garfinkle

X: @agarfinks

Email: alexandra.garfinkle@fortune.com

Submit a deal for the Term Sheet newsletter here.

Nina Ajemian curated the deals section of today’s newsletter. Subscribe here.

This story was originally featured on Fortune.com

Tech News

Dollar General CFO says shoplifting problem is ‘well in our control’—after taking this step

Good morning. Dollar General is one of the retailers that has grappled with “shrink,” an industry term that primarily defines theft from stores. But the company has been undertaking measures to address the issue, and CFO Kelly Dilts says those efforts are starting to produce some bright spots.

“Shrink,” more precisely, is a term retailers use for inventory loss often attributed to theft by shoppers and employees, or damage or errors. It’s estimated that retail businesses typically lose around 1.4% to 1.6% of their annual revenue to shrink.

Dollar General (No. 111 in the Fortune 500), has put forth ongoing efforts—most notably tearing out its self-checkout kiosks—to stem shrink. “The first thing that I’m excited about is both the shrink and damage lines are well in our control,” Dilts said in reference to gross margin during an earnings call on Thursday. She added: “It’s good to see that we have a positive trajectory right now, and we’re really already winning.” Dilts credited the improvement to the company’s Back-to-Basics strategy.

The retailer’s mitigation efforts drove a year-over-year shrink improvement of 68 basis points in Q4, she said. Improvements have continued through the early part of the first quarter, and “we anticipate this benefit should continue throughout 2025,” she noted.

That’s more upbeat than Dilts’ comments on a December 2023 earnings call: “Shrink has been pretty significant for us for a while, and it’s definitely going to carry into 2024.” In March 2024, the company reported that shrink was one of the factors that drove gross profit, as a percentage of net sales, down 138 basis points to 29.5% in Q4 of fiscal year 2023, compared to 30.9% in Q4 of fiscal year 2022.

Stemming shrink

A big part of the strategy to combat shrink was in the checkout aisle. After using an AI solution to analyze hundreds of thousands of purchases at self-checkout, Dollar General determined which stores had the highest levels of theft and mis-scanned items. That determined the company’s decision, led by CEO Todd Vasos, to eliminate the option of self-checkout in the vast majority of its stores.

Vasos announced on an earnings call in March 2024 plans to convert the self-checkout systems in about 9,000 stores to allow for cashiers. Then in May, he said that Dollar General eliminated self-checkout options at 3,000 additional stores, bringing the total to 12,000.

Removing self-checkout was actually an about-face for Dollar General. In 2022, the company expanded self-checkout to a total of more than 11,000 stores as part of a Fast Track initiative. But that was before Vasos returned to the company as CEO in October 2023 to activate a turnaround plan. He was previously CEO from 2015 to 2022. Dilts was promoted to CFO in May 2023.

Overall, to combat shrink, retailers undertake “a data-driven approach to measure the areas where losses are actually occurring,” Jennifer Fagan, EY’s retail partner, writes in a recent Fortune opinion piece. “Doing so enables the deployment of targeted mitigation techniques with the greatest potential impact,” according to Fagan.

Dollar General is attracting bargain shoppers amid an uncertain economy. For the quarter that ended Jan. 31, the company’s net sales increased 4.5% year over year to $10.3 billion, and same-day-store sales increased 1.2%, both beating Wall Street estimates. Its stock price went up 7% closing at $79.95 on Thursday.

Have a good weekend.

Sheryl Estrada

sheryl.estrada@fortune.com

This story was originally featured on Fortune.com

Tech News

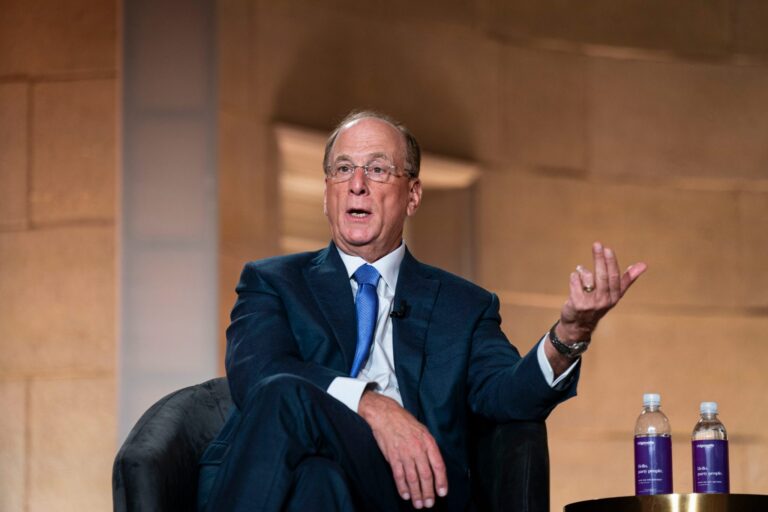

Larry Fink says retirement is a benefit increasingly limited to Fortune 500 employees, and widening the scope should be a ‘national priority’

- BlackRock CEO Larry Fink warned of a growing retirement crisis, emphasizing that only employees at top companies benefit from adequate retirement planning while many Americans feel unprepared. He urges corporate leaders and politicians to rethink the system, acknowledging younger generations’ economic anxiety and suggesting older generations should work longer to restore trust and financial security.

While short-term economic uncertainty is fairly high on the list of priorities for CEOs at the moment, BlackRock CEO Larry Fink also wants to keep the topic of retirement front and centre.

The investment management chief has often shared his thoughts on a coming retirement crisis, saying not enough is being done to generate wealth for younger generations when they hit retirement age.

This week Fink, who is worth $1.2 billion per Forbes, warned that it’s also only those who work for the biggest companies in the world who are truly benefitting from retirement planning.

“One of the fundamental problems in America is, retirement’s not that bad of a problem for the top Fortune 500 companies. We are providing enough support to our employees where they’re getting the adequacy of retirement,” Fink told CNN earlier this week.

“It’s beyond that, we refuse to talk about how do we get more broadening of our economy with more Americans participating in that. That’s why we have to have a conversation in Washington, this has to be considered a national priority and a national promise to all Americans.”

When countered that it’s easy for a billionaire to lecture the public on saving, Fink reportedly responded: “There was a time when I wasn’t one.”

Fink—whose organization handles $10 trillion in assets earmarked for retirement—is correct in his stance that many Americans don’t feel sufficiently prepared for the day they stop working.

A Fed report released last year found that, on average, only 34% of the public felt their savings were on track. This was up from a year prior as in 2022, when just 31% of Americans said their savings schedule was going to plan, but still down on the 40% reported in 2021 when COVID-related savings were at their peak.

The younger the respondents to the Fed survey were, the less confident they were in their ability to put aside adequate amounts of cash to stop working. The report—which surveyed more than 16,000 people—found those aged between 18 and 29 were the least confident with only 26% of respondents saying their savings were on track.

This rose to 34% for those aged between 30 and 44, and to 38% between the ages of 45 to 59. By the age category of 60+ this confidence rose to 45%—signaling the majority of the respondents as they closed in on retirement still didn’t feel confident about their finances.

It’s perhaps no surprise then that the Fed survey also found that 27% of adults in 2023 considered themselves to be retired, but were still working in some capacity. Of that, 4% were still in full-time work.

Generational tension

The lack of security younger generations are feeling when they think about their financial future is a dynamic Fink, aged 72, is keenly aware of.

In fact last year he called on his own generation to do more to support their younger peers, writing in a letter to BlackRock investors that corporate leaders and politicians to pursue “an organized, high-level effort” to rethink the retirement system.

“It’s no wonder younger generations, Millennials and Gen Z, are so economically anxious,” Fink wrote. “They believe my generation—the baby boomers—have focused on their own financial well-being to the detriment of who comes next. And in the case of retirement, they’re right.”

Fink questioned, for example, whether the retirement age should still be set at 65 and if his generation and those immediately below it should work for longer.

He said the burden to reestablish trust with younger people—who fear their social security benefits will be run dry by the time they reach retirement age—sits with older generations.

“Maybe investing for their long-term goals, including retirement, isn’t such a bad place to begin,” Fink added.

This story was originally featured on Fortune.com

-

Tech News3 months ago

Tech News3 months agoHow Costco’s formula for reaching uncertain consumers is pushing shares past $1,000 to all-time highs

-

Tech News3 months ago

Tech News3 months agoLuigi Mangione hires top lawyer—whose husband is representing Sean ‘Diddy’ Combs

-

Tech News3 months ago

Tech News3 months agoLego bricks have won over adults, growing its $10 billion toy market foothold—and there’s more to come

-

Tech News3 months ago

Quentin Tarantino thinks movies are still better than TV shows like Yellowstone

-

Tech News3 months ago

Tech News3 months agoInside the FOMC: Boston Fed President Susan Collins on changing her mind, teamwork, and the alchemy behind the base rate

-

Tech News3 months ago

Tech News3 months agoNancy Pelosi has hip replacement surgery at a US military hospital in Germany after falling at Battle of the Bulge ceremony

-

Tech News3 months ago

Tech News3 months agoTrump and members of Congress want drones shot down while more are spotted near military facilities

-

Tech News3 months ago

Tech News3 months agoHundreds of OpenAI’s current and ex-employees are about to get a huge payday by cashing out up to $10 million each in a private stock sale